The numbers are in for 2022 and now we look ahead to 2023.

That said, we can garner some insight into the past events. We saw something very important take place over that time which will have huge impact going forward.

At the end of 2021, the Hive Witnesses raised the interest rate on Hive Backed Dollar in savings to 20%. This caused many to question the sustainability of this. Throughout the last year, I argued that not only was this sustainable, it was necessary. Understanding the correlation between $HIVE and HBD along with the tied to economic growth is vital.

We will review some of this in this article.

Hive's Disinflation

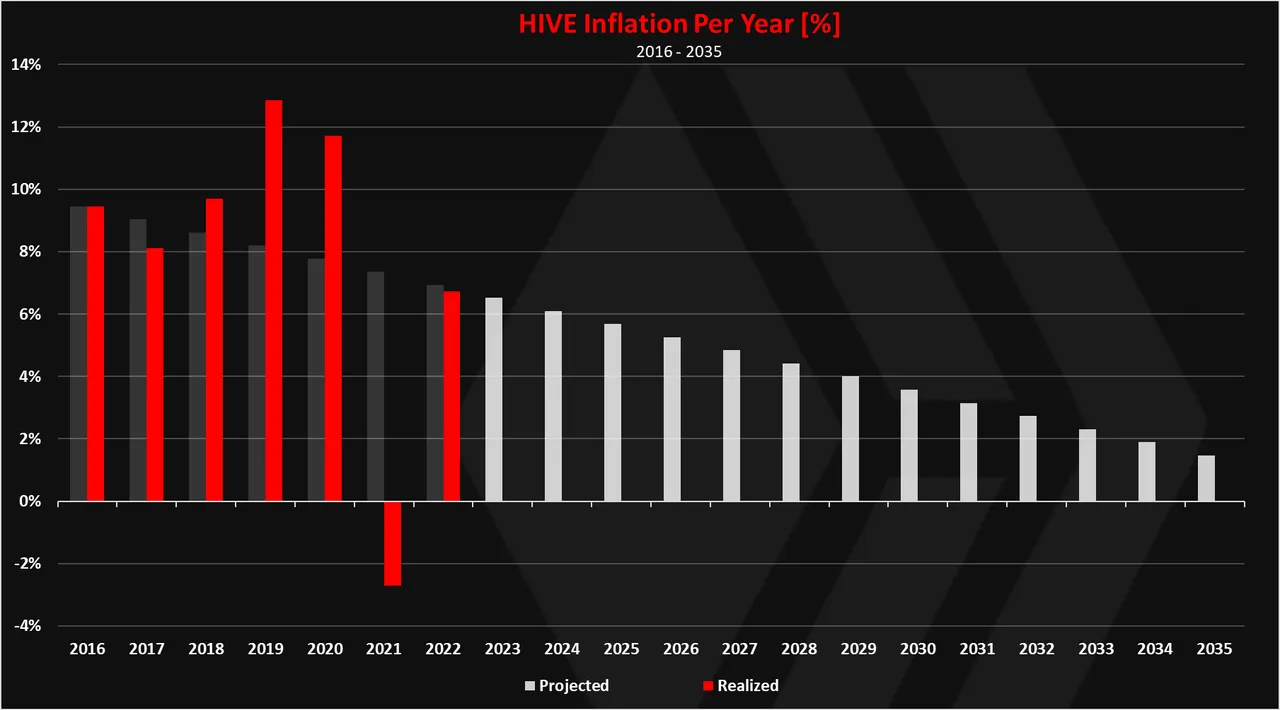

The targeted inflation rate of $HIVE for 2022 was 7%. This is coded into the chain and decreases every year until it reaches a level of, I believe, 1% (this could be .25%, I don't recall).

This means that $HIVE is disinflationary. It is still producing more coins yet at a slowing pace. This is standard across the industry with most blockchain adopting this type of model.

Hive is different though. It does contain two coin at the base layer. One is a stablecoin that is linked to the backing agent. In this instance, it is $HIVE.

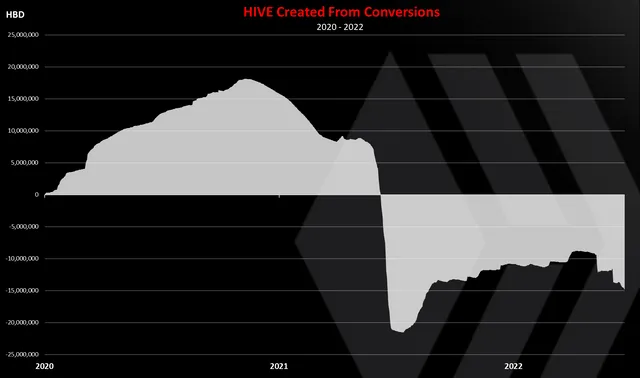

Through the conversion mechanism, we see how more $HIVE can be created. This opens up the door for the supply to be radically altered. Since HBD can be redeemed for $1 worth of $HIVE, price movement, is USD terms, can affect the conversion that is undertaken.

Here is where many feel that Hive is threatened. If prices are volatile, it allows people to load up on HBD them convert massive amounts into $HIVE. This is a logical viewpoint and one worthy of considering.

It is also what makes people question the sustainability of the Witnesses decision. Perhaps we fact the situation where the disinflation is reversed and massive inflation is experienced.

Increased Disinflation

So what happened?

Throughout 2022, we had a steady 20% APR on Hive saving. This means the HBD supply was expanding at a generous (according to many) rate.

Here is what the numbers looked like after pulling then from the chain.

As we can see, the last two years saw an acceleration in the disinflation. Actually, 2021 experience deflation with 2022 coming in under the targeted rate.

For the year, the $HIVE inflation rate was 6.8%.

This occurred during a bear market where the price of, well everything, dropped throughout the year. To say this past 12 months were rough in the cryptocurrency markets is an understatement.

Yet, in spite of the price drop, we see $HIVE actually increase its disinflation while having a 20% APR on HBD.

For more insight into the numbers, you can read it here.

As a side note, there is a more interesting aspect to this analysis.

Since March of 2020, when the blockchain was forked and Hive created, we see something very interesting. During that time, $HIVE is actually deflationary.

Starting from March 2020, the conversions are net negative for HIVE. Around 15M HIVE was removed from circulation with the help of the conversions in the period.

The idea behind HBD and the conversions is that in the long run it should burn more HIVE then create it. There will be ups and downs, but as longer the net result is negative, the impact is positive

This is obvious from looking at the first chart yet it is good to see it in a bit more detail. We know measures were put into place to strengthen HBD and the tokenomics of the ecosystem.

Economy Is All That Matters

Whatever one feels about what is written so far, the reality is none of it matters. This is great for an academic exercise but it really is nothing more than just analysis in a vacuum.

This is the problem people make about the world of fiat. They mistakenly believe things can be reduced to the basics, providing a simple paragraph (or article) about what is occurring. Sadly, economic reality is a lot more advanced, complex, and integrated than this.

At the end of the day, inflation (disinflation, deflation) is not what matters. Ultimately, it comes down to growth. This is where wealth is created. Money expansion is not wealth but, rather, a tool to enable commerce and economic productivity to potential increase. Without that, all is negated.

Many espouse how deflationary money is the only way to go. Here is another reality: if there is no value to the ecosystem, all the deflation in the world is senseless. What happens when there is 1 coin tied to a platform that is worth zero? You simply have one worth nothing (as opposed to 1 trillion).

So, the question with Hive is what was the growth throughout the year? How much did the Hive economy expand?

The answer to this is tough to figure. We can use metrics such as users, daily transactions, volumes traded or whatever we prefer to focus upon. Each of these will give us a glimpse into how the Hive economy is doing.

Unfortunately, we don't have clear answers on any of this. Going from feeling, which is not a great barometer, things feel a bit flat. Nevertheless, at a time when infrastructure is being built, this isn't the end of the world.

What is the economy doing is the real question.

High Growth Is Sustainable

Let us be honest, Hive is starting from a very low level. The numbers are not overly impressive. With about 10K active people on the blockchain, it is easy to see where growth can take place for a long time.

Going back to HBD, many question the sustainability of it. As the articles linked show, even with things rather flat, we can see it is. Naturally, one year doesn't make a trend so it is worth monitoring. However, to claim 20% is not sustainable because it is a number that most are not accustomed to is foolish.

The reality is that if Hive goes on a spree where it is growing at 35% annually, then we can see how 20% is easily sustained. In fact, at that point, a case probably could be made that the inflation of the stablecoin needs increasing since it could be holding the economy back.

This is why the conversation around building is vital. Here is where we find economic productivity in the digital world. As more entrepreneurs get involved, businesses will form that can attract more users (customers). It is at this point where we are moving closers to enjoying the network effect.

Again, monetary rates in a vacuum tell us little. In the end, it all comes down to economic growth. With an expanding and growing ecosystem, the economy should continue to thrive at higher levels.

This means more money will be required to keep incentivizing future growth. We are a long way from that point.

It will be interesting to watch Hive in 2023 from this perspective. Do we finally see applications and projects operate like businesses?

So far, we are not seeing a lot of this. It should be the goal going forward.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z