- Bitcoin Price Suddenly Drops Below $7K, Crypto Market Under $200B;

- What’s Next for Bitcoin After March’s Crash – CoinDesk Quarterly Review ;

- Bitcoin Garners New Users as Governments Flood World With Fiat;

- Chainlink (LINK) Rallies 149% Since March Bitcoin Price Crash ;

- Bitcoin SV’s First Halving Crimps Profits for BSV Miners ;

- 🗞 Daily Crypto Calendar, April, 10th 💰

- Bitcoin Trading Update

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 Bitcoin Price Suddenly Drops Below $7K, Crypto Market Under $200B

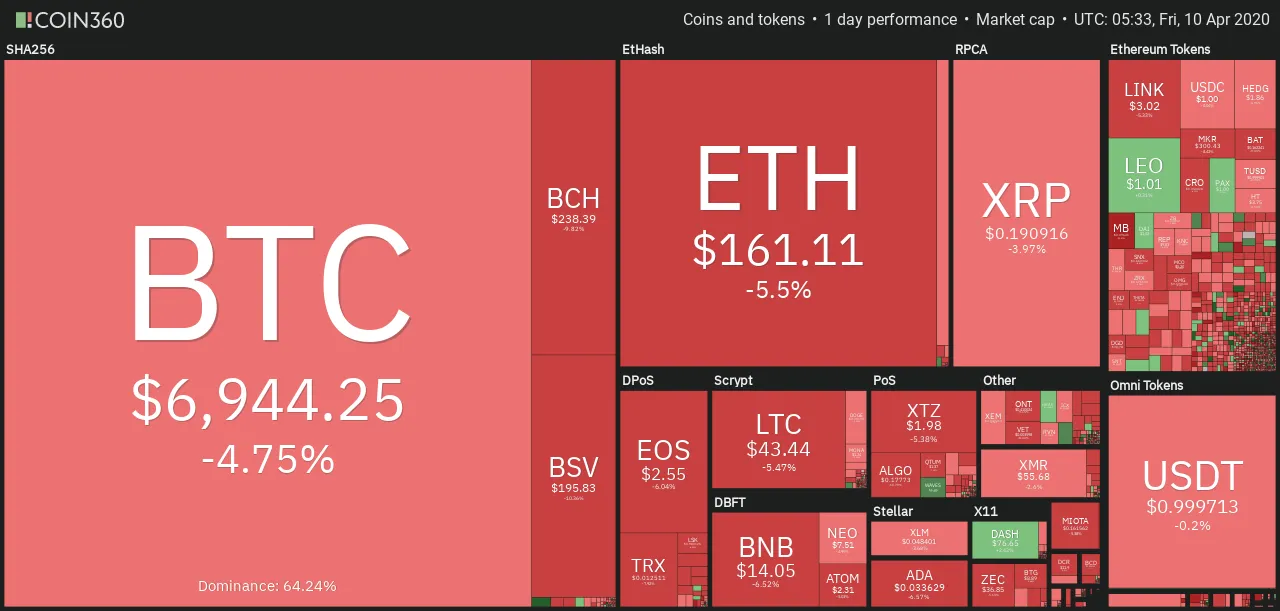

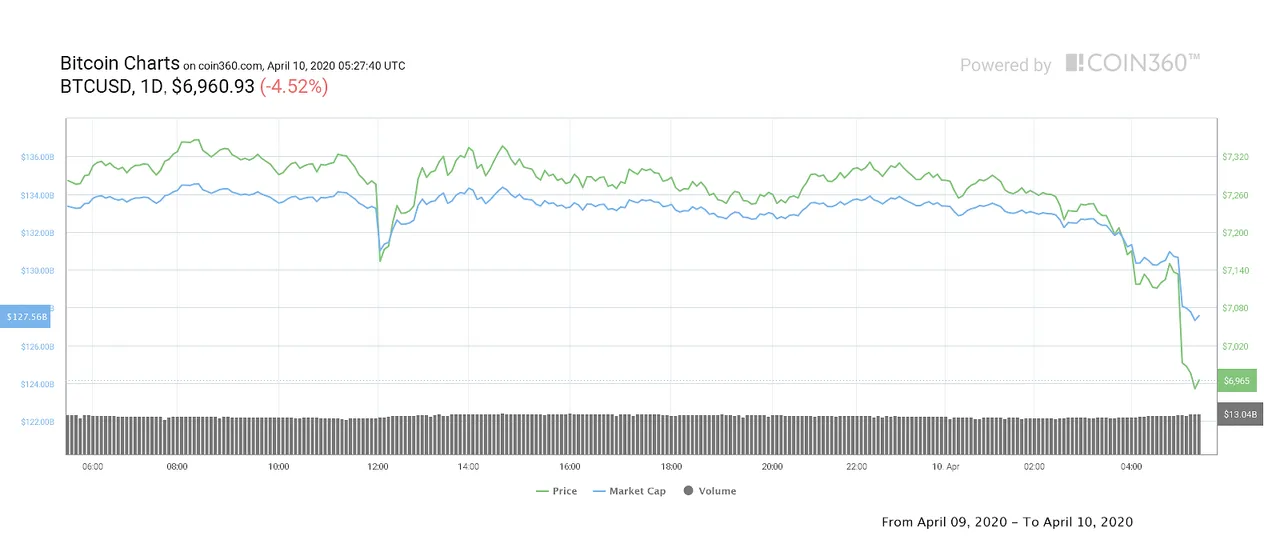

Bitcoin (BTC) price dropped nearly $200 in minutes on April 10 to slide below $7,000 for the first time in four days.

Data from Coin360 and Cointelegraph Markets showed BTC/USD now dropping below the tight $400 corridor between $7,100 and $7,410 where it had stayed for most of the week.

The sudden drop from $7,150 to $6,915 also formed the most volatility seen in recent days and, at press time, Bitcoin is trading around $6,960.

“We might be getting a liquidity tap towards $7,500-7,700 area, after which I'm expecting a sharp decline,” Van de Poppe said late on Thursday.

He added:

“If we lose $6,900 area though, I'm assuming we're going straight towards $6,300.”

🗞 What’s Next for Bitcoin After March’s Crash – CoinDesk Quarterly Review

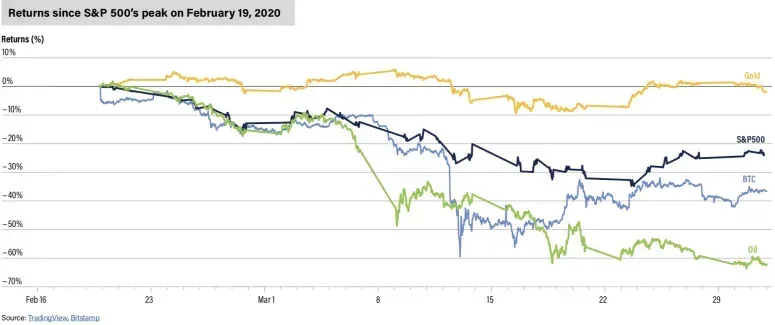

The CoinDesk Quarterly Review provides research-based insights on how the narrative has changed for blue-chips such as bitcoin and ether. We look at which assets outperformed on returns, and how the participants in crypto markets are shifting in the wake of Q1’s defining event, the March 12 plunge.

Bitcoin’s “digital gold” narrative grew up in a “bull market in everything.” Bitcoin as gold 2.0, a hedge against inflation and a safe haven in an eventual crash, was a meme investors readily understood.

Now, we’ve seen an economic crisis cause dislocation in crypto markets and push bitcoin’s price downward in tandem with stocks. Gold and Treasury bonds appeared to have failed to live up to “safe haven” expectations. If gold’s narrative is being debated, do we still know what “digital gold” means? At the very least, the events of the past month have put to rest the notion that bitcoin today can be a “haven.”

🗞 Bitcoin Garners New Users as Governments Flood World With Fiat

Governments around the world are careening toward a period of dramatic spending.

The U.S. Federal Reserve announced another $2.3 trillion in lending programs on Thursday to stabilize America’s coronavirus-stricken economy. The Bank of England announced it would likely extend billions of pounds to directly finance the government’s crisis response.

All this inspires inflation concerns around the globe, which appear to be driving demand for bitcoin (BTC) in some corners.

“The non-stop quantitative easing process will finally impact the mid-term and long-term market,” said Danny Deng, a leading member of both the China Blockchain Application Center and the National Internet Finance Association of China. “Bitcoin is designed for this kind of situation. So I’m optimistic about bitcoin's future.”

🗞 Chainlink (LINK) Rallies 149% Since March Bitcoin Price Crash

This week Chainlink (LINK) is on an absolute tear, gaining 47% over the past four days on strong purchasing volume. The price had dropped by a massive 63.50% from March 11 to March 12 and bottomed at $1.35 on March 13. Since March 13 LINK has rallied 149% and at the time of writing the digital asset was up 6.65% for the day.

Other than the entire crypto market recovering from deeply oversold conditions, the recent announcement of new partnerships with decentralized finance giant Celsius, and Fantom could possibly be adding to the current excitement as previous partnership announcements have been known to drive LINK price higher.

Regardless of the reason, the recent gains are quite impressive and the current state of the daily chart suggests that there could be more to come. After LINK broke from the $1.99 - $2.30 range the price took off, clearing the volume profile visible range high volume node and rapidly reclaiming lost ground from the March 11-12 drop from $4.10 to $1.33.

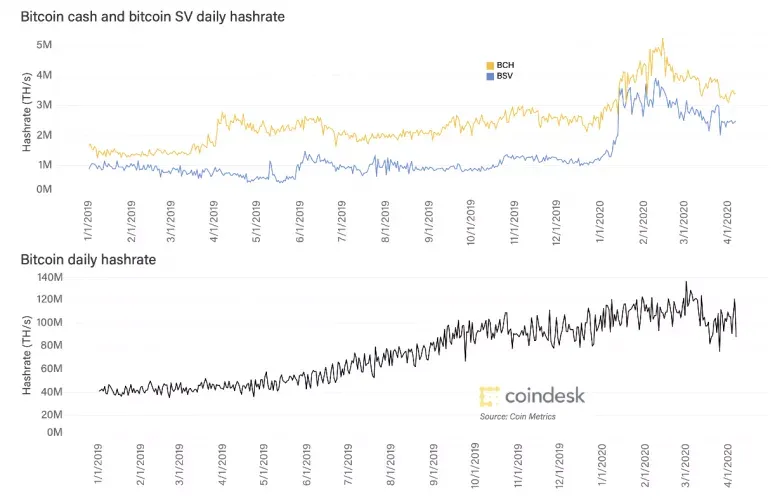

🗞 Bitcoin SV’s First Halving Crimps Profits for BSV Miners

Bitcoin SV, the network that split off from the Bitcoin Cash blockchain in late 2018, has cut its miners’ block reward in half for the first time.

Miners on the network produced the 630,000th block around 00:50 UTC time on Friday, which, by design, triggered the halving event that reduced mining rewards from 12.5 BSV to 6.25 per block.

BSV is now trading at $214 as of press time, for a market capitalization of $3.9 billion, making the network the market's sixth largest cryptocurrency. It's down 5.4 percent over the past 24 hours, according to CoinDesk's price index.

🗞 Daily Crypto News, April, 10th💰

- NULS (NULS)

"NULS ecological cross chain project #Nerve which is a decentralized digital asset service network will have an AMA on 10th April."

- NEM (XEM)

"... Next week @NEMofficial is joining our list"

- Bitcoin Diamond (BCD)

"BCD will launch zg.com all currencies futures at 16:00 on April 10."

Bitcoin Trading Update by my friend @cryptopassion

Here is the chart of my last analysis :

Here is the current chart :

As you can see we just broke the upper line of the triangle but look how that break is weak and that we are consolidating just upper that line. It is not a normal move when we break a so big triangle. So I suspect that a massive move is in preparation and that it won't be a UP so be very carefull... If we don't take distance from that upper line, the correction is imminent.

Last Updates

- 🗞 Daily Crypto News, April, 9th💰

- 🗞 Daily Crypto News, April, 8th💰

- 🗞 Daily Crypto News, April, 7th💰

- 🗞 Daily Crypto News, April, 6th💰

- 🗞 Daily Crypto News, April, 5th💰

- 🗞 Daily Crypto News, April, 4th💰

- 🗞 Daily Crypto News, April, 3rd💰

- 🗞 Daily Crypto News, April, 2nd💰

- 🗞 Daily Crypto News, April, 1st💰

- 🗞 Daily Crypto News, March, 31st💰

- 🗞 Daily Crypto News, March, 30th💰

- 🗞 Daily Crypto News, March, 29th💰

- 🗞 Daily Crypto News, March, 28th💰

- 🗞 Daily Crypto News, March, 27th💰

- 🗞 Daily Crypto News, March, 26th💰

- 🗞 Daily Crypto News, March, 25th💰

- 🗞 Daily Crypto News, March, 24th💰

- 🗞 Daily Crypto News, March, 23rd💰

- 🗞 Daily Crypto News, March, 22nd💰

- 🗞 Daily Crypto News, March, 21st💰

- 🗞 Daily Crypto News, March, 20th💰

- 🗞 Daily Crypto News, March, 19th💰

- 🗞 Daily Crypto News, March, 18th💰

- 🗞 Daily Crypto News, March, 17th💰

- 🗞 Daily Crypto News, March, 16th💰

You don't want to miss a Crypto news?

Follow me on Twitter or Facebook

Come try out a great blockchain game: Splinterlands