- This Historically Accurate Pattern Suggests Epic Bitcoin Plunge to $3K;

- Bitcoin Needs To Make an Effort to Not Waste This Crisis ;

- Ether-Bitcoin Price Volatility Spread Hits 4-Month Low ;

- Revolut Brings Bitcoin Without Private Keys to 10m+ Users ;

- Coinbase-Backed Crypto Rating Council Lists IOTA, BAT, and USDC ;

- 🗞 Daily Crypto Calendar, April, 4th 💰

- Bitcoin Trading Update

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 This Historically Accurate Pattern Suggests Epic Bitcoin Plunge to $3K

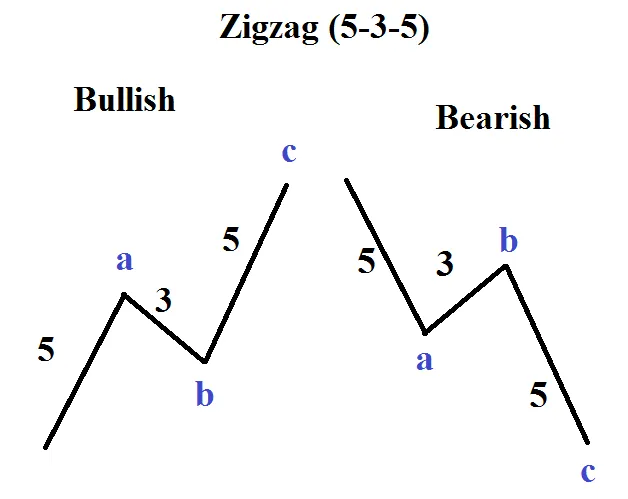

The short-term trend of the Bitcoin (BTC) price since its drop to $3700 shows an Elliot Wave pattern forming on lower time frames. While the pattern can reverse to a bullish trend, the declining volume of BTC suggests it is not likely.

The Bitcoin price has been ranging in between $5,800 and $6,900, with an exception of a brief wick to $7,300 on April 3.

The trader said:

“There's so many different ways you could count btc here. either wxy, larger triangle, larger flat, I’m not too sure, the one thing that does stick out is the series of 3 wave moves and lack of 5 wave motives. for this reason I think it’s still too early to call a bottom.”

The Elliott Wave pattern often divides traders on its practicality in evaluating price trends of cryptocurrencies, as it can be used to support both bullish and bearish scenarios.

Bitcoin Needs To Make an Effort to Not Waste This Crisis

While many bitcoin (BTC) hodlers hope that despite the COVID-19 pandemic and troubles in the traditional financial markets - or exactly because of them - BTC will skyrocket, it might not happen without the active involvement of the Cryptoverse itself.

"In addition to the unique properties of BTC, the industry needs strong storytelling, marketing, and user experience to enable folks to understand the reasons why it's a compelling investment opportunity—and ultimately purchase some bitcoin!" Zac Prince, Co-founder of major US-based crypto lending startup BlockFi, told Cryptonews.com.

However, "for fixed supply assets like bitcoin, large money printing efforts from fiat currencies should result in upward price moves," said Prince. "For crypto, we’ll continue to see inflows from both retail and institutional investors, which is driven by leading platforms acquiring new clients."

🗞 Ether-Bitcoin Price Volatility Spread Hits 4-Month Low

Cryptocurrency prices have always been roller coasters, and some rides are scarier than others. However, there may not be much difference in price volatility between the top two coins in the coming months, a key metric indicates.

The spread between the three-month at-the-money implied volatility for ether (ETH) and bitcoin (BTC), a measure of expected relative volatility between the two, declined to 8.9 percent Friday, according to the crypto derivatives research firm Skew. It was the lowest level since Dec. 5.

Implied volatility is the market’s expectation of how risky or volatile an asset would be over a specific period. It is computed using the prices of an option and the underlying asset and other inputs such as time to expiration.

🗞 Revolut Brings Bitcoin Without Private Keys to 10m+ Users

USD 5.5bn fintech Revolut has decided to open crypto trading feature to their "standard" customers earlier than planned, thus helping crypto adoption and securing another revenue stream during the global financial and economic turmoil, triggered by the COVID-19 pandemic.

The crypto trading feature is not new for Revolut, but it was previously available only for its Premium and Metal customers.

The company, that employs 2,000 people, claims it has more than 10 million customers, mostly in Europe. Revolut does not disclose how many Premium and Metal users they have, but starting this May they'll enjoy the crypto trading feature for a smaller fee than Standard users - they'll pay 67% more.

🗞 Coinbase-Backed Crypto Rating Council Lists IOTA, BAT, and USDC

The question of whether certain cryptocurrencies constitute securities is becoming increasingly relevant within the blockchain industry. As such, some core players in the space are upping their efforts to bring more understanding to the issue.

The Crypto Rating Council, or CRC, is a group of major United States’ crypto firms that advocates and promotes regulatory clarity in crypto. Recently, the CRC evaluated a number of new cryptocurrencies to determine whether they should show signs of being securities.

Three new tokens are analyzed

In an April 2 blog post, the CRC published an introduction to ratings for three new cryptocurrencies including Basic Attention Token (BAT), USDCoin (USDC), and Iota (IOTA). In the post, the CRC noted that it periodically reviews previously published scores based on new developments, as well as an understanding of available facts. As such, the council has also updated scores for Maker (MKR) and Polymath (POLY), the announcement reads.

🗞 Daily Crypto News, April, 4th💰

- COTI (COTI)

"We’ll be releasing our updated tech road map next week and that will expand upon these merchant opportunities..."

- Gulden (NLG)

"Phase 4 Release... Activation, April 4th 6pm (approx)"

- Fantom (FTM)

"If you are a current validator, please ensure you upgrade before April 5."

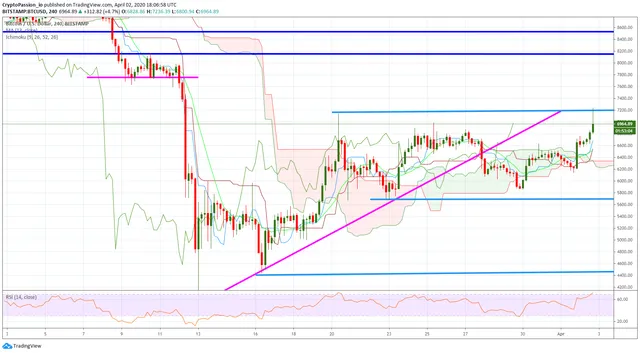

Bitcoin Trading Update by my friend @cryptopassion

Here is the chart of my last analysis :

Here is the current chart :

Yesterday I was talking you about the possibility to have a double TOP pattern which is a bearish scenario. That scenario is still possible and is not yet invalidated. We must quickly break the resistance line aroun 7150$ or the sellers will feel the weakness of buyers and start a new correction.

Last Updates

- 🗞 Daily Crypto News, April, 3rd💰

- 🗞 Daily Crypto News, April, 2nd💰

- 🗞 Daily Crypto News, April, 1st💰

- 🗞 Daily Crypto News, March, 31st💰

- 🗞 Daily Crypto News, March, 30th💰

- 🗞 Daily Crypto News, March, 29th💰

- 🗞 Daily Crypto News, March, 28th💰

- 🗞 Daily Crypto News, March, 27th💰

- 🗞 Daily Crypto News, March, 26th💰

- 🗞 Daily Crypto News, March, 25th💰

- 🗞 Daily Crypto News, March, 24th💰

- 🗞 Daily Crypto News, March, 23rd💰

- 🗞 Daily Crypto News, March, 22nd💰

- 🗞 Daily Crypto News, March, 21st💰

- 🗞 Daily Crypto News, March, 20th💰

- 🗞 Daily Crypto News, March, 19th💰

- 🗞 Daily Crypto News, March, 18th💰

- 🗞 Daily Crypto News, March, 17th💰

- 🗞 Daily Crypto News, March, 16th💰

You don't want to miss a Crypto news?

Follow me on Twitter or Facebook

Come try out a great blockchain game: Splinterlands