Today I thought I'd answer a couple of Wen's that, tbh, no one has asked me yet. Relaunching LBI comes with a plan to resume dividend distributions, and a goal of building a swap pool on HE/Tribaldex/Beeswap to make the LBI token more accessible and tradeable.

So, I have commenced tracking income this week. I gave some insight in yesterdays update around how the method for calculating income I use will be different to previously. The easiest example is that HIVE Power inflation was counted as income previously. Now it won't (as it is not liquid), it will flow as asset growth over time.

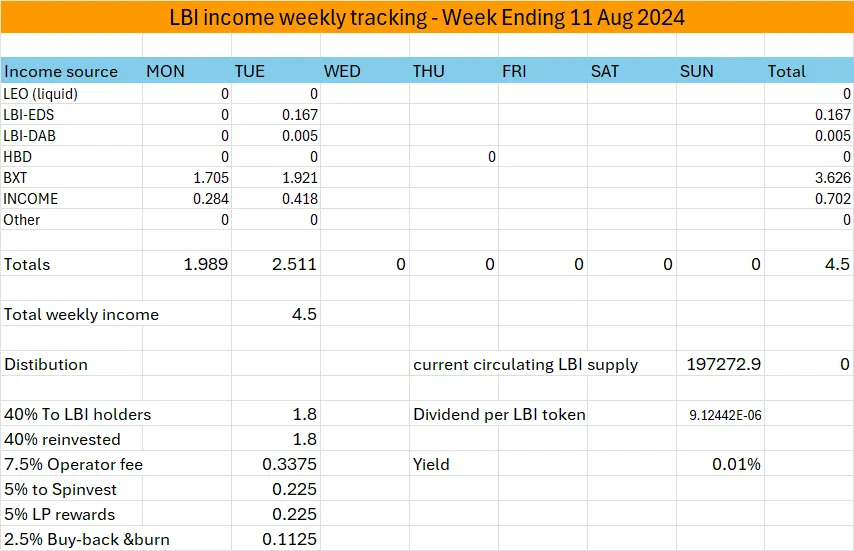

The easiest way to explain it will be to share the income tracking sheet I have set up.

LBI income weekly tracking - Week Ending 11 Aug 2024

As you can see, Liquid LEO from post payouts and curation will be counted. LEO received from our @leo.voter delegation will not. It is set to come in staked, and will contribute to a growing LEO stake over time.

LBI-EDS income will hit once a week, and it will be the weekly HIVE payout that our EDS tokens generate. The EDS earned each week from @eds-d and @eds-vote will accumulate as asset growth, not counted as income.

LBI-DAB will become a daily income, which will grow as our liquid DAB grows over time. We just received our first daily drip. There is a lot of asset growth built in to this wallet before we get to income. RUG will mint DBOND each week. DBOND will mint DAB randomly. Only the HIVE minted by DAB will be classed as income.

HBD will be a once a week withdrawal of a portion of our HBD balance, equivalent to half of the interest earned. So, each week I look at the HBD balance, work out 10% of that, divide it by 52 weeks to get a weekly amount. This will get sent to the @lbi-income wallet. The other 10% yield on HBD will remain in savings, so our HBD asset continues to grow over time.

BXT is much simpler. We own staked BXT. It generates a daily HIVE yield. That counts as income. This does not have an asset growth layer built in.

INCOME is similar - we hold the token, it pays a daily drip which goes to income. Growth here is built in to a certain degree, as the INCOME token run by @ecoinstats has conservative asset growth over time baked in to its design. We don't get extra tokens or anything(unless we buy them), but the price should go up in the long run. It is another "asset backed token" with a long and reliable track record.

You can see on the sheet the planned income distribution. Up until dividends actually start, its really a hypothetical distribution.

So WEN?

I want to target Monday 2 September for the first distribution, which will be for the week 26th Aug to 1 Sep.

My goal is that another month down the track, late September/early October, I want ot get the LBI/LEO liquidity pool up and running.

Remember, these are goals and targets, not promises. That's the plan at this stage.

I hope this post was insightful for you, and you understand the way I will be tracking our LBI tokens income moving forward. The above sheet will become a regular fixture in the weekly post that comes out each monday.

Thanks for taking the time to check this post out,

Cheers,

JK

@jk6276

If you would like to learn more about LBI, here are some recent posts that may interest you: