Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

For those that have followed LBI for ages, these reports will likely have a different look and feel from the ones that SSUK used to produce as the previous admin of LBI. Quite frankly, he is much better than I am at making pretty charts and graphs and presenting the info. But hopefully my presentation will be clear enough. Let me know if you want me to tweak anything, and I'll see what I can do.

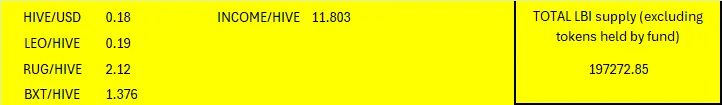

Here are the current prices at the time of producing this report:

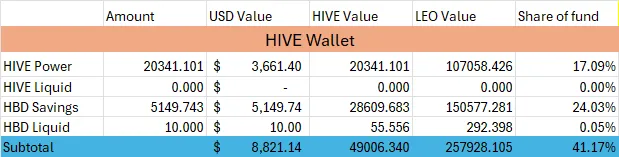

Hive wallet:

This covers our main HIVE assets, being primarily our HIVE Power and HBD savings.

A significant difference between the previous reporting method and mine will be around what comprises income. That may seem a strange thing to say, but let me explain. Previously, things like Hive inflation were counted as income. I'm not tracking it as such, and the reason is I'm interested in liquid income. Inflation comes in powered up, and isn't liquid. That inflation, in the form of hive power, will flow through as asset growth, but won't be counted as income.

Each week, I will be withdrawing an amount of HBD equivalent to half of the yield (10%) to contribute to liquid income. Basically, I'll work out 10% of our HBD balance, divide that by 52 weeks, and add that amount to weekly income.

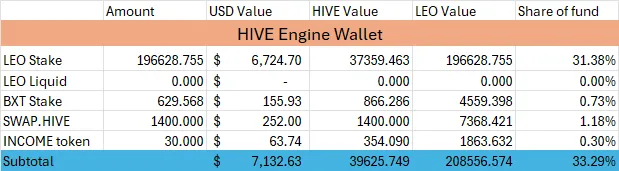

Hive Engine Wallet:

Here our single biggest holding at present, our LEO stake resides. As you can see, I have started accumulating BXT and INCOME to build some nice, easy passive income to add to the weekly distribution. LEO that comes in staked from @leo.voter delegation will not count as income. Only liquid LEO from curation and post payouts will go as income.

I plan to keep building up BXT, and INCOME over time. As you can see, there is still 1400 liquid swap.hive to play with. Some of that will be required to buy BEE to set up the liquidity pool I plan to have for LBI/LEO down the track a bit.

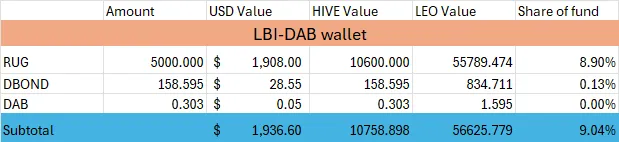

LBI-DAB wallet:

This is a new wallet, set up this week to hold our RUG, DBOND and DAB in a stand alone wallet. The RUG holding will mint us DBOND each week - possibly up to 100 per week depending on how RUG performs each week. That is an asset that is pegged and backed by HIVE at a 1:1 ratio. So that is potentially 100 HIVE in assets added to the fund every week. If you wish to keep an eye on the wallet, it is @lbi-dab

Add the amount of DBOND grows each week, it will start to mint more DAB more regularly. DAB also counts as asset growth - and for simplicity and conservatism, I value the DAB simply as 1 HIVE each. On the market they trade much higher than this, but it's one asset I want to keep a fairly conservative valuation on. As the DAB grows, it will start to bring in a daily HIVE drip. This HIVE will go to income. So this wallet will be slow to start building an income, but will contribute nicely to asset growth in the short term. Long term I think this will become a key contributor to the overall fund.

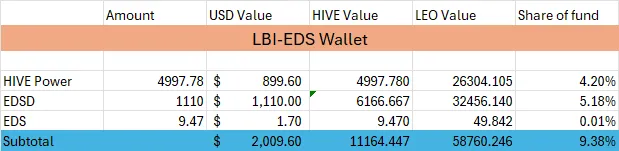

LBI-EDS wallet:

Similar to the above, @lbi-eds is a single purpose wallet, to hold our EDS eco-system assets. Currently, it holds almost 5000 HP, delegated to @eds-vote which will yield a weekly EDS payout. Also, there is 1110 EDSD, also generating EDS. The EDS that comes in each week is not counted as income, and is valued conservatively at 1:1 with HIVE, for the same reasons as the DAB above.

EDS (as it grows) will generate a growing weekly HIVE payout, which will go to income. It is my plan that the HBD generated from post payouts will be sent to @eds-d to be converted into more EDSD. Again, asset growth in the short run to boost the LBI token value, and income is the long term goal.

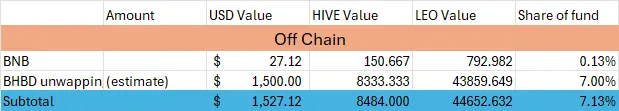

Off Chain assets:

Here lies the ghosts of the past for LBI. The BHBD unwrapping amount is an estimate only. The process has begun to bring those funds back on-chain. Our ticket is in the queue and will be addressed by the LEO team in due course.

Eventually, this section of the report will disappear, as it is planned to keep all our funds on chain for the foreseeable future.

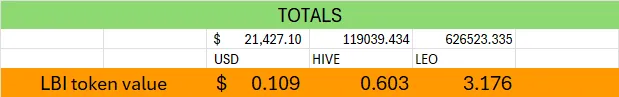

Totals.

When you add all that up, you get this weeks totals for the fund.

5 days ago, I put out the first daily thread with the tokens asset backed value in it.

Todays LBI token value is:

Each LBI is = $0.127 USD = 0.587 HIVE = 2.793 LEO

As you can see, a week is a long time in crypto. The USD value is down, thanks mainly to the drop in the HIVE value. LBI/HIVE and LBI/LEO are both up, which is nice, and is primarily down to the decent proportion of the fund that is backed by USD stablish coins (HBD, EDSD and the BHBD unwrap estimate)

Setting the fund up to grow these ratios over time is my goal.

One little thing I'm going to keep track of is a comparison between SPI and LBI. SPI is the gold standard for Hive Engine based pooled investment funds. If we can match SPI over time, that would be an awesome achievement. So, @spinvest published their weekly update a short time ago. It has each SPI valued at 5.94 HIVE. Each LBI is worth 0.603 HIVE. So the ratio is 1 SPI= 9.85 LBI. Low key, my goal is to close the gap between the two funds, but don't tell SSUK that. 🤫

Income.

Income tracking will start with next week's update. This first week has been setting everything up, and I have just started income tracking today.

Watch this space.

In conclusion:

I think it has been a great week 1. I have really enjoyed getting this handover done, and setting the fund up for the future.

I love feedback, so please drop comments on this post to let me know what you think.

Thanks for taking the time to check this report out.

Cheers,

JK

@jk6276