Probability of success

introduction

One of the single biggest things which separate options from many, if not most investments, is the ability of the investor to know their odds of success prior to making the investment.

Options are an investment vehicle favored by the mathematically inclined, but also by those who want to objectively know their odds of success every time they risk their hard earned money in an investment.

This ability to know your chances of profiting from an options investment is know as Probability of Success.

Definition

body

This is defined as the odds of winning. It is best explained in purely mathematical terms.

Example 1:

If you are a pregnant female you can give birth to either a male child or female child.

The math of probabilities in this scenario are two possible outcomes and each one one outcome.

Simply stated the probability of you having a boy is 1 out of 2, or 50%. The same goes for a girl: 1 out of 2, or 50%. Thus your probability of correctly guessing your child’s sex, otherwise called your probability of success is 50%.

Example 2:

Imagine you were trimming a tree in your yard, and fell out of the tree and hit your head. You wake up in a hospital or clinic. The medical personnel ask you questions and one of them is what day of the week is it?

There are seven possible answers or seven possibilities. But only one correct answer. That’s mathematical odds of 1 out of 7, or roughly 14%. Thus your probability of guessing correctly or your probability of success is about 14%.

Example 3

Let’s look at investing in stocks. We generally sayid you buy a stock, you are successful if it goes up, even a penny. We term that a successful investment.

When we look at your chance of being a successful stock investor we are mathematically looking at the probability of you guessing whether a stock will increase in price or decrease in price, in the predefined time period.

So if we buy a stock called stock A, in order to know the chance or odds or probability that it will go up, we first need to know what the number of possibilities are, just like in the above examples. In the case of guessing your babies sex, there were two possible outcomes. In the case of guessing the day of the week there are seven possible outcomes. But in the case of stocks there are three possible outcomes: the stock price can go up, the stock price can go down, and the stock price can stay the same. So the chance or odds of any possibility is 1 out of 3. So the probability of you being right, no matter which one you guess is 1 out of 3, or 33%. This simply the basic concept behind mathematical probabilities. The number of possible outcomes divided into your number of selections.

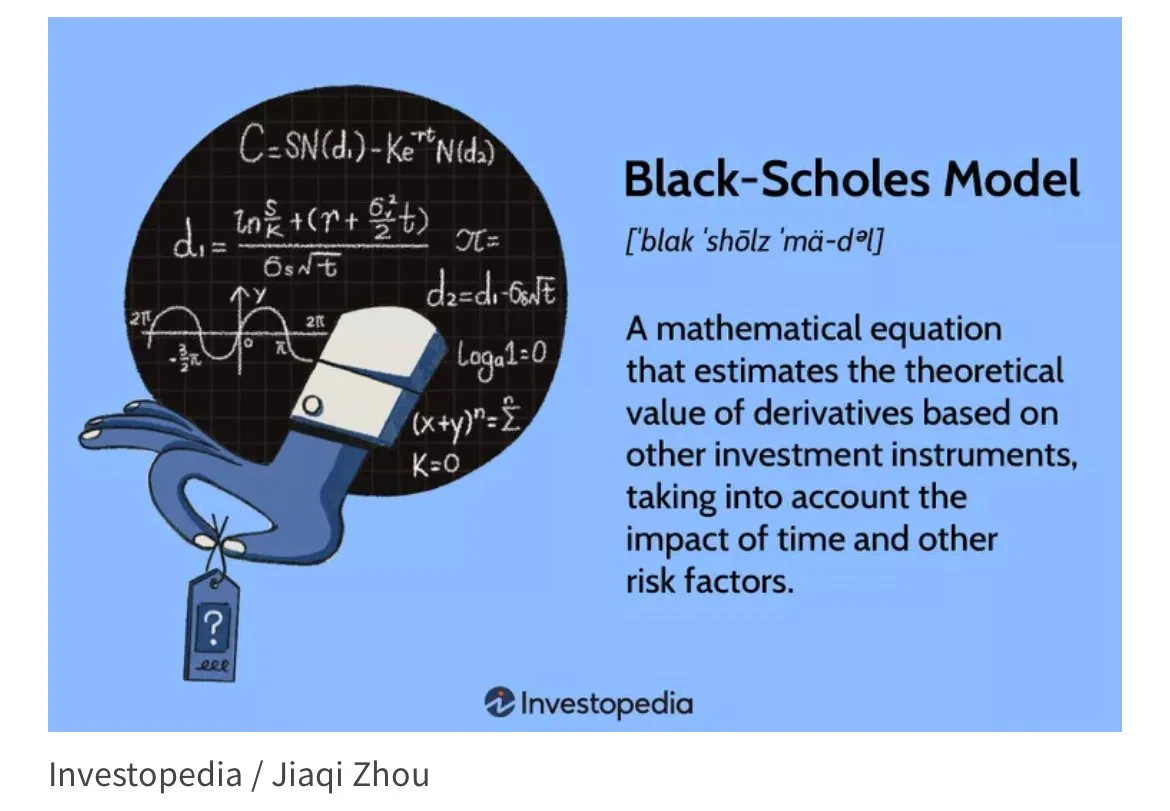

The second part is how this applies to options. When you buy an option you are betting the price will rise to your strike price. The number of possibilities includes all the numbers above todays price and all the numbers below todays price. Then you can divide the number of strike prices you chose to pick and adjust the probability by the historical rise in the strike price overtime. That math formula was derived by two Ph.D level mathematicians and became know as the Block Shoals formula. The formula calculates the statistical chance or Probability of the value or price being reached.

When you look at an Option Chain there is a colum called probability of success. Which is a two digit decimal

These two mathematicians won a Nobel Prize for proving it.

[source](Black-Scholes Model: What It Is, How It Works, Options Formula)

In 1997, Scholes and Merton were awarded the Nobel Memorial Prize in Economic Sciences for their work in finding "a new method to determine the value of derivatives." Black had passed away two years earlier, and so could not be a recipient, as Nobel Prizes are not given posthumously; however, the Nobel committee acknowledged his role in the Black-Scholes model.

[source](Black-Scholes Model: What It Is, How It Works, Options Formula)

So now when you look up a strike price in an options table you can also find the calculated mathematical probability of the stock closing at that price on the expiration date of your option. It’s not perfect, but it’s really good. So using these numbers you now can view the probability of success objectively when you enter a trade. And to my knowledge no other investment provides this type of tool. The numbers are decimals like 0.15 and you multiply by 100 to calculate the percentage of chance of success. So 0.15 equals a 15percent chance of the price closing at a certain value.

Interestingly enough probabilities are highest close to the current price. That is no movement in the stock is statistically the most likely outcome. And as you move away from the current market price the odds decrease. These price probabilities can be calculated in percentiles and standard deviations from the current price. This means probability calculations resemble a bell shaped curve. Tallest at the current market price and a 60% probability of that price being the new price in a period of time.

Conversely, probabilities are lowest at the extremes of the curve 3 standard deviations from the market price. Where the probability of the price jumping that much is very small : 0.05 or multiplied by 100 equals 5% chance of success.

Last words

So as you can seen options trading can focus on trades with a high probability of success. A unique advantage of investing in the options market. It’s all based on Nobel Prize winning math, where two Ph.D. Mathematicians used calculus integrals to algebraic derivatives to derive a formula to reduce risk in trading stock market derivatives.

I think that is poetic.

What do you think?

This post was originally posted in Leofinance as awards declined. But when I checked the Hive interface rewards were not declined, so that post was deleted.

Read the first article in this series:

@shortsegments/introduction-to-trading-options

Read the second article in this series:

@shortsegments/introduction-to-options-part-2-buying-selling-call-options

Read the third article in this series:

@shortsegments/introduction-to-options-part-3-buying-and-selling-put-options

Read the fourth article in this series:

@shortsegments/introduction-to-options-part-4-probability-of-success