Adulting 101: Banks and Financial Responsibility

Opening your own savings account can feel liberating. A whole lotta possibilities and expectations on how we are going to spend our money for the future. Yes, as an adult opening a bank account is very important. It's a fundamental step in managing personal finances.

And that is my goal today...

Choosing a bank that I can trust, accessible, and with a high interest rate with no maintaining balance required. That I can also apply online. (Because I had to wait in line for hours to get a 5-minute inquiry at the bank how great is that.)

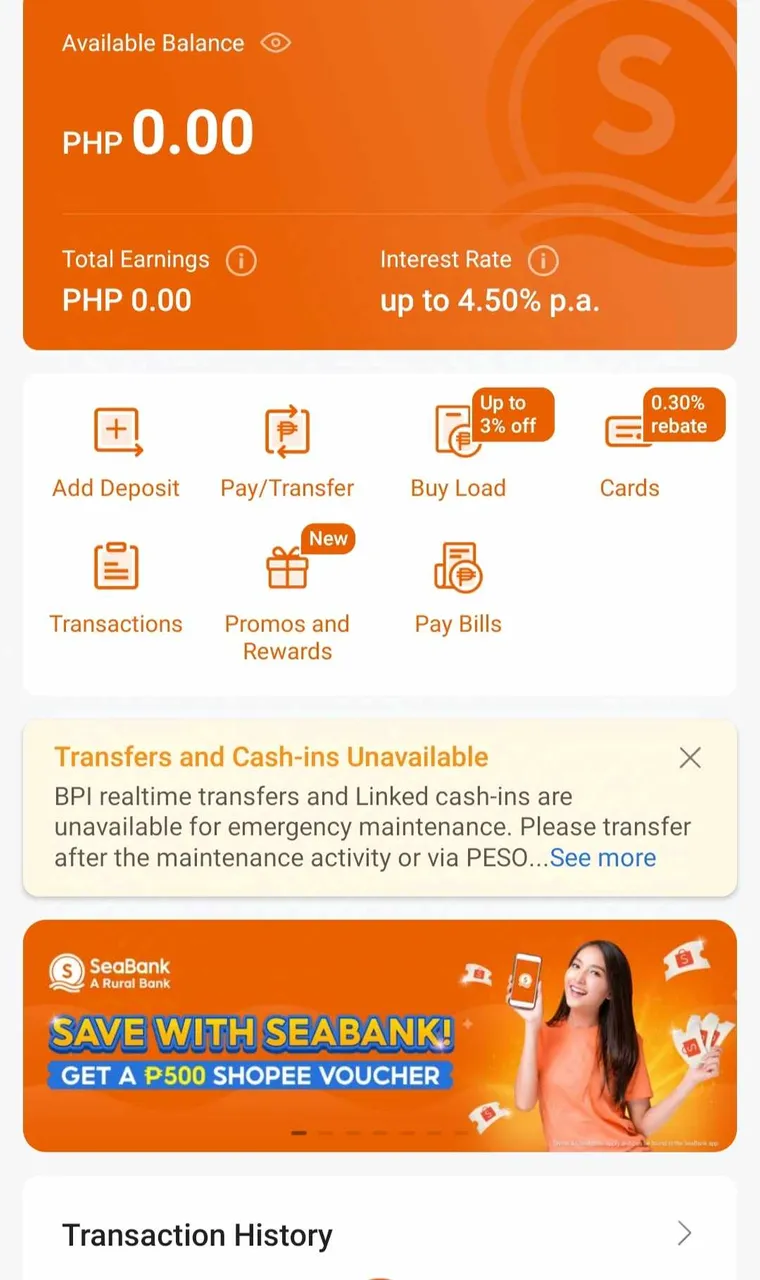

That's where Seabank Philippines comes in. Fits the checklist that I'm looking for a bank and here's why;

- Maximize Savings Growth with High Interest Rates

One of the biggest advantages of Seabank is its competitive interest rates, which are often higher than those of traditional banks. Here’s how this makes a difference:

Compound Interest Benefit:

With high-interest savings accounts, the interest earned gets reinvested, which means you can earn interest on both your principal amount and the previously earned interest over time. Even a 1% increase in the interest rate can lead to substantial growth over the years.

Beats Inflation:

The interest earned can help offset inflation, which erodes the value of money over time. Standard savings accounts usually offer low interest rates that don't keep pace with inflation, but a high-interest account ensures your savings retain or grow in value.

Passive Income:

The interest earned essentially acts as passive income. Even without making deposits regularly, your money grows, allowing you to save towards future goals with less effort.

- Financial Discipline and Security

Keeping your money in a high-interest savings account helps foster better financial habits and ensures peace of mind.

Encourages Saving Over Spending:

Parking your money in an account with attractive returns motivates you to save more and avoid unnecessary spending.

Emergency Fund Ready:

A savings account ensures you have liquid funds available in case of unexpected expenses or emergencies. Having easy access to a fund with accumulated interest means you’re always prepared for the unexpected.

Safe and Secure Storage:

Banks like Seabank are regulated and insured by the Philippine Deposit Insurance Corporation (PDIC), which protects deposits up to PHP 500,000 per depositor.

- Seamless and Convenient Online Banking

Gone are the days when you had to physically visit a branch and fill out multiple forms to open a bank account. With Seabank Philippines, opening an account is incredibly easy and can be completed entirely online in a matter of minutes. Here's how:

User-Friendly App:

Seabank offers an intuitive mobile app available on both Android and iOS platforms, making account setup quick and straightforward.

Minimal Requirements:

All you need to open an account is a valid ID (e.g., government-issued ID) and a selfie verification. There’s no need to visit a branch.

No Initial Deposit or Maintaining Balance:

Seabank does not require an initial deposit or a minimum balance, which makes it accessible to everyone.

High Interest from Day 1:

Once your account is verified, interest accrual starts right away, meaning you start earning as soon as you deposit money.

- No Hidden Fees and Full Transparency

Traditional banks may charge various fees that reduce your savings, such as monthly maintenance fees, withdrawal penalties, or balance fees. However, Seabank is known for its transparent policies:

No Transaction Fees: You can transfer money between accounts or other banks via PESONet and Instapay without incurring charges.

Instant Notifications: You receive real-time notifications for all transactions, allowing you to track your spending and savings accurately.

- Financial Flexibility and Accessibility

Seabank’s online platform offers complete flexibility, ensuring you are always in control of your finances.

Easy Fund Transfers:

You can transfer funds to and from other banks effortlessly through Seabank’s mobile app.

24/7 Access to Your Account:

With the convenience of mobile banking, you can access your funds anytime and from anywhere, removing the dependency on physical branches or ATMs.

Integrated with Shopee Pay:

Seabank is integrated with Shopee, one of the Philippines' largest e-commerce platforms, making it easy to manage finances for online shopping or cashback rewards.

Conclusion: A Smart Financial Move for Everyone

Opening a high-interest savings account with Seabank Philippines is a strategic step toward financial freedom. With competitive interest rates, zero fees, and a seamless online account setup, you can grow your savings effortlessly. The ease of opening an account through the Seabank mobile app removes barriers, ensuring everyone—whether a first-time saver or a seasoned investor—has access to reliable and rewarding banking.

Investing in a high-interest savings account means taking control of your financial future. Your money won’t just sit idle—it will grow and work for you, bringing you closer to your financial goals.

Account has been made. Another goal has been achieved today. More in the future.

Thank you for reading and have a blessed day! @terganftp @terganftp