Welcome back!

As you can understand from the title, today you can read the first part of chapter 1 of my book; I hope it will be interesting and maybe somehow useful too.

Enjoy the reading.......

Chapter 1: Rehabbing Basics

Rehabbing or House flipping has gotten more popular over the years. In recent times, we have seen the rise of house flipping shows and experts in real estate investment on TV shows. This kind of real estate investment is advertised as being a leading method of getting a considerable amount of cash during a short period.

For a lot of individuals, rehabbing or house flipping is an excellent way of taking charge of their lifestyle and finances. There were moments when more than 250,000 rehabbers in the US were in search of properties to purchase and sell once more for profit. Also, official figures prove that during moments with the most activity, about 10 percent of all property sales have been flips.

However, if you watch reality shows a lot, you will know that it is not all reality. So what is rehabbing or house flipping? How does it work? We will be exploring all of these questions in detail in this chapter.

House Flipping: What is it?

House flipping is when an investor in real estate, purchases properties or homes and then disposes of them for a profit after making the essential repairs. For a home or property to be classified as a flip, it needs to be purchased to resell fast. The duration between when the property is bought and when it is sold usually falls within a few weeks and sometimes as long as a year.

There are various ways of flipping homes which we will be looking into below:

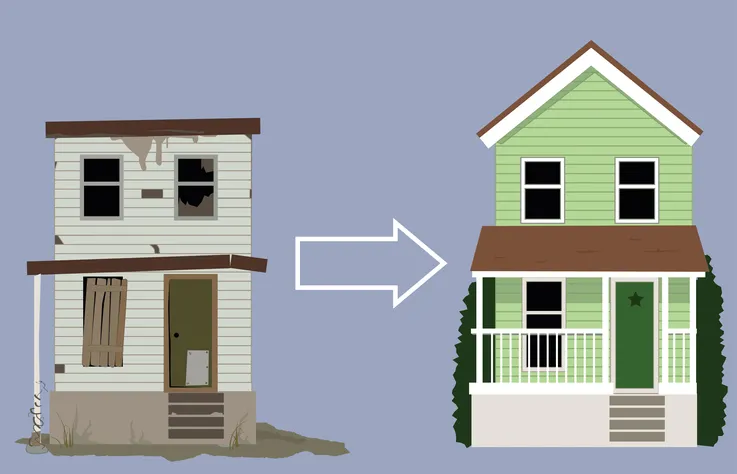

Fix and Flip or Rehabbing

This method of flipping homes is the most recognized one to date. It is the one you come across on television showing the purchase, fix, and flip technique of investing in residential properties.

Here, a real estate investor purchases a distressed home for a reasonable price. Then, he/she begins to carry out repairs on various aspects of the house, enhancing them and even replacing some components entirely. The instant they are through with repairs, they place the newly completed home on the market for sale with the hope of disposing of it for a higher price quickly.

If you are in search of a fast way to profit from real estate, this can be an excellent strategy to adopt. Also, this strategy can provide a valuable service to buyers, sellers, local neighborhoods, and the economy.

However, there are still other ways to fix and flip or rehab; investors in Fix and flip or rehabbers can differ depending on the level of fixing they intend to carry out on a property. Some investors don't go beyond some necessary cosmetic enhancement or looks. It is easy to enhance the value of a home and get more profit just by improving its appeal, which may consist of making a few renovations to the landscape. In contrast, some investors will stick to the basic painting of the exterior and interior of the property, installing new flooring, and replacing some fixtures.

Some other investors may choose to flip or rehab homes or properties with structural problems. These could range from replacing things like plumbing, foundations, roofs, and electrical wiring, among others. Properties that have these kinds of issues often come at a much lower price because of the increased risks and costs. Because of the low amount of competition involved in properties like these, some investors see this as a great option. However, many other investors stay away from them because of the additional capital requirements and liability.

All of these are great strategies for making a profit depending on your experience and the level of risk you are comfortable taking on. However, as a starter to the business of rehabbing homes, a safe bet for you would be to purchase a home that has the least issues. Doing this will allow you to fix and sell for a profit quickly.

Hold and Flip

Some investors are not interested in doing that much work, or who don't need the cash fast. If you fall into this category, this option will be ideal for you. Here, investors purchase a property and hold on to it till they can sell it for a profit later on. This could range from a day, months, or years. Investors who fall in this category are mostly depending on earning profit from a rise in price. This strategy comes with a lot of risks but can yield a lot of returns if it goes the right way.

Real Estate Wholesaling

Wholesaling is another method of house flipping. Here, you don’t have to rehab or fix anything. It mostly involves purchasing properties at a low price and selling them for profit. Here, you sell most of these properties to rehabbers who do all the fixing before they sell it to the final users from the public who live in them or rent them out.

In this book, we will be paying attention to the first kind of house flipping called rehabbing or fix and flip. Now, let’s have a look at how it works.

How Does a Real Estate Rehab Work?

Flipping homes typically has to do with purchasing a property or home to dispose of it for a profit. However, it is not as straightforward as that as there are a few factors involved.

● You need to make lots of choices from the start. For instance; where should you purchase? If you buy a property in a neighborhood that is just growing, you are hoping that the value of the area will go up. House flipping has a lot to do with the real estate market as well, for example; when there is a boom, it is an excellent market for rehabbers or flippers, and they can choose their prices in specific areas. However, when it is a slow period, a lot of these properties can remain on the market for a long time after they have been fixed.

● After deciding where you want to purchase the property, you need to determine the kind of property you intend to buy. If you go with a property that is depreciated, you will need to make the necessary renovations which require money and time. If you decide to purchase from a bank or auction, you may get a good deal. However, you need to note that there may be hidden issues to deal with as well. We will be covering more on these later in this book.

● The next step is to go in pursuit of a way to finance your flip. This means you will search for lenders who can offer you the funding you require, depending on the property's value. If you can afford it, you can use your funds during this process.

● Once financing is in place, what you need to do next is make the necessary repairs to the home. To ensure this is a success, it is essential to pick the right contractors, stay within your budget and timeframe, and keep track of the repair cost, all in a bid to ensure you develop homes that individuals will want to purchase. Also, you have to learn to properly negotiate with contractors and pay them the appropriate amount, which will make sure that they do an excellent job for you.

● Finally, if you did all you were supposed to the right way, you will be left with a property people will love to buy. Here, you learn to advertise your property, and you sell it off at a profit.

Is House Flipping a Great Investment?

House flipping may seem like something simple, but it is not without its hassles. Speaking factually, if you flip a home the wrong way, it could lead to a massive amount of losses.

However, if you do it appropriately, a house flip can be a fantastic investment. In a brief period, you can make strategic repairs and dispose of the home for higher than you purchased it for. If you make the choice of flipping a house, your goal will certainly not be to lose your hard earned cash. You need to invest smartly so you can get the best Return on Investment.

Now that you understand how great an investment house flipping can be, you may be tempted to head right into it and start making a profit. However, this is not possible as you need to have a few things in place before you begin.

Requirements for House Flipping

To begin the business of house flipping, there are a few essentials you need. They include:

Good Credit Score

It will be challenging to start flipping houses if your credit is not great. At some point, you will require some form of loan unless you have enough money of your own to purchase a home and do all the needed repairs. The standards for lending have become stricter, especially if you are after a loan for a house flip which comes with a lot of risks.

If you don’t know your score, the first thing you need to do is to find it. To get your credit record for free. If your credit is not presently great, you need to begin developing your credit score by reducing your debts, paying bills at the right time, and ensuring the balance on your credit cards are low. There are various ways to do this, so ensure you do your research and do all you can to make your credit score better.

A better credit score will ensure the interest rates you get when you request a loan, will be much better. This can reduce a lot of cash from your expenses when you begin flipping homes, allowing you to invest more money in other vital areas. Finally, you need to learn what makes your credit score go down. For example, when you take out a lot of credit cards simultaneously, it reduces your score. You have to ensure you stay away from activities that will bring your score down during the periods you apply for a loan.

Cash

Flipping a home requires capital. Lots of new investors run into financial issues when they initially purchase a property without a reasonable down payment, then use credit cards for the payment of renovations and home enhancements. If the property spends too much time on the market, or the cost of improvements is higher than projected, the investor may become stuck.

You want to do all you can to ensure this is not the case with you. If you're going to flip the right way, you will require a reasonable amount of money on hand. Lots of traditional lenders will need a 25% down payment, and they offer you the best rates you can find. When you have ample resources to make the down payment, you will eradicate the need to pay a PMI or private mortgage insurance which can take a dip into your returns.

In addition, the interest rates on loans for house flipping are higher than typical loans. As stated by TIME, many investors request for an interest-only loan, which has a standard interest rate of 12- 14 percent. In contrast, the interest rate for conventional home loans is usually around 4 percent. The higher the amount of money you pay in cash, the lower the interest you will need to pay, which is why it is essential to have as much cash as possible on hand.

Why Should You Invest in House Flipping?

There is a range of benefits associated with flipping homes. You, as an investor, has the most to gain. For one, you get to earn a sizable amount of income if you know what you are doing. Even though the money you earn from flipping a property can differ based on a range of factors, in the end, what you make is better than you will get from working for someone else.

Also, the flexibility of the business means you can determine your work hours. You can decide to flip part-time or full-time, depending on what suits you best. You can decide to flip homes only during the weekends, or a few hours of the week after your typical work hours. Regardless of the option you choose to go with, you still retain full control of your scheduling.

You can take breaks when you want and close for the day when you desire, to spend more time with your family or attend important events. It gives you the chance to be your boss. You don’t report to anyone but yourself, and it lets you take charge of your financial future.

House flipping also offers a range of benefits to all the parties involved. Similar to constructing a new home from scratch, rehabbing properties can create jobs for lots of people. It can also make revenue for the local government. What's more, a rehabbed home can enhance the value of a street or neighborhood.

Buyers and sellers can also enjoy some benefits as well. Many homeowners in dire need of cash, may be stuck in a financial crisis. When a real estate investor comes to take their property off their hands, it can help them get out of their financial crisis. Other individuals who want to purchase a residential home to live in may not buy those that are not structurally sound, require minor repairs, or have issues with the titles. Finally, buyers of homes also benefit because they can purchase properties they genuinely desire. Now that you understand how house flipping can be of benefit to you, the next chapter will be taking a look at the steps in a successful rehab.

you can find my first post here .... @pikkio10/i-introduce-myself-and-present-my-book

sorry for the confusion but I'm still getting used to Hive :-)

Pikkio10