While I acknowledge the persistent risk of inflation due to the robust economic strength we're witnessing, I also believe that the surge in interest rates could potentially impact economic activity in the United States, subsequently influencing global markets. This presents a delicate balance between inflationary pressures and the dampening effect of higher interest rates on economic growth.

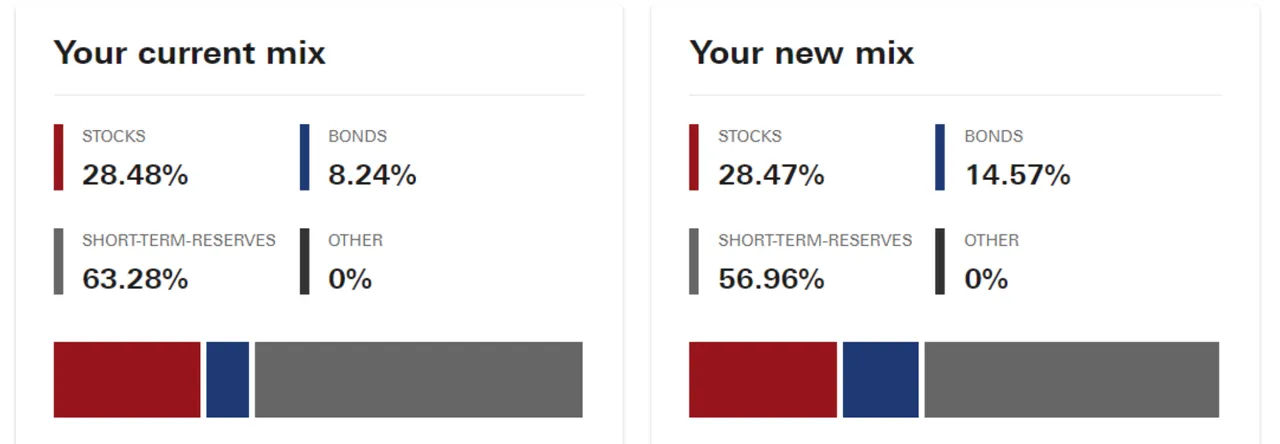

In light of these considerations, I'm considering reallocating a portion of my portfolio from short-term paper at higher rates to medium-term bonds. By doing so, I aim to capitalize on the relatively attractive yields offered by medium-term bonds while also positioning myself to benefit from potential appreciation over time.

Moreover, diversification remains a cornerstone of prudent investing. With my current exposure skewed towards non-traditional markets, such as cryptocurrencies, I recognize the importance of diversifying into more traditional asset classes like bonds. Not only does this enhance portfolio resilience, but it also provides a hedge against market volatility and downside risks.

By strategically allocating a portion of my portfolio to bonds, I seek to achieve a balanced and diversified investment approach that can weather various market conditions. While the prospect of shifting towards bonds entails careful consideration and analysis, I'm confident that it could yield favorable returns and bolster the overall stability of my investment portfolio.

As I continue to monitor market developments and assess investment opportunities, I remain committed to navigating the ever-changing investment landscape with prudence, foresight, and a focus on long-term wealth accumulation.

Discord: @newageinv

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities and services that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

My go to exchange is Coinbase; get bonuses for signing up!

The future of the internet is here with Unstoppable Domains! Sign up for your own crypto domain and see mine in construction at newageinv.crypto!

Always open to donations!

ETH: newageinv.eth

BTC/LTC/MATIC: newageinv.crypto

Disclosure: Please note that for the creation of these blog posts, I have utilized the assistance of ChatGPT, an AI language model developed by OpenAI. While I provide the initial idea and concept, the draft generated by ChatGPT serves as a foundation that I then refine to match my writing style and ensure that the content reflects my own opinions and perspectives. The use of ChatGPT has been instrumental in streamlining the content creation process, while maintaining the authenticity and originality of my voice.

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.