Welcome to the MPATH Weekly Report.

A decent week, with a higher distribution, hence income values increasing, plus a slight uptick in vote yields in line with the variable blockchain yield.

We have also seen a significant new purchase of MPATH tokens. These have been largely powered-up now, but the figures below reflect this in the "Other HIVE" figure and will be updated next week as "Earning HP".

I have simplified the data a bit by removing the breakdown of values for the "Gross yield" as it is easy enough to calculate by doubling the vote-yield in the "Net yield". When the reward curve was non-linear, this made sense, but with the current linearity it doesn't give any extra meaningful information.

One other thing to report is that there are on-going issues with our voters, and perhaps you have noticed that even doing manual operations can be glitchy and error-prone. Once this is sorted then we can fix our script, but note that members have been getting manual votes instead - for those with low amounts of MPATH, it is more efficient to give out one large vote rather than many smaller ones.

The Hive blockchain yield is almost static compared to last week. As I said before, we are seeing two distinct effects overlapping - the recent HF25 and the volatile market price - so let's see what happens next.

As I also mentioned last week, we may see MPATH moving towards a higher vote and lower income in relative terms to each other.

Having said all this, our lower estimate comes in at 27% APR, which is still pretty good!

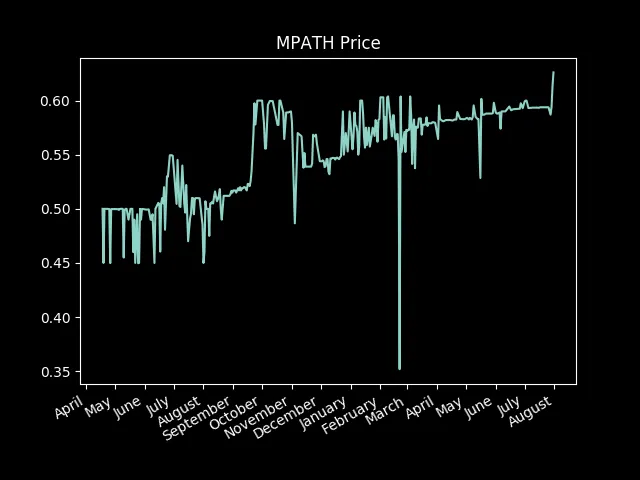

Here is a graph of the MPATH token price. (Thanks to @gerber for the discord-bot.)

As you can see, it is a rather jagged affair, mainly because the spread remains wide so those spikes are merely the difference between someone buying tokens and someone selling them.

A reminder that this is a market, and not a shop, so although official prices are designed to guide the market, you can sometimes find cheap MPATH tokens. I reiterate that our promise is that we will guarantee official buybaks equal to that week's income. Anything above that will require some waiting for an increase in power-downs.

MPATH has finally broken through what seemed like a 60-cents resistance level! I shall continue to narrow the buy/sell spread slowly as we move up. Worth a reminder here that MPATH is asset-backed, so our buyback price is fully-funded by HIVE assets.

And on to my usual closing remarks...

As ever, I give the caveat that individual member returns depend on many things, but these are our baseline figures to see how income changes from week to week. This is also a good time to remind members that such high returns may require adjustments at times so that our Voting Power does not get too low. We have plenty of capacity left, so this is not an issue, as yet, but members with 2000 MPATH tokens are getting votes from about 35k HP, so even if the VP is down to 60% that's still an effective vote from a 21k HP account.

A final reminder that the maximum holding to receive votes is 2000 MPATH, and the maximum to receive reward distributions is 5000 MPATH. You may, of course, own more than this as an investment. We shall increase these if we see the demand to do so, but they are there to attenuate the effects of large accounts and thereby help the smaller accounts. Also worth a reminder that any accounts below 10 MPATH will receive no benefits.

For full details, please read How the MPATH Program Works [May 2020].

Have a good week!

The MPATH headline figures are:

MPATH tokens active = 43,625

Earning HP = 42,660

Voting HP = 35,840

HP in MPATH = 21,770

Other HIVE = 4,340

Total HIVE = 26,110

MPATH ABV = 0.5943 HIVE (+0.0003, +3.0% APY)

Sale Price = 0.6286 HIVE (spread 0.0343 HIVE)

Estimated Gross Earnings = 9.00 HIVE per 1000 MPATH = 46.7% APR

Estimated Net Earnings = 5.19 HIVE per 1000 MPATH = 27.0% APR

(5.19 = 1.40 income + 3.79 votes)

Total MPATH Distribution = 61.0 HIVE = 97 MPATH tokens at 0.6286 HIVE sale price

Hive est. APR = 22.0% (+0.1)

Note that "Other HIVE" is the sum of all holdings not powered up as HP: liquid HIVE and HBD plus holdings within Hive-Engine. Also note that such values are volatile, especially any holdings priced in US$, so the above numbers are a snapshot and may have changed when you look at the @MPATH account.

The Asset Backed Value (ABV) is our total holdings calculated in HIVE divided by the number of active MPATH tokens.

Any questions, please ask in the comments below or in our public chatroom.

[BUY MPATH] - [READ MPATH]

[BUY new M token] - [READ M posts]