A couple of months ago now, I posted regarding relaunching LBI, with myself taking over as the main admin of the project. That post was well received, and most commentors felt the move was a good one. Since then I have taken some of the feedback on board, looked at our options and firmed up my plans for the fund moving forward.

So here is the plan. Note, I won't put a lot of specific numbers in this post, it is more of a high level overview and guide to how LBI will run moving forward.

Current position:

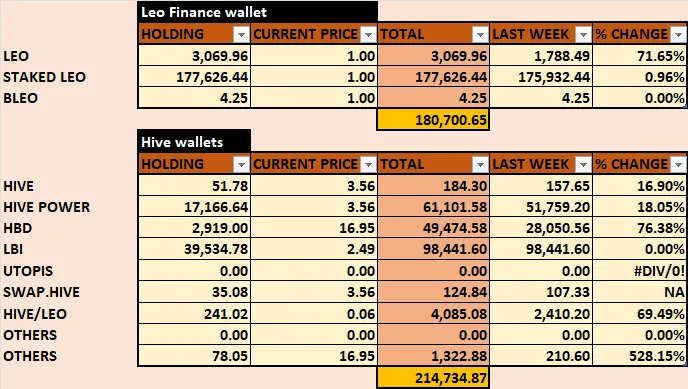

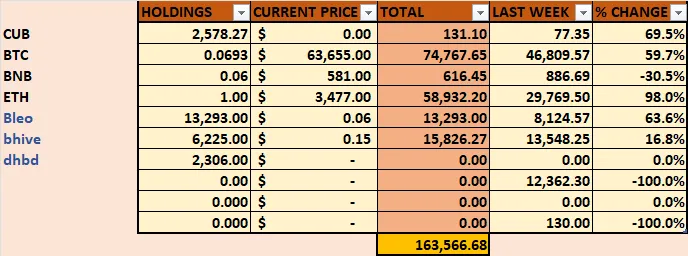

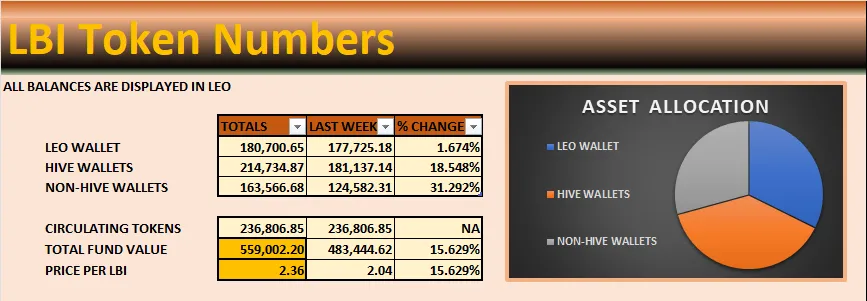

@silverstackeruk has sent me some current values for the LBI fund since the last LBI update post

As you can see, the recent market moves have boosted the value of LBI in terms of LEO, from just over 2, to 2.35 currently. Now is probably a good time to bring non-hive assets back into HIVE, with the BTC in particular giving a good amount of HIVE to work with.

All on HIVE

My plan is to bring off chain assets back onto HIVE, and have the fund run as a 100% HIVE based fund. Primarily this will be done for ease of operation. Also, It makes it easier for anyone wanting to keep an eye on the wallets to monitor what is being done. The philosophy for this fund will revolve around building HIVE assets to build LEO income.

In my original post, I spoke about the split of income, and how it would be allocated. A valid point was raised, in that it is easy to allocate income, however when a portion of it comes staked or through HP inflation, it is not that easy. So, to address that, I think the following clarification is in order. I’ll split income into two categories.

- Liquid income: This will obviously be any HIVE, HBD, LEO or so on that is liquid and able to be swapped into LEO and put in the income distribution wallet.

- Asset growth: This will be non-liquid income such as HP inflation, staked LEO (from Leo.voter) and other tokens we may earn from investments (like EDS for example).

The plan would be to build up investments in stages. Let’s look at EDS as an example of this. Step 1 would be to invest HBD into the EDSD token. This would mint us EDS each week. I would count these EDS as Asset growth, and not include them in the weekly liquid income distribution. Over time, these EDS would accumulate (building another asset on the balance sheet) and pay a weekly yield in the form of liquid HIVE. This liquid HIVE income would then go into the distribution wallet and add to the weekly income split.

In this way, the fund puts capital into one investment. That then generates growth in the form of a second asset, which then generates an income that will consistently grow over time. LBI’s philosophy is born from SPI, and that is the “get rich slow” motto. I think this two-step approach to our investments fits that nicely. A steadily growing asset base, which builds a steadily growing income over time.

Another example of this would be our HBD savings. The simple option would be to take the 20% yield each month and swap it into LEO and distribute it. However, what I would do instead is pull half of the yield out, and swap it to LEO for distribution, and compound the other half. This means, that without any extra funds added, our HBD balance would grow at 10% per annum, and the income that (growing) asset generates would steadily grow over time. Again, a two-step approach.

Even our LEO balance (the mainstay of the fund) can be seen in this light. Income from LEO.VOTER delegation of HIVE power is earned staked. This would remain staked and grow our LEO stake position over time. That stake then curates and earns (in theory) a slow but steadily growing liquid income (curation).

So, I guess that sums up, with examples, how I would seek to invest LBI’s funds. Now let’s look at specifics.

The goal would be to begin by working through converting the “unavailable funds” mentioned above into useable funds. I’ll work through the unwrapping process with the LEO team to unwrap these funds back to hive. I believe their will be some losses from bridge fees on these distressed assets, but my goal will be to bring the maximum amount back to HIVE and able to be redeployed.

Regarding the LBI tokens, I am exploring some token swap possibilities, and have had some discussions with Ecoinstant regarding the INCOME token. My initial proposal was too big, and we may explore smaller amounts to begin with

So, aside from HIVE power and LEO power, here are the assets I’d like to build into LBI’s balance sheet:

- HBD – as mentioned above, half of the yield would go to liquid income, half would remain in HBD and compound into savings. This gives a growing asset, and a growing income over time. The main risks are a HBD de-peg event (small risk but must be noted) or a decrease in yield (fair chance of this happening at some point in the future). Goal would be a minimum of 5000 HBD to begin with. This would yield asset growth of around 19 HBD per week, and the equivalent in LEO (roughly 240) going straight into the income distribution wallet, significantly boosting this from the start.

- EDSD/EDS. As mentioned, a position in EDSD would be built to mint a steady flow of EDS. The EDS would be added to “staked assets” (even though they are liquid, but I would not sell them thus the classification). These EDS would then mint a weekly yield in HIVE, that would be swapped into LEO and added to the distribution. Goal would be 5000 EDSD, which would mint approximately 20 – 30 EDS per week. The income from this would start out small but grow every week as more EDS are added to the wallet.

- SIM/HIVE liquidity pool. This one might seem odd to many, with SIM being the token for the DCity game. However, I think it is a highly underrated investment, and the LP has a long track record of consistent yield. SIM’s price has also been stable for a long time. How this works is we would deploy funds into the LP on Beeswap. This generates a daily yield in SIM. I would steadily grow the position by swapping half the SIM back into HIVE and adding to the pool. This gives us the slowly growing asset base. SIM also generates another yield, in the form of liquid HIVE paid every day, at consistently over 30% APY. This is based on a 30-day average of your SIM holdings – including SIM in the LP. This income would go to the weekly distribution wallet and would steadily grow over time as more SIM gets added to the pool.

- BXT/HIVE liquidity pool. Another two-step process. First, add funds to the BXT pool. This position I’d scale into over a period, as a significant investment all at once would move the market price too much. Slow and steady for this one. The pool yields BXT tokens, at roughly 20% currently. These earned tokens I would then stake, which gives us the steadily growing asset base again. Staked BXT earns a share of platform fees generated, and this yield tends to range between 10% and 20% APY. The yield would go into the distribution. The contribution of this to income would be insignificant to begin with, but as the staked BXT grows, then the income will start to become noticeable. Another slow and steady growth of both assets and income.

- INCOME. This is a bit more simple than the above. For this, the asset value growth is built in to the token model itself, so we don’t have a two-step approach here. The hardest part is building a sizeable position in what is a quite small project. I would look at a combination of swapping LBI tokens held by the fund, and slowly buying off the market to build this position. The yield it generates would go into distribution. This is another high quality project, with a long track record that is fairly “under the radar”.

- DBOND/DAB. Similar to EDS, my goal would be to build a position over time. DBOND direct sales have concluded, so buy in will need some patience. They minted at 1 HIVE each, and buying at this price seems doable, with patience. In addition, new ways to mint DAB are coming, and we will likely get involved. However this ends up working, DBOND is asset one, DAB tokens accumulate as “asset growth” and then the income that DAB yields (liquid HIVE) goes to the income distribution. I'd also look to get some funds into the new token in this project - RUG. This gives another layer to the asset growth model. Invest in RUG (asset growth potential) - income mints DBOND (a second asset) - DBOND mints DAB (a third layer of asset growth) - which finally generates a liquid income (HIVE) that would go into the income distribution.

As you can see, yes the goal is to turn LBI into an income generating token, but there will be multiple avenues of asset growth built in along the way.

INCOME DISTRIBUTION.

I’ve given this some thought, and will stick with the initial proposal for income distribution. All funds that count as "Liquid Income" will go to a distribution wallet, and once a week will be sent out as follows:

40% as dividends to LBI holders

40% returned to the asset wallet to be re-invested

7.5% paid to me as an operator fee

5% sent to @spinvest as payment for assistance with various aspects of running LBI

5% to fund rewards for the LP on BeeSwap/Tribaldex

2.5% to fund a buy-back and burn program.

The LP would not be set up straight away, I would accumulate the 5% plus the 2.5% burn fund to initially save up for the pool and distribution creation costs. Once those are covered, then the pool will kick off, and as mentioned, in addition to the share of income used to incentivize the pool, LBI that holders put into the pair will still count for peoples weekly dividend.

I had some feedback that when I set up the pool, it should be paired with HIVE rather than LEO. After some careful thought, I can see the merits of either approach. In the end, however, I think sticking with LEO is the right way to go. LBI is a LEO project, and while I understand that many LBI holders have reservations about LEO, I still think that LBI will benefit from its deep connection to LEO. Having a LEO/LBI liquidity pool benefits both sides. It makes it easy to accumulate more LBI, or more LEO, and provides another use case for LEO.

Content.

Content was LBI's backbone, and one of its biggest sources of income back in its prime. I would like to revive this side. LBI will become an INLEO premium member, and both long form content and threads will be a focus. Threads will be perfect for a daily update on token values, and any significant news, as well as general engagement and chit chat. My goal will be to personally produce three long form posts each week, with the weekly update being one. I'm also keen to work out deals for other LBI holders to help out on the content side of things.

With content rewards, obviously post payout come in a few forms. Powered up HIVE will stay powered up, and count as asset growth (not liquid income). Liquid HBD payouts will go to the distribution as will liquid LEO (and any other tribe tokens). So, obviously, the quickest way to boost LBI's liquid income and thus dividends would be to revive our content creation.

Going to tag all token holders with more than 5 LBI so people may see this post and keep up to date with what is happening. If there are any objections to the above plan, please let us know. @silverstackeruk is onboard, and happy to hand over the reigns to LBI. I am keen to get it back into action, and hope LBI holders will be happy to see the token active and growing again.

Cheers,

(I have set @lbi-token as 100% beneficiary of this post.

@cornavirus

@taskmaster4450le

@wxmark

@onealfa

@forexbrokr

@silverstackeruk

@partituna

@myvest

@hykss

@r1s2g3

@jk6276.holdings

@dagger212

@alexvan

@oneup-cartel

@d-company

@ammonite.leo

@beyondhorizonmm

@bozz

@netaterra.divi

@tbnfl4sun

@zoe24

@amr008

@cryptoandcoffee

@oldmans

@jocieprosza

@trumpman

@oldtimer

@ambicrypto

@preparedwombat

@jzn

@asteroids

@notaboutme

@erikah

@mcoinz79

@eirik

@tonyz

@underground

@erikklok

@localgrower

@geneticshuffling

@shitsignals

@metzli

@atma.love

@cryptomaniacsgr

@pouchon

@successchar

@wallar

@no-advice

@sames

@riandeuk

@dealhunter

@rxhector

@filotasriza3

@euporie

@gungunkrishu

@flemingfarm

@cryptictruth

@jfang003

@japanguide

@vincentnijman

@lammbock

@behiver

@pardinus

@beverages

@lukaszolejnik

@chrisparis

@stortebeker

@deanliu

@honeysaver

@foreverhero

@gattino

@sk1920

@gadrian

@walterjay

@nikoleondas

@jznsamuel

@a4xjeeper

@loshombresdepaco

@asia-pl

@cmplxty

@cmmemes

@horstman5

@lebey1

@katerinaramm

@rgondie

@moretea

@ammonite

@whitelightxpress

@tefer13

@justclickindiva

@scooter77

@tin.aung.soe

@drax.leo

@polish.hive

@thatcryptodave

@meta.condeas

@theb0red1

@bobby.madagascar

@arrliinn

@erangvee

@meltedmush

@curatorcat.leo

@drax

@kingneptune

@petertag

@tokenizedsociety

@bdmillergallery

@gillianpearce

@keniel16

@ericburgoyne

@emsenn0

@hivecoffee

@swelker101

@harpreetjanda

@failingforwards

@moonthumb

@bitandi

@shtup

@mjmarquez4151

@sgbonus

@torran

@jfuji

@stevenwood

@lnakuma

@braaiboy

@nomaddreamer

@yeckingo1

@drippinouttadebt

@oivas

@curatorcat.pal

@aniol77

@meaganx08

@gerber

@znnuksfe

@samsemilia7

@thatgermandude

@salexa5

@hive-124542

@sinistry

@cooperclub

@xzer0

@ejmh

@taskmaster4450

@roger5120

@methus

@risingstarhub

@noctury

@reonarudo

@guurry123

@h3m4n7

@sayee

@tapeworm16

@geke

@rosatravels

@dylanhobalart

@stdd

@adolfom

@namok

@synergized

@deraaa

@pinkfloyd878

@samest

@apprentice001

@shawnlauzon

@sodomlv

@uncorked-reality

@vimukthi

@sodom-lv

@ijatz

@ichheile

@newigennity

@ecoinstant

@numanbutt

@namelessnameless

@alejoca

@notak

@stevermac1966

@kimmyhime

@bigtakosensei

@killerwot

@athomewithcraig

@chaosmagic23

@hive-183741

@douglasyukanov

@ifeoluwa88

@therecantonlybe1

@manoloeldelbombo

@inakuma

@warmstill

@pastzam

@d-zero