I'm a little lost at the moment with how much funds exactly I have in $FOT, and what the overall earnings being realized are. So this post is to track and measure what is in there. After that I will look at what comes next for Fortis, with the dungeon opening soon.

Hard to track FOT.

The FOT eco-system is a hot mess. Money goes in, it gets burned, swapped, LP'd and what not in a number of different forms. Tracking everything is a nightmare. I am doing these calculations right around epoch time, so I'll work out my earnings and assets directly after the epoch.

The prices I'll use for these calculations are as follows:

- bFOT - $1.34 (highly highly volatile)

- ATOM - $27

- JUNO - $21.50

- UST - $1

Starting point is 0 FOT in my wallet, and 0 bFOT, and the assets I have staked as gFOT and in the various LP's.

gFOT

Currently, I hold 0.0293521294 gFOT staked. These convert to bFOT at a rate of 1 gFOT = 10745 bFOT.

So the value of my gFOT is $422.62 (gFOT * 10745 * $1.34)

FOT income today = 1.595676264000337

Converts to 15.95676 bFOT ($21.38 value)

Daily return = 5.05% (yes daily)

sFOT/UST pool.

Here is where it gets hard to track. I have 254776.106251 LP units in this pool. There is no indication of what the components are. sFOT is the system stablecoin, pegged to 1 UST (not sure what the pegging system is, maybe just arbitrage???)

My return here is just over 0.1 FOT (1 bFOT)

To work out the asset value, I have to use the stated daily return of 2.3742%

If 1 BFOT ($1.34) is a 2.3742% return, then the total asset value is $56.44

sFOT/bFOT pool.

Have to use similar methods for all the pools now.

Return is 0.2711 FOT = 2.711 bFOT = $3.63

Rate of return is 7.42% DPR.

Thus my pool asset value is $48.92

sFOT/gFOT pool.

Return is 1.045 FOT = 10.45 bFOT = $14.00

Rate of return is 8.92% DPR.

Pool asset value is $156.98

sFOT/JUNO pool.

Return is 1.627 FOT = 16.27 bFOT = $21.80

Rate of return is 9.10% DPR.

Pool asset value is $239.58

sFOT/ATOM pool.

Return is 1.979 FOT = 19.79 bFOT = $26.52

Rate of return is 7.86% DPR.

Pool asset value is $337.38

Total income and assets.

So adding all this up, I currently have $1281.92 in total assets locked in the castle. TBH, I consider these assets lost. I put around $800 of my own funds in, so technically in profit. I rate the likelihood of retrieving all that value as low, with 14 day unlocking periods. If I did want to cash out, maybe I could, but maybe this whole thing will collapse before then. Anyway, high risk seeking play money put in to the system, and see what happens was the plan.

Income today is $88.67. So overall my daily return on assets is 6.9% DPR - nice.

Sorry for all the math, that will be it for this post.

Cashing out - the math just changed.

In the time it took me to work all the above out, and claim all those little rewards, something changed in the system. It has been stated that the burn rate of FOT to bFOT will go from 1:10 to 1:11 once the first 1 million FOT gets burned. That point literally happened while I was doing this. So my total of 6.619 FOT income actually burned into 72.81 bFOT. Nice. Also during this time (around half an hour) the price of bFOT dropped to $1.24 (from $1.34)

So take all the above numbers as a broad guide only. Things change so fast in the Castle that calculations are out of date faster than you can work them out.

Anyway, I burn my rewards into bFOT. Then in to gFOT, then in to sFOT. Then I swap half the sFOT into ATOM, using the pool. Each day I am cashing out half the income, to shift some of that insane DPR into something more sustainable. So after all the above shenanigans, I have withdrawn $44 worth of a real asset, ATOM, out of the system and into my wallet. Nice.

The remaining half can sit in my wallet for now. It is in the form of a "stable" coin, so I'm not exposed to bFOT's wild price swings (in theory anyway). What I do is wait till near the epoch time each day, and then add those funds to whichever pool is going to pay the highest DPR. I'm not too worried what the asset is, just chasing after the highest return to maximize till it all collapses.

What's coming next.

We have news today that the airdrop of FOT to ATOM stakers (snapshot in December last year some time) has been delayed. It will come out now early next month, sadly. I was hanging out for that, as I have absolutely no intention to put any more of my own funds into the castle, but playing with house money? Absolutely.

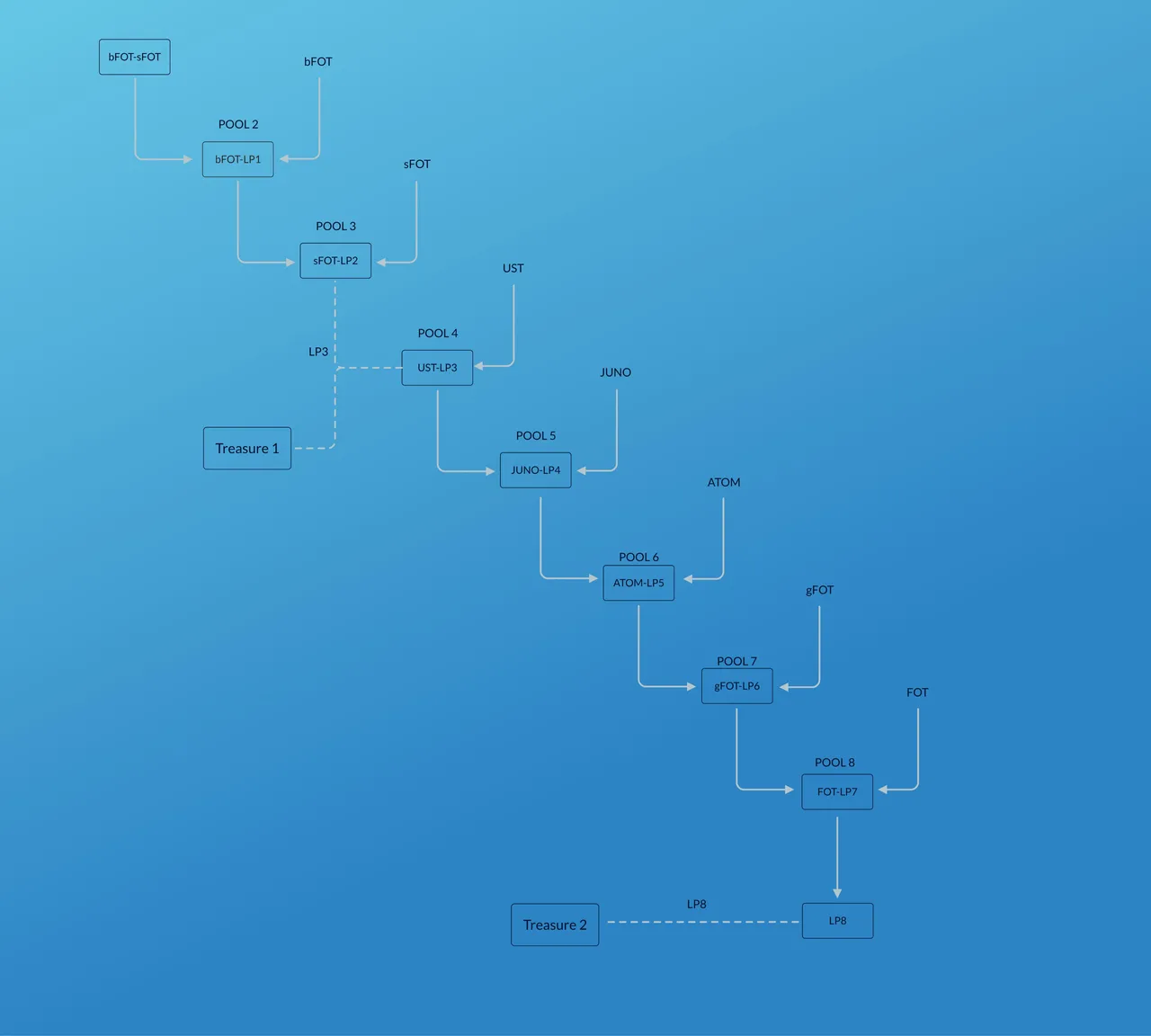

The big thing opening up soon is the dungeon. Yes, this castle is about to have a dungeon. What we know so far is that this dungeon will have 8 levels, and each one will require adding to a new LP, which will contain the previous level LP tokens plus another asset. If what we have seen so far could be described as "gamified defi on steroids", then the dungeon sounds like some "next level, gamified defi on steroids and crack". There is even Lore for this adventure. This is all starting to feel more like a play-to-earn game with many LP's. Whatever it is, I'm here for it.

The insane part is that the Fortis Oeconomia website has a whole bunch more modules they are planning, that don't even exist yet. Could this really last for years, and make anyone brave enough to enter the castle mega rich? only time will tell.

I also want to add a link to an interview done recently by Kevin Garrison with one of the founders of Fortis, Cem Oral. Here is the interview for you If you want to research this experiment further.

I hope you enjoyed this post, feel free to share it around and drop a comment on what you think of this fascinating defi experiment.

Nothing in this post is a recommendation at all. Fortis is an extremely high risk investment, and readers should do their own research on this one. Definitely not financial advice!

Cheers,

JK.

If you liked this content, here are some more posts you may enjoy: