In yet another #ELI5 explainer we will be discussing lending protocols. If you used DeFi you probably came across one of these. Here is your chance to understand why we have them and why we will need them even more in the future.

What Is a Lending Protocol?

A lending protocol is just a big chunk of code specifically designed to create an environment where we can all lend and borrow money to each other trustlessly. There is no need for a centralized entity like a bank to interfere because the code itself makes sure that everyone is getting their fair share in the process.

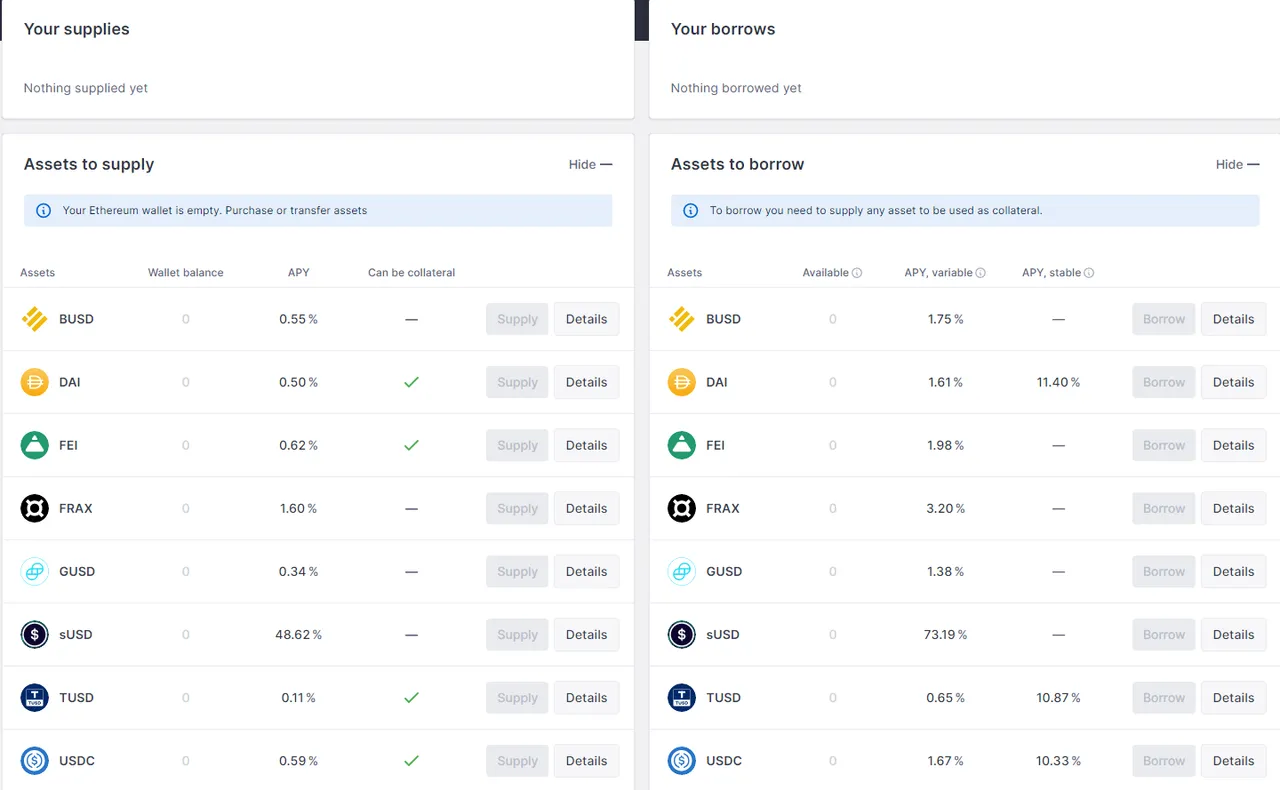

Under the hood, a lending protocol looks like this but on the surface, you will probably see it as something like this.

If you add funds on the left side of the screen you will be able to borrow funds on the right side of the screen, as long as your deposits are collateralized. It is also good to know that borrowing and lending rates depend on demand.

If the total amount of pooled USDC on AAVE is $1M and users have taken out loans worth $900K the protocol will raise borrowing and lending rates for two reasons. Those that want to borrow money will probably refrain from doing so due to high interest rates and the pool will stay liquid while those that are looking to earn income on their USDC will be incentivized to add even more tokens to the pool and increase its liquidity.

If it isn't clear by now, all crypto that you deposit as collateral is immediately available to be taken out as a loan. All deposits go into one single pool from which every user that provides enough collateral can take out a loan.

What Is Collateral?

The value of the loan that you can take out will always depend on the value of the collateral that you provide. For example, many lending protocols have a borrowing limit of 75% meaning that for every $1000 deposited in any accepted cryptocurrency you will be able to take out a loan of ~$750.

It may sound simple on paper but as soon as your liquidation threshold is reached (loan exceeds 75% of your collateral) a liquidation event will take place. Either the protocol or an individual will have an opportunity to repay your loan for you and take the equivalent amount plus ~8% commission from your collateral.

To put it simple, if you put in $100 worth of BTC and your loan is now worth $80 I can come in, repay your loan and take $86.4 worth of BTC from your deposited funds/collateral. This is $80 for the money you owe and 8% ($6.4) in liquidation fees.

The Importance of NFTs

Now that we know how collateral works let’s take a leap in the future and see how NFTs fit into this script. First, try to imagine that your home can become an NFT. It won’t literally turn into a non-fungible token but with proper proof of ownership, you could get an NFT representing your house and use it to borrow money from others.

This would be equivalent to a mortgage on the blockchain. And why would we stop at houses? If we can find a suitable mechanism to do the same with cars, personal belongings, or anything of value that can be used as collateral it can be used for borrowing and lending.

Putting all of this in a functional framework is not as easy as it sounds but some progress has been made with collateralized cryptocurrencies already. We just have to keep moving forward.