Brief Background

Whilst online and mobile banking had been around for over 2 decades in the Philippines, not many people utilize the services and not all banks offer them. And according to 2019 statistics, majority of the adult population are unbanked and data indicates that only around 29% of them have bank accounts which ranked the country one of those with the lowest in terms of number of banked population in Asia Pacific region. The good thing is that out of those with bank accounts, 30% are already using digital payments, majority of which are women.

And thanks to the advent of smartphones and the growing number of people with high mobile phone literacy (which according to statistics are over 74% of the adult population) that sparked most banks to go digital during the years preceding the pandemic. It has since become easy to open a bank account through authorized mobile applications.

With that said, the Central Bank (BSP) also set a goal to increase the number and have at least 70% of the adult population open and own a bank account by 2023 and to make the country become a cash-lite society. That prompted them to start working on regulatory policies and strategies. And Fintech solutions seem to be helping with that concern.

Government Support & Regulations

The government is supportive to innovation and technological advancements with the central bank (BSP) spearheading the efforts to upgrade and modernize the payment solutions, partnering and collaborating with other nations to broaden the financial landscape in the country.

There are 3 government agencies which are the main regulators of the Fintech industry in the country, re:

Central Bank of the Philippines/Banko Sentral ng Pilipinas (BSP)

Its main goal is to increase financial inclusion and broaden the ecosystem of service providers. It has created two special regulations namely, BSP Circular No. 942 and 944 which aims to further supervise and regulate fintech companies in the country. It adopted a test-and-learn approach when it comes to fintech regulations. (Source)At the beginning of 2021, BSP set guidelines on virtual asset service providers to protect the Philippines from becoming an easy target of criminals and terrorists. Apart from strict AML rules, crypto exchanges and other financial organizations were obliged to obtain proper licenses to operate in the country. A few months later, BSP introduced new guidelines for the Open Finance Framework, suggesting a consent-driven data-sharing model. - (Source)

Securities & Exchange Commission (SEC)

The agency is responsible for controlling lending and a few other industries. It takes or pushes for a more conservative or traditional approach in protecting the public. It established the Philippine Finance & Technology (PhiliFinTech) Innovation Office which hears and reviews all business models, products, and services of fintech entities wishing to set up a domestic entity in the Philippines or amend their registration. (Source)Department of Information & Commissions Technology (DICT)

Its role is to monitor the insurance and home maintenance organizations. (Source)In addition to these government agencies, there's also the Fintech Philippines Association which is an independent association that represents the interests and growth of the fintech community in the country.

This was established way back in 2017 with the aim of positioning the Philippines as a hub for technological innovation in financial services and is the largest financial technology trade association in the country, consisting of over 145 advisory, institutional, and individual members. (Source)

Fintech Startups

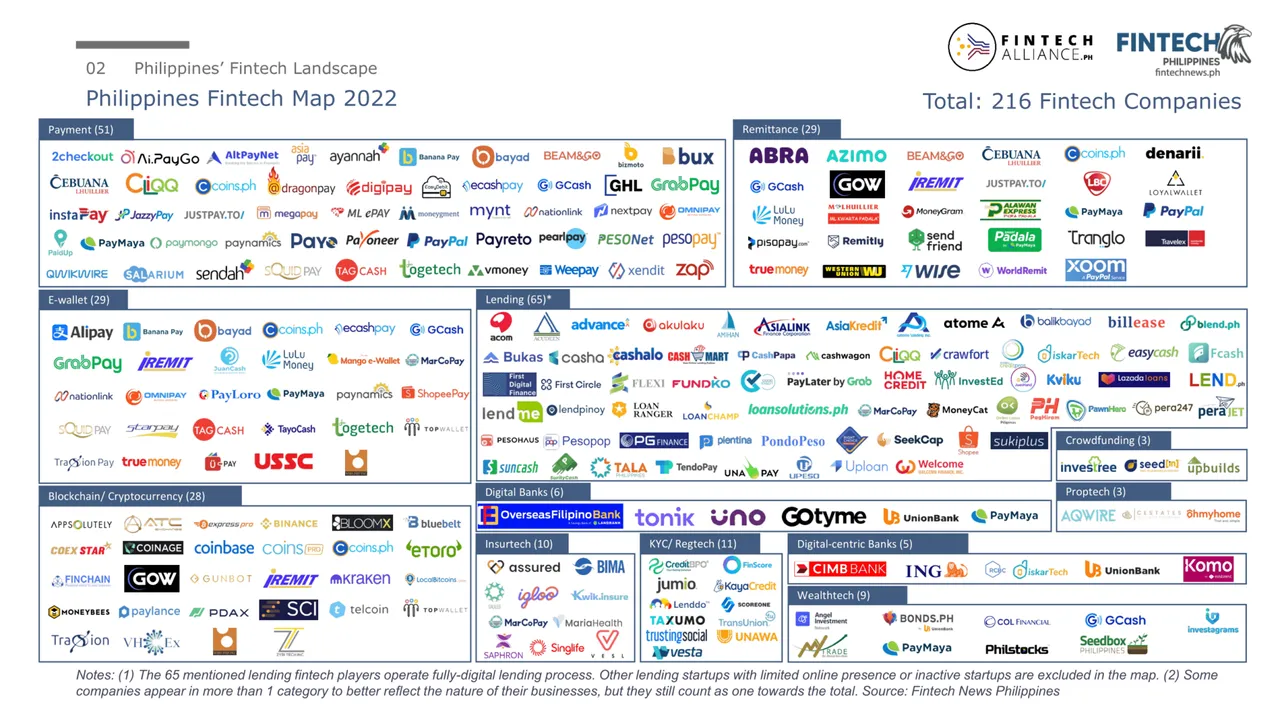

FinTech companies in the country has been around even prior to the pandemic years. It however took off during covid and has been on the rise since. As of November 2022, there are about 220 FinTech firms registered and operating in the country, offering various services from digital payments and mobile wallets among others.

There are also several startups in various fields including cryptocurrency, crowdfunding, digital banks, insurance, investment, lending, KYC or identity proofing and others. According to the latest report, here are the breakdown of the share of Fintech firms with respect to their category:

Thanks to favorable government support (and the pandemic that forced majority of banks to improve their services and go digital), the growth of the FinTech industry has accelerated and now continues to thrive. There was also a significant increase in Fintech funding activities between 2017 towards 2021 according to data.

FinTech Pioneers

GCash

This is one of the earliest FinTech firms in the country which launched in 2004 as a SMS-based money transfer service pioneered money remittances when it rolled out its application in 2012, turning mobile phones into an e-wallets is reported to have seen a surge in its registered users to 51 million as of October 2021.Apart from money remittances (GCash Padala), the e-wallet also offers additional services such as QR-based payments, online checkout, barcode cash in, bills payment, mobile and gaming credit purchases, financial services like investments, savings (GSave), insurance services, loans (GCredit), interbank transfers among others.

Maya (PayMaya)

Launched in 2000 as Smart Money and it was claimed to be the world’s first card linked to a wireless phone and one of the biggest innovations in Finance by Smart Communications. It rebranded to PayMaya in 2016 and renamed as Maya in 2022. Per information from Wiki, it has reached beyond the 50 million registered users as of June 2022, making it the second most-used e-wallet service in the Philippines. (Maya)

(Maya)

The Maya Wallet, commonly still referred to as PayMaya, allows various features and or transactions such as money transfers between Maya users; send money to other local banks; pay recurring bills; purchase mobile and gaming prepaid credits; pay offline merchants by scanning unique QR codes; checkout from online stores using virtual or physical cards; and get insurance coverage for e-commerce purchases, personal health, and mobile devices. (Source)There's also the Maya Savings which allows users to save with up to 4% APR. And the "Personal Goals" which is a time deposit with 6% APR.

Although Maya primarily deals with the transactions in fiat currency, the wallet also lets users buy, sell, and soon send and receive cryptocurrencies such as Bitcoin, Ethereum, Cardano and Uniswap in its Crypto section.

OFB, First branchless digital-only bank

The government-owned bank (LandBank) launched the very first virtual-only bank in 2021 which is primarily for Overseas Filipino Workers (OFWs) and their families. I may write a separate post on this one.

Conclusion

The Fintech landscape in the Philippines is growing strongly and with the support of the government and people readily welcoming and adapting to financial and technological innovations, this field will certainly continue to thrive.

DISCLAIMER: Thoughts and or ideas expressed in this publication are based on my own understanding and are for infotainment purposes only.

17th May 2023/21:00ph