Welcome to The Daily Leo! We pull the best articles in Finances, Crypto news, and Hive/Leo into one condensed information-packed space.

Be sure to follow @thedailyleo so you never miss the Daily LEO. You can also subscribe to the newsletter here Subscribe to the Daily LEO

Russia’s Inflation Spike Sets Kremlin and Central Bank on Collision Course

The Central Bank of Russia at an emergency meeting jacked up interest rates by 350 basis points to 12% in a bid to halt a rapid depreciation of the ruble currency.

The sudden move came after President Vladimir Putin’s economic advisor penned an op-ed arguing that an acceleration of inflation and the sinking currency were the result of “loose monetary policy.”

Prior to the Kremlin’s intervention, the Bank of Russia had blamed the country’s shrinking balance of trade for the inflation and currency frailties.

Oil Edges Up as China Seeks to Calm Economic Fears

Oil prices crept up on Thursday after China's central bank sought to stem the rising tide of pessimism over the country's property market and wider economy.

Prices had fallen for the previous session on simmering worries over the impact on fuel demand from a deepening property crisis that is stifling momentum in China's economy and from the potential for further increases to U.S. interest rates.

Crypto Miners Establish Digital Energy Council To Lobby in Washington

An entity called Digital Energy Council (DEC) has been formed by crypto miners with the aim of influencing U.S. policy concerning cryptocurrency regulation and energy use.

It intends to advocate for beneficial policies that encourage responsible and sustainable energy development, strengthen grid resilience, maintain U.S. competitiveness, and ensure national security as regulators and Congress consider regulations relating to cryptocurrencies..

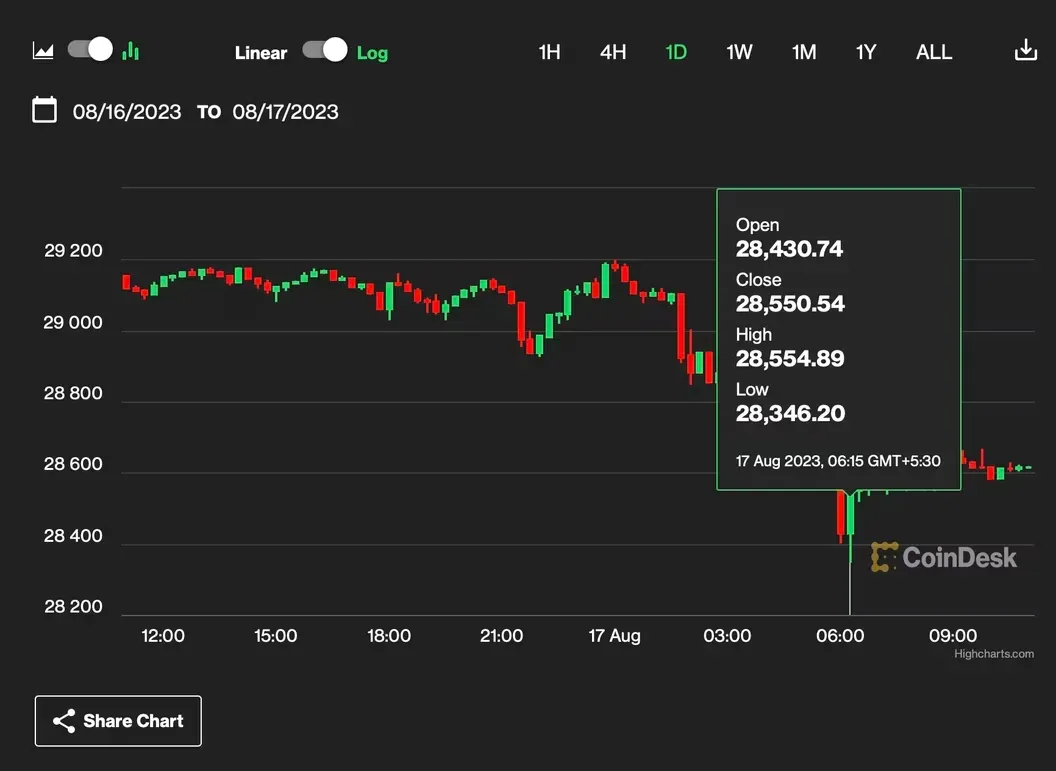

Bitcoin Slides to $28.3K After Leveraged Funds Ramp Up Bearish Bets

Bitcoin (BTC) woke up from its deep slumber early Thursday but not in ways the bulls would have liked to see. The leading cryptocurrency slipped to $28,346, the lowest since June 21, extending Wednesday's 1.6% slide that mirrored risk aversion on Wall Street. US stocks fell Tuesday on renewed banking sector concerns and China recession fears.

The downside volatility in BTC comes days after the US Commodity and Futures Trading Commission's report on the Commitment Of Traders showed leveraged funds – hedge funds and commodity trading advisors – ramped up bearish bets...

CME Group to Launch BTC, ETH Reference Rates Aimed at Asia’s Investors

Derivatives marketplace CME Group is launching Bitcoin and Ether reference rates for the Asia Pacific region, in another sign of growing institutional interest in crypto from Asia.

CME Group said it’s partnered with crypto indices provider CF Benchmarks to launch the two Asia Pacific-focused crypto reference rates on September 11.

Reference rates are used as a credible source of a cryptocurrency’s price and are used — in CME’s case — to price settlements of crypto futures contracts.

BitGo Vaults Ahead in Crypto Custody Space, Valued at $1.75B Following Fresh Funding Rounds

BitGo, the Palo Alto-based crypto custody firm, has raised $100 million in funding, setting its valuation at an impressive $1.75 billion, a stark contrast to its price tag in 2021 when a $1.2 billion acquisition deal by Galaxy Digital Holdings was eventually called off, according to Bloomberg.

BitGo focuses on securing crypto assets, with private keys often protected in physical vaults. The company acts as the custodian for major players in the crypto space...

Leo: A Huge September?

We could be getting close to some things really starting to change regarding Leo. In today's AMA, we had a few tidbits dropped that could end up changing the entire direction of the platform.

They were Leo-cache, Marketing project, NFTs. Individually, they might be of impact. Collectively, they could be very powerful.

LeoFinance is a blockchain-based social media platform for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.