I can't believe it's been one week already, but here we are, another Sunday, another week's close and I'd like to do an analysis on $HIVE today.

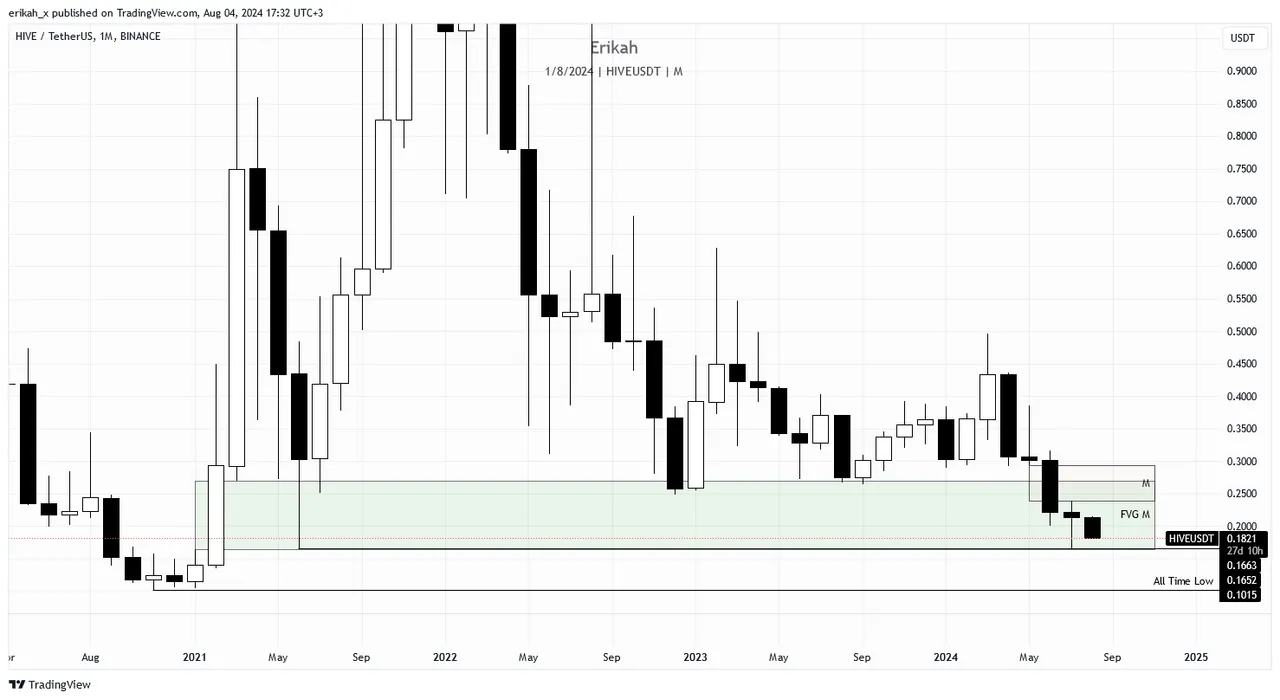

Last week we were a few days before the monthly close, so let's start with the monthly chart, shall we?

Since my last post, the month of July ended and the candle closed. I'm not sure if we can consider it a doji, but it sure signals indecision in the market, due to its slim body. It's been almost 4 days since the candle close, price is still inside the bullish fair value gap (FVG) and the new candle, of August is a bearish one so far. Again, this candle can't be taken for granted, till the end of the month, but right now price is gravitating towards those equal lows, that you'll see in my next chart.

Price is moving from external liquidity, to internal and vice versa. We have internal liquidity inside the bearish FVG, marked with red on my chart, and there's external liquidity below the two wicks, that are considered relative equal lows (EQL). At the moment of writing, it looks like price is gravitating towards the lows. There's no guarantee price is going to sweep those lows, but as we know, the evolution of $BTC is influencing alts as well. Chances for $BTC to fill the CME gap right now are high so I can see $HIVE sweep the lows at $0.1652.

The weekly chart is bearish as well, needless to say. Again, the weekly candle is not closed, there are less than 6 hours till the candle close, but chances for this weekly candle turn bullish are slim to none in my humble opinion.

The daily chart shows clearly price swept the low of the candle marked on my chart and the next obvious liquidity pool is at the relative equal lows, which lay within the daily order block (OB D), which is meant to defend price. It's a crucial level that should hold as otherwise things could get ugly, we could revisit the $0.15 area, or even lower. I'm hoping for a quick wick to sleep $0.1652 and a quick v-shape recovery.

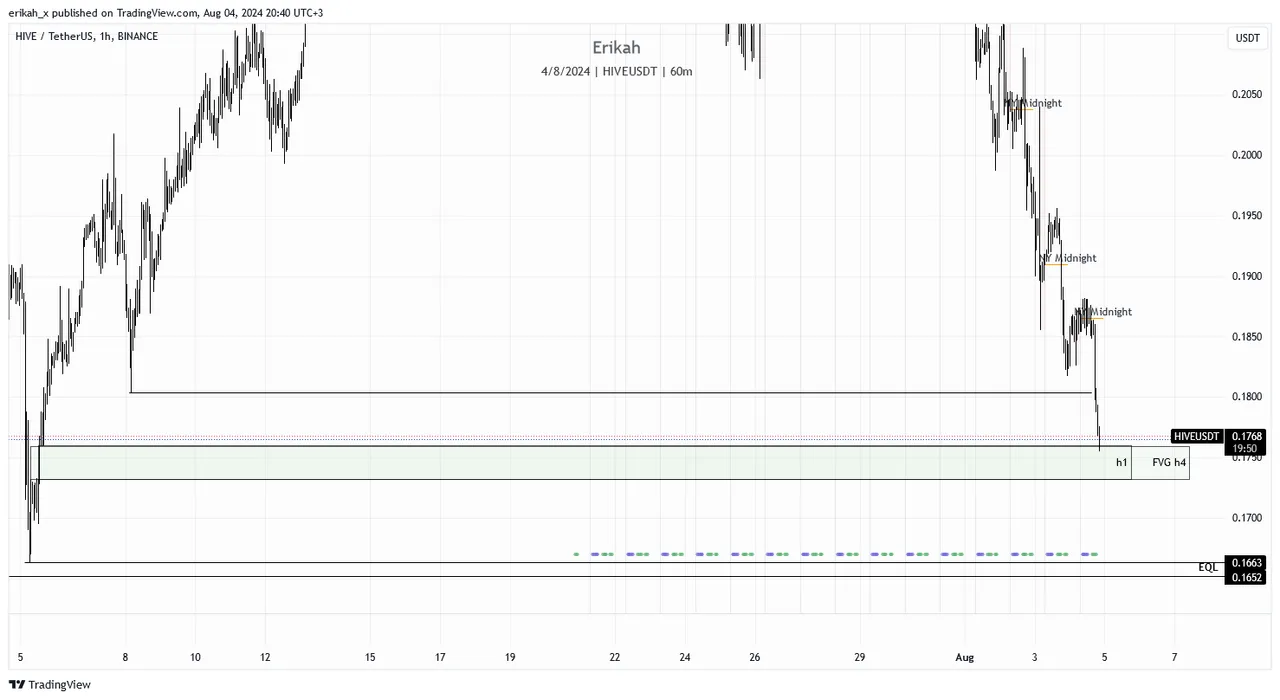

On a more granular scale, the h4 chart shows a bearish trend as well. Price just swept the last low before the bullish FVG, marked with green on my chart. At the moment price is sandwiched between two fair value gaps, but with those long time equal lows are working like a magnet in my opinion. If the bullish FVG does not hold price, chances are $0.1652 could be swept.

The good news is, the sell side of the curve looks really good, apart from that one bearish gap and an intermediate high higher, there's not much to stop price. Obviously, this is a 4 hour chart, so it takes time for price to revers and reach the top of the curve, but the chart looks good.

At the time of writing, $BTC has just filled the CME gap and price is dropped way below the h4 OB. There's still 2.5h to go till the h4 candle close, to know if the OB can hold price or not.

$HIVE tapped into the h4 FVG, bounced off f it and at the moment it seems the FVG is holding price. I'm really curious if it sweeps those lows, or creates another low, close to the equal lows. Would be funny for sure.

The h1 chart is quite interesting. The h1 bullish FVG overlaps the h4 FVG. Price just tapped into it and bounced off of it. There are 17 minutes to the candle close. Let's see if these FVGs can defend price, or not.

This is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

Next week's economical calendar looks pretty clean, compared to what we had this week. There are only two news days, which, in theory means, we have three days with less volatility, but only in theory as any major, or less major (unexpected, unpredictable) event can move the markets.

All charts posted here are screenshots from Tradinview.

I'm really curious to see what $HIVE does next.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27