Goddess Moon is not on our side!

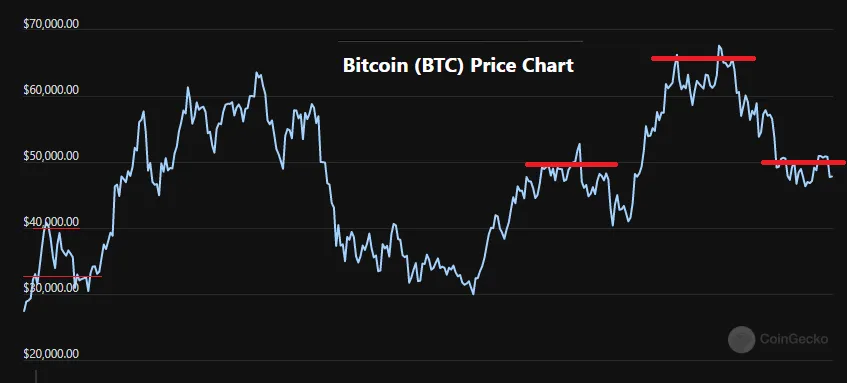

A couple weeks ago I talked about how we need to spike above the MA(100) to stay bullish. Hm yeah, that did not happen; not by a long shot. During this bullish period we've been floundering to stay above even $45k. On top of that, not only are we trading below the MA(100) at $55k, but we are even trading under the MA(25) at $48300. Even the MA(25) looks like it's batting us down... which is really bad... especially since we just had a death-cross that hasn't affected the market yet.

Yeah, the on-chain analysis still looks good, but at the same time, I've never seen any of the on-chain analysists post anything bearish. They are all diehard maximalists, so you have to take that information with a grain of salt. I once saw them write that moving Bitcoin to the exchanges was bullish. And then when Bitcoin was exiting the exchanges that was also bullish. Like, what? Pick a lane, ass.

So yeah it's not looking good imo, which... if you've seen how often I'm wrong this should be a very good sign to you. Still, this head-and-shoulders pattern is no joke. It's been in the making for 6 months now, and isn't really comparable to the one we saw at the beginning of 2021 (that was just a volatile unpredictable clusterfuck). This one looks way more legit.

That being said there are so many good supports below $45k. Every $5k functions as a great support. $40k is great, $35k is even better, and $30k is virtually unbreakable. If BTC dips back down to $30k I'll actually be pretty happy because I can finally go back to leveraging debt to margin trade again. This weird middle ground we've been in for over a year has made me very uncomfortable.

On the one hand, no one wants to sell, because if you sell right before a mega-bubble that makes you a ridiculous chump. How in the world could you sell the 4 year cycle. We've been waiting 4 years for this. We're committed.

On the other hand, institutions control this market now, and institutions aren't very keen on FOMOing and wasting money. They are looking to buy cheap and take gains every quarter. They are constantly hedging their bets and flexing for their superiors and underlings. Welcome to the legacy economy. We got what we wanted: isn't this great?

Ironically perhaps this is exactly what Bitcoin needed: liquidity providers. Big players who weren't going to fall for that HODL bullshit. More money, more stability, more growth, less deflation. All good things.

Hive, on the flip side, is still looking sexy as hell. The Koreans are pumping it again, preventing that tiny death-cross between the MA(7) and the MA(25) from happening. The MA(99) is already up to $1.20, which is truly a thing of legend. Even after the double-airdrop snapshot on Jan 6th, the price can't flash crash below $1.20 in my opinion. That's a great price to buy back in to sell the dead-cat-bounce.

Hive has been in a golden-cross bull run since August. Our price action is pretty unparalleled, and it's been very satisfying to watch Steem just hang out below 50 cents a coin this entire time while we finally head on to a bigger and better future.

That being said, when the death-cross for Hive does hit, I imagine it's not going to be very pretty. As far as I can tell our floor value of 80 cents hasn't really moved up at all. We're gonna have to pump back up to $4-$8 before I decide that $1.20 is the new floor. If we death-cross before then, 80 cents is back on the table... which is where I'll be aggressively accumulating once again. There are just too many amazing projects happening simultaneously around here that the world is simply blindly ignorant to.

It's funny how time allows us to refactor the value of our own network. I bought so so so much Hive at the 10-25 cent range. I thought I'd never be able to mentally justify buying more at a higher level like 80 cents. Yeah, well, I've completely gotten over that mental barrier. 80 cents is the new bargain. Count me in. I'm here for it.

Of course it's always possible that crypto mega-bubbles before we death cross... in which case Hive could spike all the way up to $80 a coin, which sounds cool but that would be very... very bad. I don't want to attract a couple million high-quality users just for them to buy the peak and rage-quit months later. That's a super lame way of going about our business here.

Again, I must point out that Hive has dogshit liquidity, and there is absolutely no excuse for that. The longer we ignore the ridiculousness of the archaic internal market the more we look like jackasses.

The obvious solution to this problem is to upgrade the internal order-book market to an AMM yield farm between Hive and HBD. That solves all our liquidity problems. It stops Hive from spiking too high too fast, and it stops Hive from dumping too quickly as well. Stability is king, and this farm would also make HBD have x1000 times more liquidity and stability. Pretty much a win/win/win on every front... except for the liquidity bots that profit from our garbage liquidity (oops).

AMM and IL: Convincing Communities they shouldn't HODL.

This entire concept of HODL is deflationary garbage that preaches having garbage liquidity and siphoning value from new users to old users. It's dumb. AMM implementations on EVM networks have shown us the light. We create a honeypot of exponential liquidity that allocates a massive amount of inflation to the liquidity providers.

It is in this way that the liquidity providers lose money when the liquidity is needed via impermanent loss. Heavy pumps or dumps place the burden of value being siphoned away onto the liquidity providers in combination with the new users entering the network, rather than solely on the new users. While the liquidity is not needed (periods of stability) the LPs make bank and just farm massive yields (25%-100% annually).

Once we have an AMM internal market, it will be much easier to outsource our "debt" to centralized exchanges. Way more exchanges will list HBD as an asset if HBD actually has stability and does what it's supposed to do. This is especially true when more apps on Hive actually use HBD as their primary asset because it's doing what it's supposed to do. Also once all these regulations hit non-algorithmic stable coins we could see massive adoption of HBD. All of these things synergize together to create exponentially deep STABLE liquidity pools.

There's no doubt in my mind that ten years down the road there will be billions upon billions of HBD in circulation. Let's not forget that HBD has only been functional since the last hardfork (25) when it actually became possible to convert Hive to HBD. Before then it was just a joke of a currency that had zero cap to the upside. That zero cap to the upside created a situation that would constantly break the downside volatility as well. Now both sides are 10x more stable than they were before.

We can 10x HBD stability again with an AMM yield farm, but I think I'm done beating that dead horse, for now. HBD is going places, and I'm glad all that ridiculous jabber about scrapping it has diminished to an inaudible whisper. These things that I talk about aren't a matter of 'if', but 'wen'.

The longer we don't implement AMM, the more clout I gain when it does roll around and the price instantly goes x10 and I'm like: "See? Duh, we could have done that years ago." Legit free x10 on the table whenever we feel like taking it. Easy. I have all the patience in the world... of warcraft.

Conclusion

Got a bit sidetracked but that's to be expected in a speculative shitpost.

Gotta pad those numbers somehow, amirite?

In any case, the TA on Bitcoin looks abysmal. The head-and-shoulders pattern looks like it's fully about to complete. The only question in my mind is whether we go to $40k, $35k, or all the way down to $30k.

I keep telling myself I need to hedge against this reality, but it's impossibly hard to actually do that. CUB is already at all time lows, and I'd feel like an idiot selling it with an airdrop right around the corner. Hive has a double-airdrop in literally 4 days; can't sell that either. BNB is continuing to outperform just like it always does, and is only 19% below all time highs. LEO is about to get another LP pool with massive yield allocated to it. I'm stuck holding the bag on everything because everything is giving me an airdrop soon™.

Oh well, HODL it is.

How entitled I am to be able to lose $100k without a care in the world.

How did this happen?

Perhaps miracles did occur in 2021, and we didn't even notice.