A little over a month ago I decided it was time to get my feet wet in the DeFi world, so I took a few steps to deposit crypto on a few of the bigger DeFi platforms. Today I'll be sharing my results and feedback after a full 30 days using Compound, Yearn, & Uniswap!

Compound

My first venture in the DeFi space was with Compound, where I deposited a small amount of Basic Attention Token which I had on my Ledger. Using MetaMask, I sent my 45.116 BAT to Compound to gain the 13% yields at the time.

Well, for the most of this last month, the yields on BAT on Compound have dropped to a slim 0.01%! Right now, I currently have 45.216 BAT, a net gain of 0.1 BAT, which is currently valued at a little more than a penny. (Side note: BAT is currently at 0.18 cents USD, far from it's average home of around 0.25 cents!)

When providing liquidity on these DeFi protocols, we also often earn additional crypto in the form of the native governance token of the platform, in this case, COMP. With my small investment of 45.116 BAT, I've earned 0.00014158 COMP, which is currently valued at about 0.013 cents, so another penny :)

Now since this was my first test with DeFi, I was willing to deposit a small test amount, and also willing to pay the gas fees, which came out to be almost $9 USD worth of ETH to send the BAT as well as the smart contract. So there goes my 2 pennies worth of profit!

My net result has been a loss of about $-9.00 USD.

This experience was altogether a great one, mainly because I broke through my initial resistance and took action in the DeFi space. But moving forward, I now know how frequently the APYs can and will change, and my overall verdict here is that my BAT would have done much better after lending it to Celsius, as they offer a very consistent 4.51% APY.

I would have also saved on gas fees, as I would have only needed to transfer my BAT to my Celsius wallet instead of also paying the fees to submit the smart contract on Compound.

Celsius is a company though, so it's not decentralized like Compound, so keep that in mind.

I'm going to be keeping my BAT on Compound for awhile longer as a way to check in and see if, or when, the interest rates go up. Until then though, I won't be making anymore deposits onto Compound, and will be sending all the new BAT I earn (from Brave Browser and Publish0X) to Celsius.

Yearn Finance

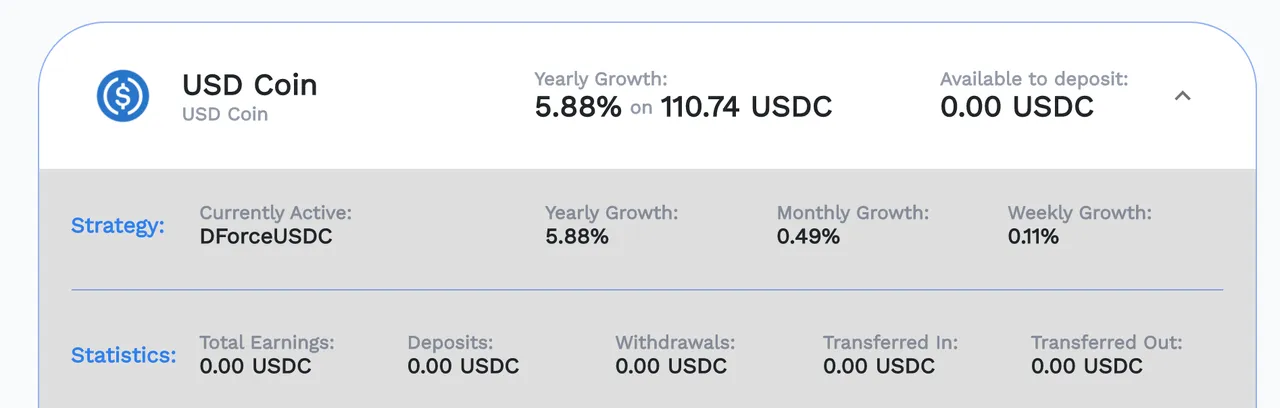

My second venture into DeFI was with depositing 110 USDC into Yearn Finance's Vault. Yearn Finance is a decentralized yield farming ecosystem which uses strategies to maximize your deposits' yield across various other DeFi protocols such as Aave, Compound, and Curve.

At the time of deposit, the Yearn Vault was bringing upwards of 30% on USDC, but is currently at a much more realistic 5.88% based on this last week's vault performance, which is still good in my opinion.

My 110 USDC has now turned into 110.74 USDC, but I also paid $10.43 in ETH gas fees.

Since USDC is a stablecoin, the 0.74 USDC I earned is easily accounted for .74 cents USD.

This means if we subtract my USDC earnings of 0.74 cents from $10.43 (from the gas fees), I'm in the red for -$9.69. I'll also have to pay more gas to withdraw my USDC, so that number is a technically a bit higher.

However, I'll be leaving my 110.74 USDC on Yearn for a little while longer, as I'm interested in following along and seeing how the yields develop. As the market grows and as more money comes into DeFi, the yields will grow as well.

In comparison, Celsius offers 10+% on USDC, Blockfi offers 8.6%, and Nexo offers 8%. Yes, these are all centralized businesses, but using them also mitigates smart contract risks as well as fees.

Uniswap

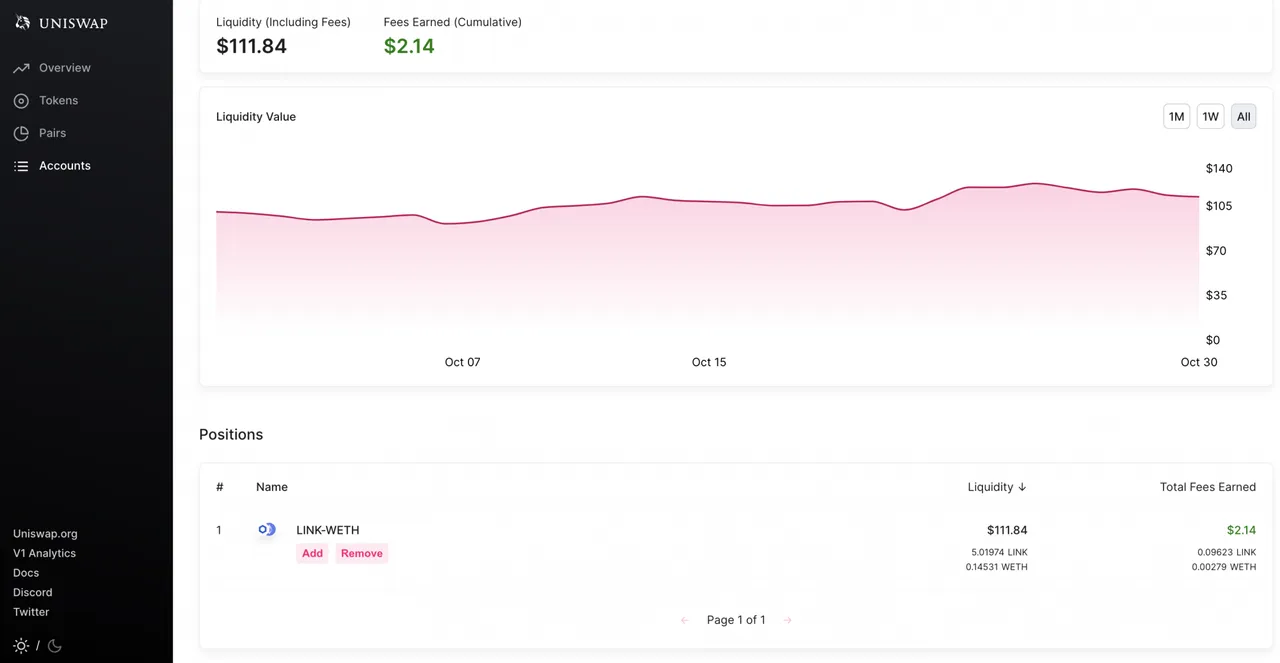

My third venture into DeFi is definitely my favorite so far, and this one entails me providing liquidity for the LINK-WETH pool. (The W in WETH stands for 'wrapped Ethereum', which is converted for you automatically when depositing ETH.)

With Uniswap, you have to provide an equal value of 2 crypto assets to be a market maker and to provide liquidity in one of the pools. In return for doing so, you receive a percentage of the trading fees based on the percentage of liquidity you're offering in that pool.

I chose to deposit into the LINK-WETH pool, so I chose $50 worth of LINK and $50 worth of ETH, which at the time was 5.02229 LINK and 0.13972 ETH.

A month later, I have 5.01481 LINK and 0.14543 ETH, and have received a total of $2.16 in fees in the form of 0.09571 LINK and 0.00278 ETH.

Now what better way to learn what the buzzwords 'impermanent loss' are other than to personally experience it myself?! As you can see, my LINK balance is currently lower than what I began with.

The value of my liquidity has adjusted due to the changing prices in LINK and ETH, and although this looks like a loss of value, it's truly only a loss if I withdraw my liquidity, which is why it's called an 'impermanent' loss.

So now let's calculate my earnings or losses here. I currently have 'lost' -0.00748 LINK, which currently is valued at $0.08 USD. I've gained 0.00559 ETH, which is currently valued at $2.15. Total liquidity earned is a profit of $2.07.

My gas fees for this deposit were only .84 cents of ETH, so my total outcome so far has been a profit of $1.23.

Out of these 3 tests I've done, I've been most impressed with my results on Uniswap. By earning $2.15 in one month, we're looking at a total profit of around $25 for one year if this keeps up. $25 earned on a $100 investment is a stunning 25%!

Final verdict, I'll be leaving my BAT in Compound and my USDC in Yearn, but I'll be ADDING more to Uniswap, as this has proven me the most desirable results from my initial 30 days in DeFi.

I hope this helps you on your crypto journey!