Imagine if selling your house to a home buyer was as simple as transferring an NFT to their blockchain wallet address. Now imagine if we could trade cars, commodities, and other financial assets just as easily. That is part of the promise that blockchain technology holds.

Blockchains are often described as "trustless", which means you don't need to lawyer up and pay fees to notaries and other officials to ensure that a transaction is completed properly. In the case of a decentralized blockchain, everything is programmatically done by software, and can be verified on-chain by all parties.

Defining RWA

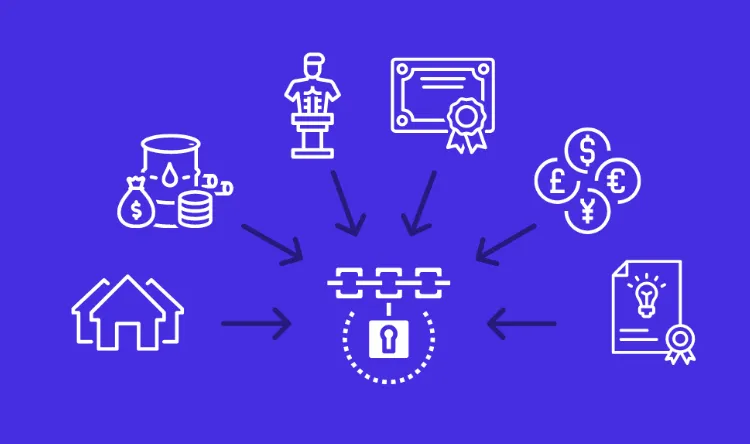

An increasing number of use cases for blockchain technology are being thought of as crypto gains more legitimacy in the real world. As of late, there has been a lot of hype surrounding the buzzword RWA (Real World Assets).

RWA is all about putting traditional financial assets like treasuries, commodities, and real estate on a trustless blockchain (like Ethereum, for example), so that they can be traded more easily.

One major real-world asset that has already been tokenized on several blockchains is the US dollar. It is now much easier to transfer dollars from one person to another internationally using something like Tether, USDC, or DAI, eliminating the need for middle men like banks and payment service providers.

Now that US dollars have been tokenized on the blockchain, there are other projects attempting to get other real world assets such as stocks, bonds, and real estate onto decentralized ledgers as well. In order to get there though, we need to solve a few problems first.

Real Estate

How do we link real world property to the blockchain? We are so accustomed to checking with municipal governments to find out who is the rightful owner of a plot of land.

At some point in the future, we will have to get used to the idea of checking a record, whether it be an NFT or a set of fungible tokens, on a distributed ledger instead.

Realio is one RWA project that is working to bring real estate to the blockchain.

Corporate Stocks

When it comes to stocks, we have to consider that the SEC has come after crypto startups in the past for launching unregistered ICOs (Initial Coin Offerings) to raise capital.

Bypassing traditional venture capital, the ICO was an innovative idea that allowed a team to crowdsource funds by accepting ETH as investment capital in return for a proportional amount of their own ERC20 tokens.

Migrating traditional corporate stocks from banks to blockchains could be a challenge due to all the legacy rules and regulations, but there are projects like Polymesh working on the problem anyway.

I often wonder if most of the corporations that exist today will be replaced by decentralized entities over the next few decades, with each one being powered by its own token.

Government Bonds (Treasuries)

Fintech developers have been thinking about tokenizing US treasuries (bonds) for a number of reasons including increased liquidity, transparency, and security.

Ondo Finance is one RWA project that is working to tokenize treasuries in order to improve market efficiency, transparency, and accessibility.

It seems comical that we would spend our time tokenizing assets that might become obsolete in a decade or two, given the insane debt situation.

From my point of view, the tokenization of assets like real estate, cars, and resources is far more exciting than putting American debt on a blockchain.

The Future

The aforementioned projects are just a few in the real world asset sector that are hard at work bringing real estate, bonds, and stocks to the blockchain realm.

In the future, we could see hundreds, if not thousands, of interoperable blockchains keeping track of all of our real world assets, allowing us to transfer ownership of physical items far more seamlessly than in the past.

Before this becomes our reality however, some technical and legal challenges will need to be worked out, and the population will have to learn to trust decentralized ledgers over government databases.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...