Why have countries like El Salvador and Argentina decided to integrate cryptocurrencies like Bitcoin into their economies? What is causing more and more American states to pass laws protecting their citizen's rights to mine and self-custody crypto?

The short answer is that fiat currency is fucked, and we are actively making preparations for its ultimate demise. In this post, we will discuss the primary problem with the "money" we use today, and what could possibly replace it.

Why Fiat Is Fucked

In order to understand cryptocurrency's use case, you first need to understand the problem with the currencies we use today.

To sum it up, worldwide debt is growing much faster than our economic activity, and that means stocks, bonds, and real estate have been extremely overvalued because too much currency has been created.

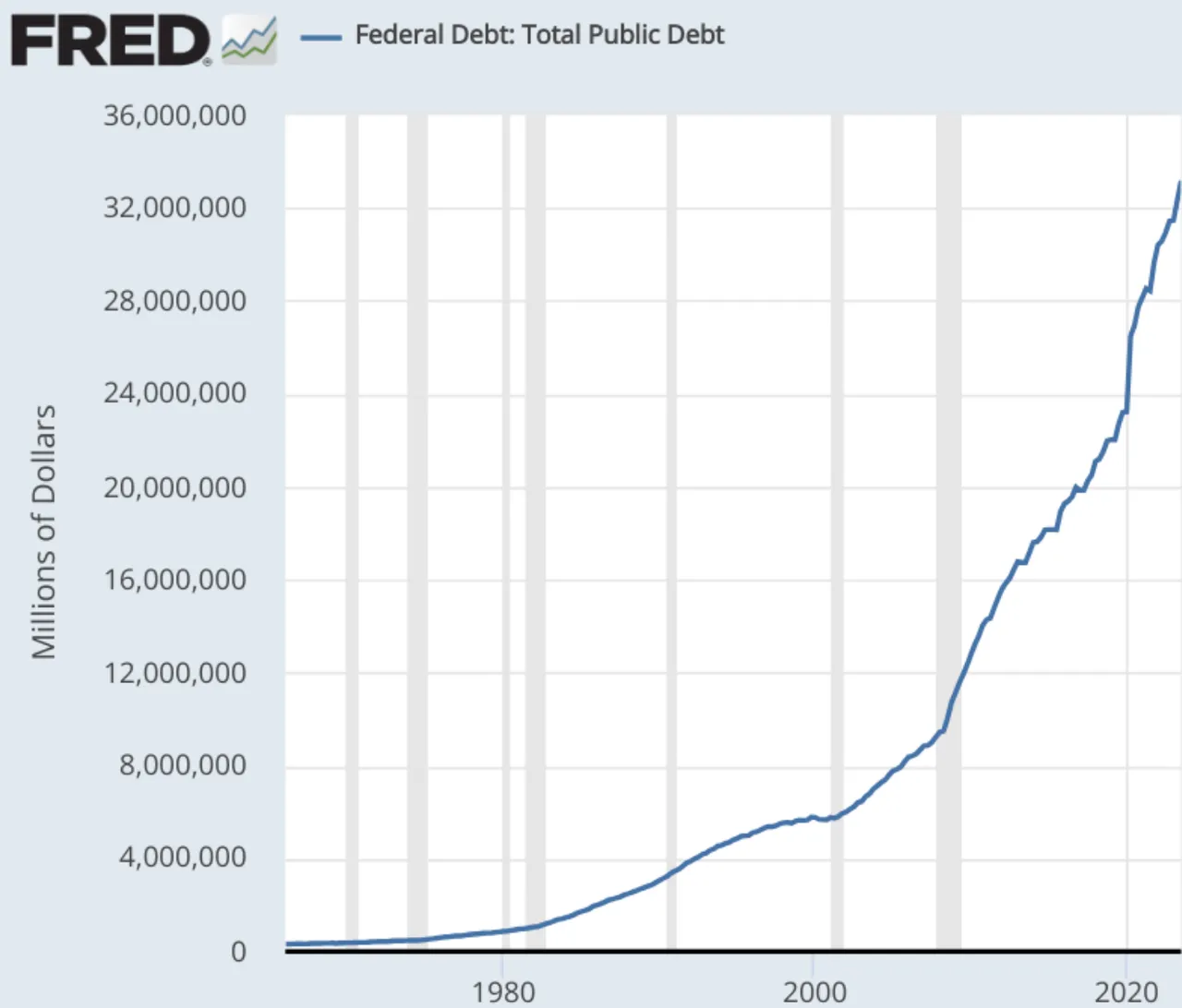

In fact, since 2020 the United States has borrowed an additional 12 trillion dollars, meaning that more than 35% of the entire national debt has been added in just the past four years. To drive the point home, the last trillion was tacked on in just three months.

It looks like we are about to go 100% vertical, doesn't it?

While the chart above illustrates the federal debt of the United States, it also represents worldwide debt, which has been growing at an exponential rate due to zero percent interest rates, unlimited quantitative easing, and massive bailouts.

Thanks to this hyperbolic debt expansion, we are living in the biggest financial bubble in human history, with the population falsely believing that they own homes, stocks, and retirement plans worth millions of dollars.

The problem is that if everyone decided to trade their assets to pay for real goods and services, they would be left with a tiny fraction of their net worth, and that's why we refer to it as a financial bubble.

In order to pay the interest on this debt monstrosity, even more money needs to be borrowed at an even faster rate, and that causes inflation, which you've probably noticed a lot of over the past few years...

This inflation has caused not only an increase in drug use, crime, and homelessness in the western world, but it has also led governments to propose communist ideas like Universal Basic Income (UBI), which would ironically just make inflation even worse.

The Establishment Has A Solution

But don't worry! The powers that be are aware that the financial system is screwed, and they have been planning a solution for decades. You have probably heard terms like "Central Bank Digital Currencies" (CBDCs) and the "Great Reset" in recent years, and they're all part of the plan.

Okay, so they're going to convert our dollars into some new currency, what's the big deal? After all, the dollars in our bank accounts are already digital anyway, right?

Realize that if these powerful people have their way, you will be corralled into a centrally controlled economy powered by these CBDCs, which will be programmed to limit where and what you can spend your money on, based on your social credit score. Sounds a bit like communism, doesn't it?

Most importantly, CBDCs don't solve the actual problem. Namely, how do we fix the massive debt bubble and distribute the wealth proportionally?

The "great reset" is about more than just converting your dollars to digital form. It's about redistributing the world's wealth in a centrally planned way, which is contrary to the capitalistic ideals that made countries like Britain and America so successful in the first place.

If you have been paying attention to social media, you will have seen that there is a growing number of people who are opposed to this impending draconian system, and are looking for alternatives.

Bitcoin to the Rescue

Satoshi Nakamoto was also well aware of our unsustainable debt problem. Back in the financial crisis of 2008, he saw how wealth was being unjustly taken from the people and handed to the bankers via bailouts. This is evident in the message he inscribed into the first block of the Bitcoin blockchain:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

Unlike the US dollar, Satoshi engineered Bitcoin to be decentralized and limited in supply, eliminating the need for corrupt middle-men to process our transactions.

He unleashed Bitcoin on the world in January 2009 to give humanity an essential building block for a new financial system, and an escape hatch from the inevitable debt spiral he predicted.

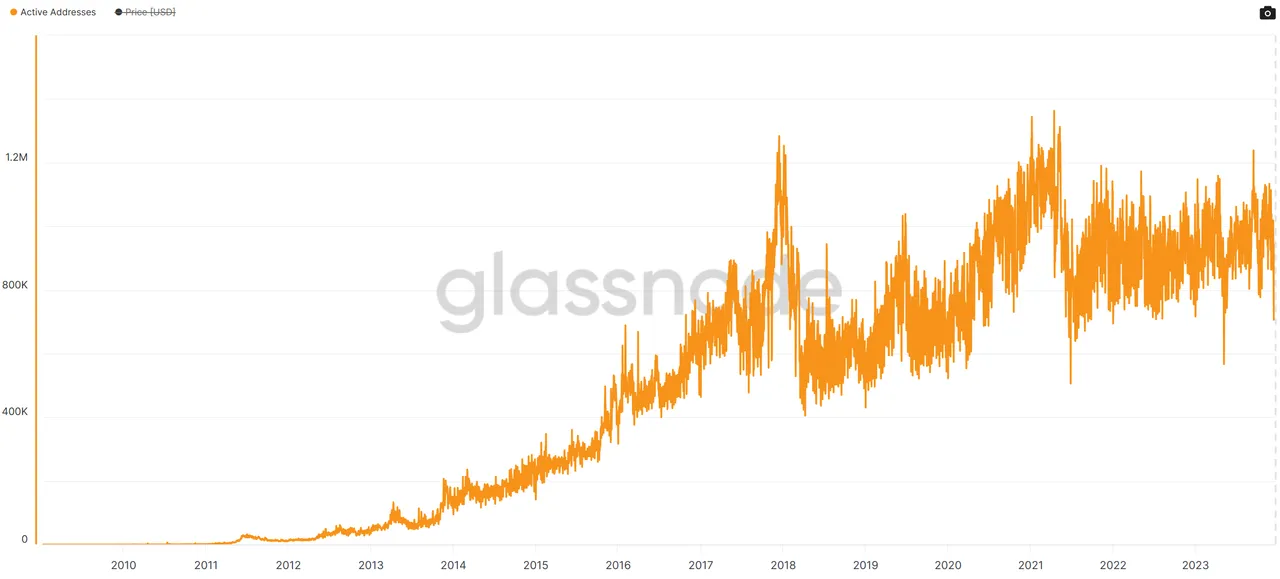

From 2009 to 2017 the Bitcoin network grew rapidly as merchants and consumers increasingly used it as an alternative to the dollar. It looked as though we had found a replacement for fiat, as Bitcoin was well on the way to mass adoption.

But something happened in 2017. In the chart above, you can see that the number of active Bitcoin addresses stopped growing exponentially that year.

Emotions got heated as the price of Bitcoin reached new highs, and the community started to fight over how the network should scale to reach mass adoption.

One camp thought that Bitcoin's block size should be increased, to allow for more transactions per second, while the other camp believed the block size should remain at 1MB to keep the network as decentralized as possible. The second group advocated for off-chain scaling via the experimental lightning network.

Unfortunately the community did not come to an agreement, and in the summer of 2017 there was a hard fork of Bitcoin, meaning it split into two separate blockchains.

The new chain supported bigger blocks (Bitcoin Cash), while the original chain kept the block size at 1MB. That explains why Bitcoin active addresses were artificially stunted in 2017. Some argue that Bitcoin's core developers were co-opted by bankers, to intentionally impede Bitcoin's growth.

While Bitcoin Cash did achieve some adoption in places like Tokyo and Saint Kitts, the original Bitcoin stayed in the lead, at least in terms of US dollar valuation. The problem still remained. Namely, how do we catalyze the mass adoption of Bitcoin to replace fiat?

Fast forward to 2021, and El Salvador is the first sovereign nation to adopt Bitcoin as legal tender. Likely aware of the unsustainable debt situation outlined earlier, president Bukele and his government took matters into their own hands by investing into Bitcoin and promoting its usage with a free airdrop of $30 to their citizens.

While this trial run has certainly been an interesting experiment, I can report that it hasn't sustainably increased the adoption of Bitcoin on the ground as originally planned. In addition to technical issues with the Chivo wallet and the lightning network itself, the volatility of Bitcoin has prevented many consumers and merchants from adopting it.

The sad fact is that almost nobody here is paying for goods and services with Bitcoin, as it is too cumbersome and volatile compared to cash and credit cards. That said, the good news is that the Chivo/Bitcoin payment system is still in place, and the country is better prepared than most for when the fiat system finally buckles.

Moreover, El Salvador was the first nation to purchase Bitcoin, and after being pulverized by the bear market of 2022, their investment is finally in the green. As long as the dollar remains standing, and the price of Bitcoin continues to increase, the government will be able to use the profits to further improve the region's infrastructure, and perhaps drop more Bitcoin to their citizens.

Taking El Salvador's Bitcoin experiment into consideration, the question we need to be asking ourselves now is, how do we organically motivate people to use a cryptocurrency, and make the experience as pleasant as possible?

Bitcoin's Alternatives

Since Bitcoin's release in 2009 we've seen a lot of competitors hit the scene. We now have cryptocurrencies like Litecoin, DASH, and Nano which have all innovated on Satoshi's code in order to make transactions faster, keep fees low, and help to replace fiat.

Each has managed to garner a respectable level of adoption worldwide, but will these cryptocurrencies be the easiest to integrate into the economy when the fiat system finally collapses?

Rewind slightly to 2013 when a young programmer by the name of Vitalik Buterin had the novel idea of adding programmable smart contracts to a blockchain. In order to make it a reality, Vitalik and his co-founders launched Ethereum in 2015.

The revolutionary concept allowed anyone to create their own programmable token atop the Ethereum blockchain, and led to ideas such as decentralized compute (Golem), storage (Storj) and wireless (Helium) networks that could be built out utilizing token incentives.

Ethereum turned out to be a wildly successful experiment, but it was very inefficient, and its absurd gas fees prevented it from reaching mass adoption. However, thanks to the free market, an array of competitors arrived to take on the challenge.

Brilliant mathematicians and software architects from around the world saw the amazing potential for this new technology and started engineering more scalable smart contract platforms such as EOS, Polygon, Cardano, Cosmos, Polkadot, and Solana.

In recent years, we have seen a lot of projects that originally launched on Ethereum start migrating over to these next-generation blockchain ecosystems in order to improve usability and keep gas fees low.

Tokens That Actually Disrupt

While we should be forever grateful to Satoshi, Vitalik, and the countless others who engineered the essential building blocks of decentralized finance, we also need to keep our emotions in check, and think about this new technology rationally.

We have seen that the general population is resistant to using volatile cryptocurrencies as money, especially if they cannot be used for much more than speculation. The reality is that most people see Bitcoin and Ethereum as a means to increase their fiat holdings, rather than as an alternative form of money.

This begs the question then, what cryptocurrencies will actually be used as money in the future?

While it could be argued that a blockchain project like Solana is relatively centralized, the fact remains that the user experience is far more pleasant, and the platform is much more affordable for regular people. Above all, these advanced blockchains are paving the way for next generation crypto projects such as Decentralized Physical Infrastructure Networks (DePIN).

We now we have projects like Hivemapper, which reward dashcam operators in tokens for collecting mapping data. We also have Helium, which uses token incentives to deploy decentralized 5G infrastructure and wireless hotspots. These kinds of projects have the potential to disrupt the likes of Google and AT&T.

In the Cosmos ecosystem, we have decentralized compute networks like Akash that are attempting to decentralize the data centers once controlled by tech giants like Amazon and Facebook. Simultaneously, projects like Crust and Arweave are working to tokenize the world's storage capacity.

While it is necessary to question their initial token distributions and recognize the possibility of censorship, we should consider the real-world economic activity these next-generation crypto projects could produce, and their potential to reach mass adoption.

Ask yourself, would you be more willing to accept a payment in crypto if you could actually use the token to pay for a service like a 5G wireless plan, cloud storage, virtual private server, or mapping data?

In addition to Bitcoin and its alternatives, these DePIN tokens could very well end up being the replacement to our ill-fated fiat currencies (Not financial advice!).

Conclusion

Anyway you slice it, traditional currencies like the US dollar, the Euro and the Yen are completely fucked, and about to collapse under their own weight as worldwide debt spirals out of control.

The exponential debt curve, along with the constant news of CBDCs and UBI are signs that this could come about sooner than we think.

The question is, what will replace these fiat currencies and become money?

The powers that be would love for us to use their tightly controlled CDBDs in a 100% planned economy.

Unfortunately for them, they did not foresee the creation of Bitcoin, Ethereum, and other cryptocurrencies, which are raining - absolutely pouring - on their parade.

As inflation picks up, and the "great reset" is attempted, more and more people will discover that cryptocurrency is the one true unconfiscatable asset, and its adoption will pick up pace.

We will likely see a large portion of the population corralled into CBDCs via another black swan event (cyber attack, anyone?), but the upward trajectory of decentralized cryptocurrency adoption will be impossible to stop.

Those who find themselves trapped in centralized economies powered by CBDCs will look over enviously at the prosperity of places like El Salvador, Argentina, and the other regions that have chosen to embrace decentralized finance and free market money.

Follow Me

If you enjoyed this article be sure to read my other posts about finance and crypto here on Hive, and follow me on InLeo for more frequent updates.

Until next time...

Resources

US government debt [1]

WEF leader [2]

Bitcoin active addresses [3]

President Bukele and Bitcoin [4]

Vitalik's Ethereum [5]

Hivemapper dashcam[6]

Break the chains [7]