Aside from providing humanity with a transparent and trustless financial system, one thing that I absolutely love about Bitcoin is how the coins were distributed fairly from its launch.

In 2008, Satoshi Nakamoto published the Bitcoin whitepaper to an open mailing list about cryptography. There were no seed rounds, early investors, or insiders. Bitcoin was completely open to the public from its inception.

Unlike most blockchains launched these days, Satoshi didn't allocate himself any coins when the network launched. He may have mined the first block, but he made it unspendable, and inscribed the famous newspaper headline:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

While Satoshi did end up with over 1 million coins (roughly 5% of the total supply), he earned them by constantly mining Bitcoin over the two years that he led the project.

Perhaps most importantly, he disappeared after two years of hard work and left behind a massive stash of unspent Bitcoin.

Maybe Satoshi knew that for a decentralized currency to survive long-term, he would have to abandon his coins, depart quietly, and hand the project over to the community.

Based on the information we have, I think we can deduce that Satoshi's goal was not to get rich in fiat dollars. His objective was to replace a corrupted financial system with something that would serve future generations.

Unfortunately, the cryptocurrency space is now riddled with projects that have lost sight of Satoshi's original goal. Instead of upending a corrupt financial system, we are aiming to increase our wealth in fiat terms.

However, in order for cryptocurrency to truly succeed long-term, we must be willing to part ways with the old financial system. For the longer we stay attached to the old system, the longer it will take for this new technology to flourish.

Are Fair Blockchain Launches No Longer Possible?

One could argue that after Bitcoin's massive success, doing a fair token launch is no longer possible, as existing mining companies and cryptocurrency investors could gobble up the supply from launch, and lead the project in an undesirable direction.

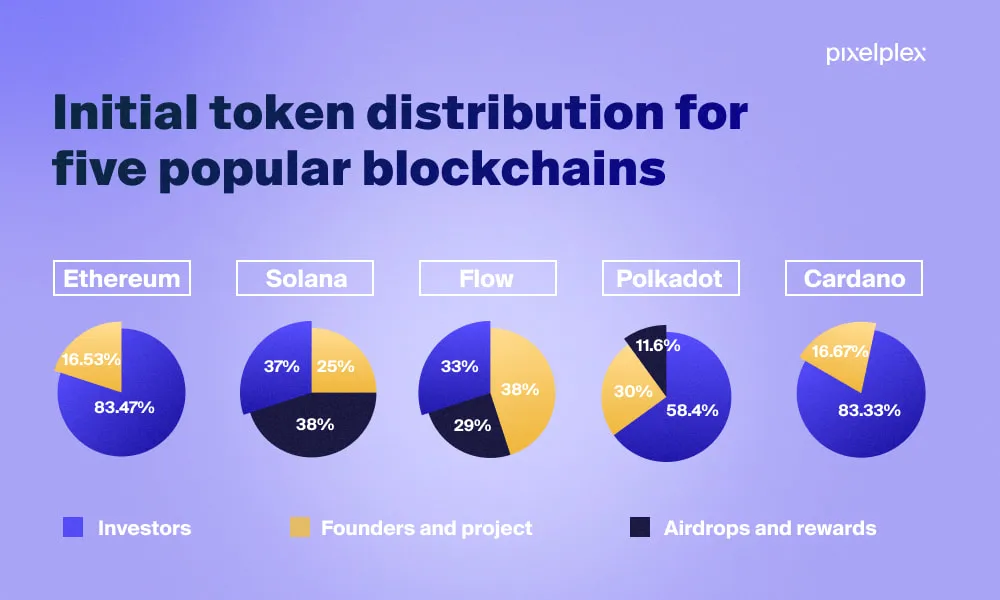

Perhaps that's what the founders of more advanced cryptocurrencies like Ethereum, Cosmos and Cardano were thinking. Because in contrast to Bitcoin, all of these projects were launched with a pre-mine, meaning anywhere from 15-20% of the initial token supply were allocated to the project's team and foundation, with the rest alloted to early investors.

There are other projects illustrated above whose teams have allocated themselves greater than 25%, and control another 29-38% of the token supply, which has been set aside for things like "airdrops and rewards".

Throughout my research on DePIN I have come across some projects that have allocated over 50% of the supply to themselves when factoring in things like treasuries, community development, reserves, etc.

On the one hand, allocating a large portion of the supply to the founding team could keep the project on the right track during its early days. On the other hand, we must consider the negative ramifications of such an uneven distribution of tokens:

1. Kills Community Motivation

If the foundation controls the majority of the token supply, the community will take on less personal responsibility, and instead rely on the team to push the project forward. This essentially centralizes the efforts of the project, and kills potential network effects.

If a project's efforts are to be decentralized, its token supply should also be decentralized.

2. Ineffective Governance

The idea is that we want to decentralize the decision-making when it comes to the project's direction, blockchain protocol and smart contract upgrades.

However, voting doesn't make sense if a few team members control greater than 50% of the token supply, as the community doesn't stand a chance to steer the project in a new direction.

An even and wide distribution of the token supply gives community members a greater sense of empowerment when it comes to submitting and voting on proposals.

3. Vulnerable to Hacks

Large chunks of the token supply, such as treasuries and reserves, are often under the control of multi-sig wallets, which are controlled by a few core members of the team.

Not only do we need to trust a few people to custody these funds properly, but we also need to trust that they have protected their private keys adequately.

If the team's private keys were to be compromised, the funds could come under the control of a malicious actor, who could then either dump the tokens on the market, or use them to force though a undesirable governance proposal.

Instead of centralizing these funds in the hands of a few team members, the tokens would be better off under the control of a DAO (as is the case with DASH, for example), so that they can only be spent if the majority of the community votes yes on a spending proposal.

4. Possible Confiscation of Funds

If a project is truly disruptive to certain market incumbents, the teams who control these treasuries could be forced to hand over control of these funds.

On the other hand, if the treasury is controlled by a DAO, there is no central point of failure to be targeted.

Gradual Decentralization?

Despite the above risks, many projects are still planning to decentralize over time, by manually handing out funds to individuals and groups they feel will help the ecosystem grow.

This could work, but the strategy is risky for the reasons listed above.

A more resilient and sustainable approach would be to set aside a common treasury controlled by a DAO. Or better yet, a DAO that is allocated a portion of mining/validation rewards over time, to which spending proposals can be submitted and voted on.

Potential Forks

Venture capitalists (VCs) and the founders of these crypto projects need to consider the possibility that the community could fork the chain in the future, leaving behind some of the initial allocations.

If the community feels that the team or VCs are not acting in the best interest of the project, or if any of the risks listed above are realized, initial token allocations could be dropped via a blockchain fork.

Look no further than the blockchain that this post is being published to. HIVE forked from Steem back in 2020 and dropped the founder's 20% allocation to return power back to the community.

Conclusion

Unlike Bitcoin's fair launch, a lot of today's blockchain projects have allocated a large portion of the initial total supply to themselves, the foundation, and early investors.

We need to consider the negative ramifications of unevenly distributed token supplies, such as killing community motivation, ineffective governance, possible hacks, and confiscation.

We shall see if these projects are able to decentralize their token supplies manually over time, or if some communities end up forcing decentralization via blockchain forks and decentralized DAOs.

If you learned something from this post be sure to check out my other articles here on Hive, and follow me on InLeo for more frequent updates.

Until next time...

Resources

Initial token distribution blockchains [1]

Blockchain fork [2]

Anonymous bitcoin founder [3]

Letting go [4]

DAO image [5]