While America is worrying about correct pronoun use, China has sold US treasuries to the tune of 53 billion dollars in the first quarter of 2024, and appears to be loading up on gold at an ever increasing rate. In this post, we discuss what impact these actions might have on the US dollar, along with the upcoming BRICs currency, and cryptocurrencies in general.

According to US Treasury data, the Chinese government has sold a record number of treasuries (US government debt) in the first quarter of 2024 - 53.3 billion dollars worth, to be exact. This move demonstrates China's desire to distance themselves from precarious American bonds as US national debt nears 35 trillion dollars.

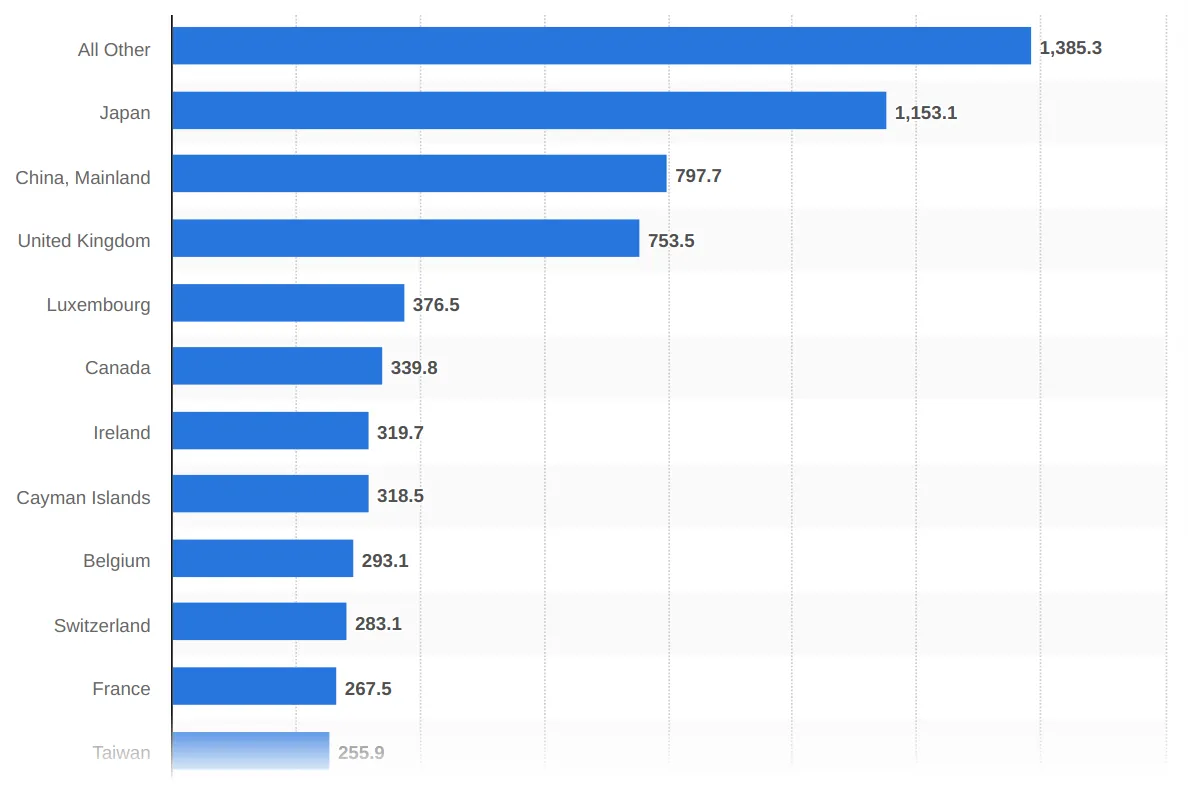

As per Statista, China is currently the second largest foreign holder of American treasuries, after Japan, which holds the number one spot.

This recent action by China to dump treasuries is just the latest in a sequence of plays by international governments to reduce their overall dependence on the US dollar, which many believe to be on its last legs.

Who Is The Buyer?

This latest news begs the question, who is buying the treasuries that China is selling? After all, they have to be listed on an open market somewhere.

It could be a number of market participants including the central banks of other nations, pension funds, mutual funds, insurance companies, hedge funds, corporations, commercial banks, or other private investors.

Of course, there is no way for us to verify that these treasury sales actually took place, given the opacity of the international banking system. The bottom line is that these treasury holdings are numbers put out by the government that we simply have to trust.

Increasing Gold Accumulation

Whilst selling US treasuries, China has simultaneously been on a gold buying spree. According to recent numbers, the Chinese government has purchased over 550 billion dollars worth of the precious metal in the past 18 months alone. Their mass gold purchases could have something to do their plans to launch a gold-backed BRICs currency, which is set to complete with the US dollar.

https://x.com/RadarHits/status/1793634026739085397

If these numbers are accurate, it means that China is rapidly diversifying away from US bonds into gold, possibly in preparation for some significant upcoming economic turmoil. Again, as is the case with treasury holdings, we just have to trust the numbers put out by governments regarding their gold holdings.

Transparent Cryptocurrencies

In contrast to bond and gold holdings, cryptocurrencies like Bitcoin and Ethereum operate in complete transparency, allowing anyone in the world to verify their total supply, and confirm that transactions actually occur. It would seem that smaller governments worldwide are beginning to recognize crypto's merits.

While China and other nations divest away from US debt into gold, smaller countries are taking the initiative to adopt cryptocurrencies. El Salvador and Argentina are just two examples of nations that have taken the step to recognize cryptocurrencies as legal tender, or as a means to settle contracts.

In addition to smaller countries, there are states within America itself that are passing laws to protect their citizen's rights to self-custody and mine cryptocurrency. This is a trend that will not be stopping anytime soon, and a good reason to be diversified in crypto assets.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...

Resources

Bloomberg article [1]

Watcher.guru article [2]

Ranking of Countries Holding US Treasuries [3]

China clashing with USA Image [4]