This is something that I've been meaning to do for quite a while... and of course, in hindsight, it was probably better to do this a year or so ago when the stock market was still down in comparison today... but still, better late than never for long-term investing. And with all the talk of the Bitcoin ETFs... well, this gave me a reminder and a kick in the arse to get a move on with something that wasn't too difficult to do!

I'm not really looking to make short or even medium profits on trades. But instead, this is more for investing a small bit for our kids when they get older, so that we can hand over the shares to give them a little bit of a boost into their adult lives.

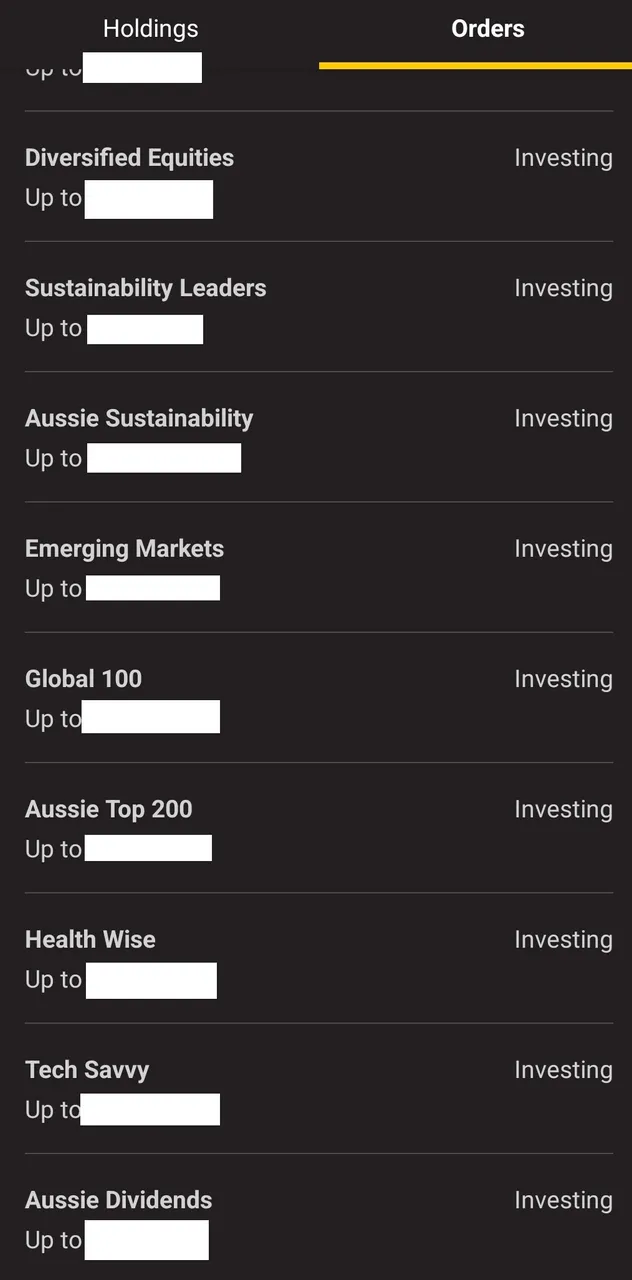

Recently, our bank enabled a option to purchase a selection of 10 ETFs via their mobile phone app. The best thing about this is that it is geared for smaller purchases, with a low brokerage fee. So, ideal for what we were looking for. And in the spirit of ETFs... I figured it was easiest to go with the a complete exposure across the 10 ETF themes. So, a mix of investment "types" like Tech or Sustainability... a broad ASX ETF... as well as global and foreign exposure as well. It is really hard to tell which way the stock market will go... potentially it will all crash from here... but I suspect that if that happens, the interest from the term deposits aren't going to be much better either.

... and always being the pragmatist, I did leave money in the term deposits as well...

But doing all of this... again, I was again exposed to the sheer inefficiency of the stock market system. Again, a very much analogue infrastructure with a digital wrapper that makes people think that they are living in a modern digital world. However, with T+2 settlement times with public holiday delays and stock market opening hours... it took nearly a week for the trades to be properly settled! A far cry from the always live and near instant settlement of the digital native markets... the plumbing is definitely ripe for fixing!

I can also be found cross-posting at:

Hive

Steem

Publish0x

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Coinbase Wallet: Multi chain wallet with lots of opportunities to Learn and Earn!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

WooX: The centralised version of WooFi. Stake WOO for fee-free trades and free withdrawals! This link also gives you back 25% of the commission.

GMX.io: Decentralised perpetual futures trading on Arbitrum!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

KuCoin: I still use this exchange to take part in the Spotlight and Burning Drop launches.

MEXC: Accepts HIVE, and trades in most poopcoins! Join the casino!

ByBit: Leverage and spot trading, next Binance?

OkX: Again, another Binance contender?

Account banner by jimramones