With my targeted Time Deposits going according to schedule, and while trying to steadily increase my Hive Power and my staked Leo tokens. I want to start investing into a relatively riskier investments involving the stock market early next year. My stock of choice is MAIN and Today I will share with you some reasons why I would be investing in this venture capital.

DYOR (Do Your Own Research) this article is not financial advise

Main Street Capital 5 Year Historical Price

Before we start, if you are part of the Leofinance community let me know in the comments section below so I could check out your posts. I recently posted about the pros and cons of having Universal Basic Income. Read about it here.

Why Main Street

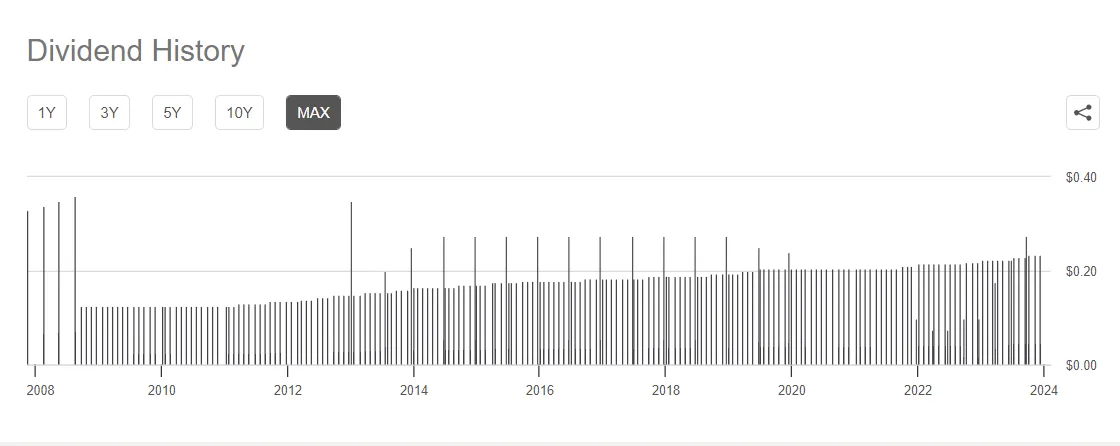

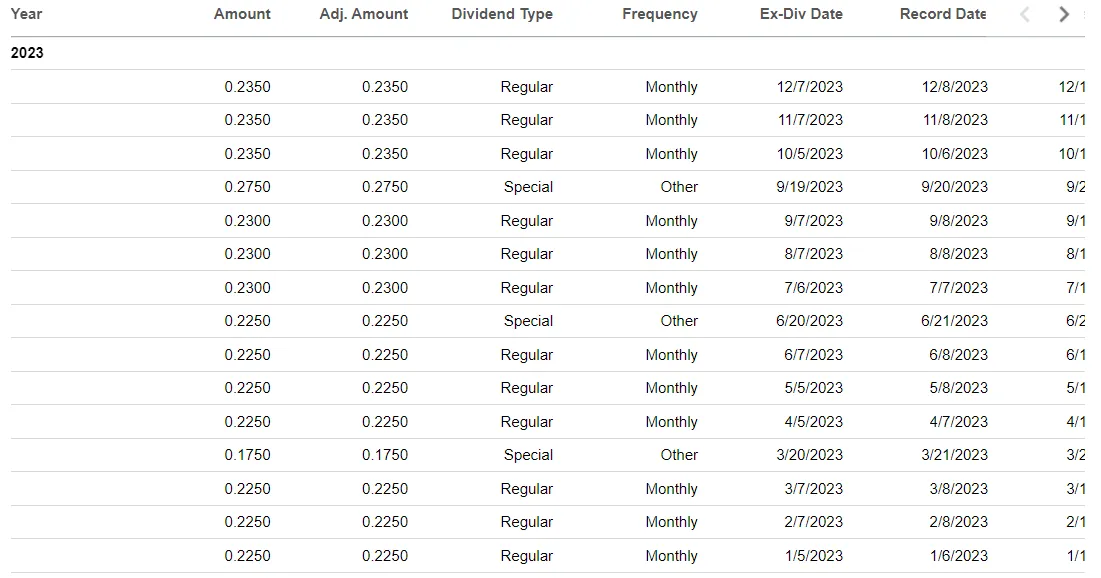

One thing I love with HBD is the passive income that it generates and at 20% APR that is really unmatched. And if you've been following my posts, you would know that I am a big fan of generating and growing passive income as well as diversifying my holdings. And just live hive backed dollars, my one criteria in selecting stocks or other investments is that it generates a monthly payout. I want it to be monthly because I want to have that liberty of using the income to reinvest on the same holding or towards another. And Main Street Capital ticker symbol MAIN as you can see on the graphs below is one of the dividend kings when it comes to monthly payouts.

Graphs and Tables are from here

Who is MAIN?

Same with cyrptocurrency, investing in the stock market will expose you to risks and volatility. So it is important to invest your hard earned money into established and well known entities. Main Street Capital Corporation is a business development company (BDC) that primarily invests in and provides debt and equity capital to lower middle-market companies. Their business model of helping companies grow, along with having a proven track record during financial downturns makes them a solid choice for me.

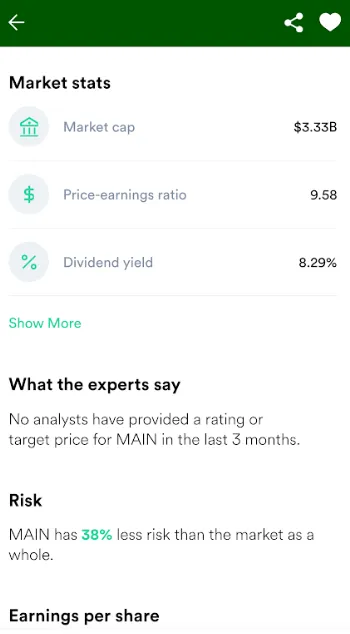

Screenshots taken from my GoTrade App. It is an application which allows me to purchase fractional shares in the US.

How do they look moving forward?

Main Street Capital has a history of paying consistent and reliable dividends. This can make it an attractive option for income-focused investors who seek a steady stream of dividends. But how about in the future? Well as one article suggests, confidence in this corporation remains positive. They offer yields of 7.1% which beats interest rates. And while their share price is not something I truly focus on, still they have a strong record of growth over the years. You can read more about it here.

Image is from here

Where does Main Invest?

The company's diversified investment portfolio includes various industries and sectors. Main Street Capital specializes in lower middle-market companies, which often have a niche market presence and may be less affected by competition from larger corporations. This idea of lending to a smaller business and helping them grow is something truly appealing to me. It gives the feeling of helping entrepreneurs reach their dreams by providing capital. I'll do some research if they invest in tech and blockchain companies.

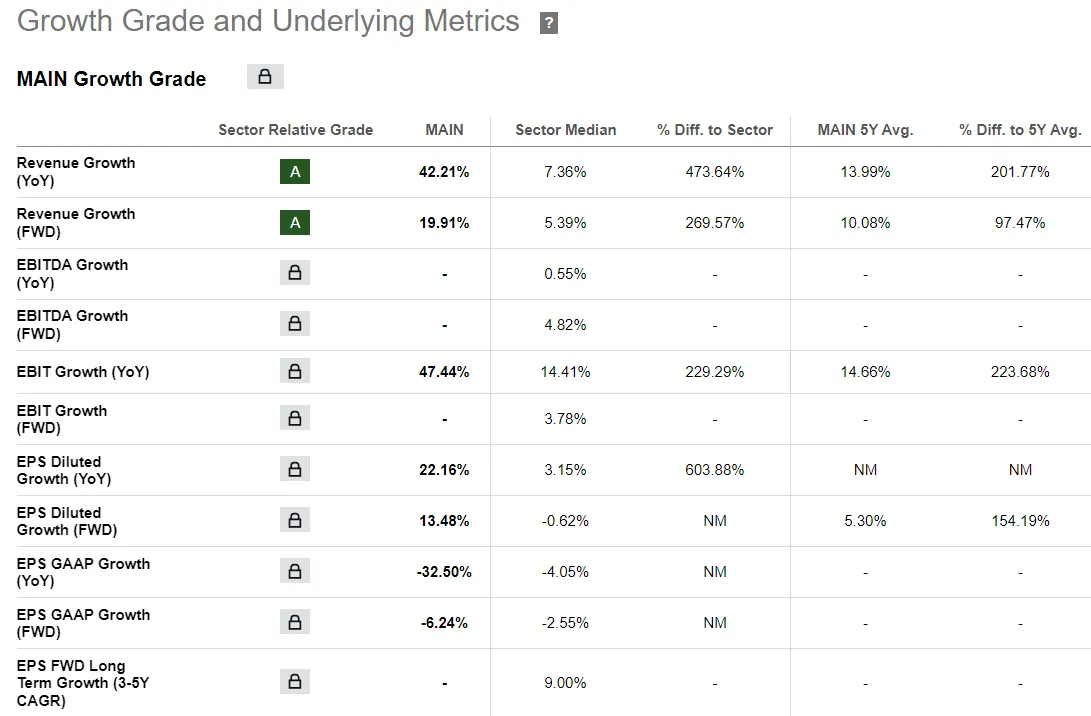

Solid A rating in revenue growth both YoY and FWD. see full table here

How I found out about MAIN

Giving credit to where credit is due, I am subscribed to a youtuber who focuses on dividend investments called dividend bull. Below you can learn more about Main Street as he goes into detail on this BDC. He tackles how the loans are actively managed by the corporation. It also actively manages its investments and provides operational and strategic support to the companies it invests in. This approach can lead to improved performance and increased value in its portfolio.

Some Final Thoughts

As mentioned earlier, each of us should be conducting due diligence and personal research. I have done mine and there are multiple factors that made me decided to add Main into my portfolio next year. One more factor is interest rates, As a BDC, Main Street Capital may benefit from rising interest rates since it typically earns interest income on its debt investments. In an environment of increasing interest rates, the company may see improved profitability.

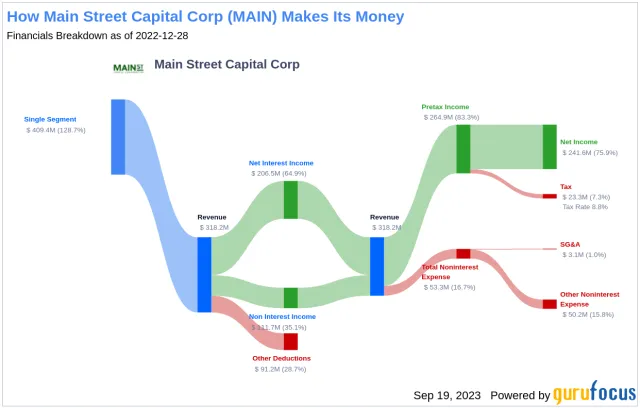

Here's a close look on how this BDC generates their income. Source

There are several types of monthly income investments, there are mutual funds, exchange traded funds, master limited partnerships, and in this case BDCs. I plan to invest and diversify into all of them as long as they meet my requirements and risk appetite. I chose to start with Main Street Capital Corporation because BDCs often have a focus on senior secured debt investments, which can be less risky compared to other forms of debt. This can be attractive to investors seeking a balance between risk and return.

Sources:

Seeking Alpha MAIN

Wikipedia