Thailand's financial regulator, the Securities & Exchange Commission, has announced a nationwide ban on crypto as payment for goods and services, effective April 1st, 2022.

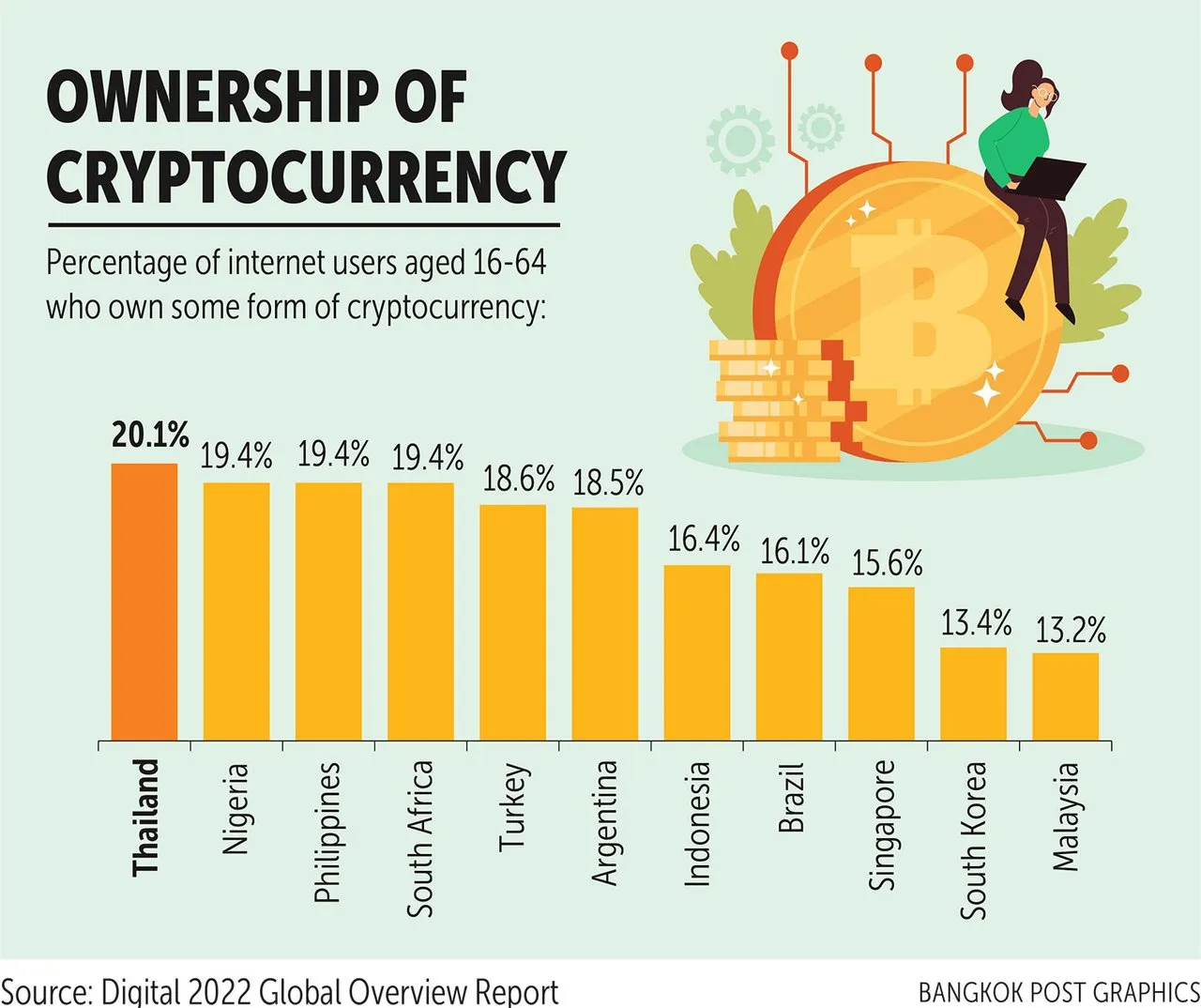

This comes in a country with HIGH crypto adoption, with over 20% of the population aged 16 - 64 years holding crypto assets.

Thailand is also the world leader when it comes to online grocery purchases with 45.8% of its internet users aged 16-64 buying groceries online each week. Just behind Thailand is South Korea (43.1%), followed by Mexico (39.4%). The global average stood at 28.3%.

According to the report, Thailand ranks second in the world in terms of fixed internet connection speeds with median download speeds of 171.37 megabits per second, behind Singapore with median download speeds of 184.65 Mbps. Source

So why the about face?

Spoiler alert - it's not an about face, per se, but a pre-emptive move to capture & control the market once the e-CNY launches globally.

You see, Thailand is one of 4 countries signed up for global testing of the eYuan, the new centralized Chinese government issued digital currency.

China launches digital yuan app in pilot cities nationwide

In country testing of the new eYuan is nearing completion, and there are four countries who have already agreed to be part of the next phase of testing & rollout: Thailand, Vietnam, Cambodia and the UAE.

Full digital currency is moving RAPIDLY here in Asia with many businesses using Covid as an excuse to no longer accept cash. Recently, when I tried to renew some business documentation at the Chiang Mai Provincial Government Offices, I was stunned to see they no longer accept cash either.

Instead of trying to slow down the rate of adoption of cryptocurrency amongst citizens of Thailand by banning cryptocurrency trading and mining, the country’s governing bodies are putting a regulatory framework in place.

This framework will implement a 15% capital gains tax on profits for cryptocurrency trading according to an anonymous source inside the Finance Ministry, who disclosed information to the Bangkok Post last month stating that all taxpayers, investors, and mining operators who gained from cryptocurrencies will be subject to a 15% holding tax.

Thailand’s central bank has also expressed its intention to trial a central bank digital currency in the second quarter of 2022. Furthermore, the country will launch its own utility token, the TAT token, which is part of a planned crypto-tourism campaign. Source

Step one appears to be temporarily eliminating current competitors and making sure that the eYuan test is managed...

China digital currency: could Beijing’s advanced e-yuan replace smaller Asian currencies?

Make no mistake that crypto will be accepted for the exchange of ALL goods and services in Thailand by the end of this year, just they will prefer it to be THEIR new TAT crypto coin. And do everything in their power to offset the incoming tsunami of Chinese crypto.

Pondering all of this, I have just 3 words top of mind: