Change the course of your entire life with 1 Habit.

In this article I will give you the 1 simple rule for life I learned after reading “the richest man in Babylon” that will put you ahead of at least 50% of the entire world population.

Arguably, now more than ever, it is easier to get stinking rich than previous generations. The internet has allowed millionares to pop up in a couple of years, as opposed to decades of grafting to get on the property ladder. It’s all about knowing the right strategies.

Although methods of achieving wealth have changed, there is one age old strategy that rings true today.

The 10% Rule:

To explain, I will give my own earnings as an example.

Right now I earn more or less £1064/$1295 per month. For the past 5 months I have managed to save more than 10% of my earnings and be smart with my investments. I spread my investments into 3 categories.

I will show you all of my investments and then explain how the 10% rule is the foundation of all of this.

Low-Moderate Risk: LISA

So this one here is probably my favourite. I do absolutely 0 work apart from move money into the account.

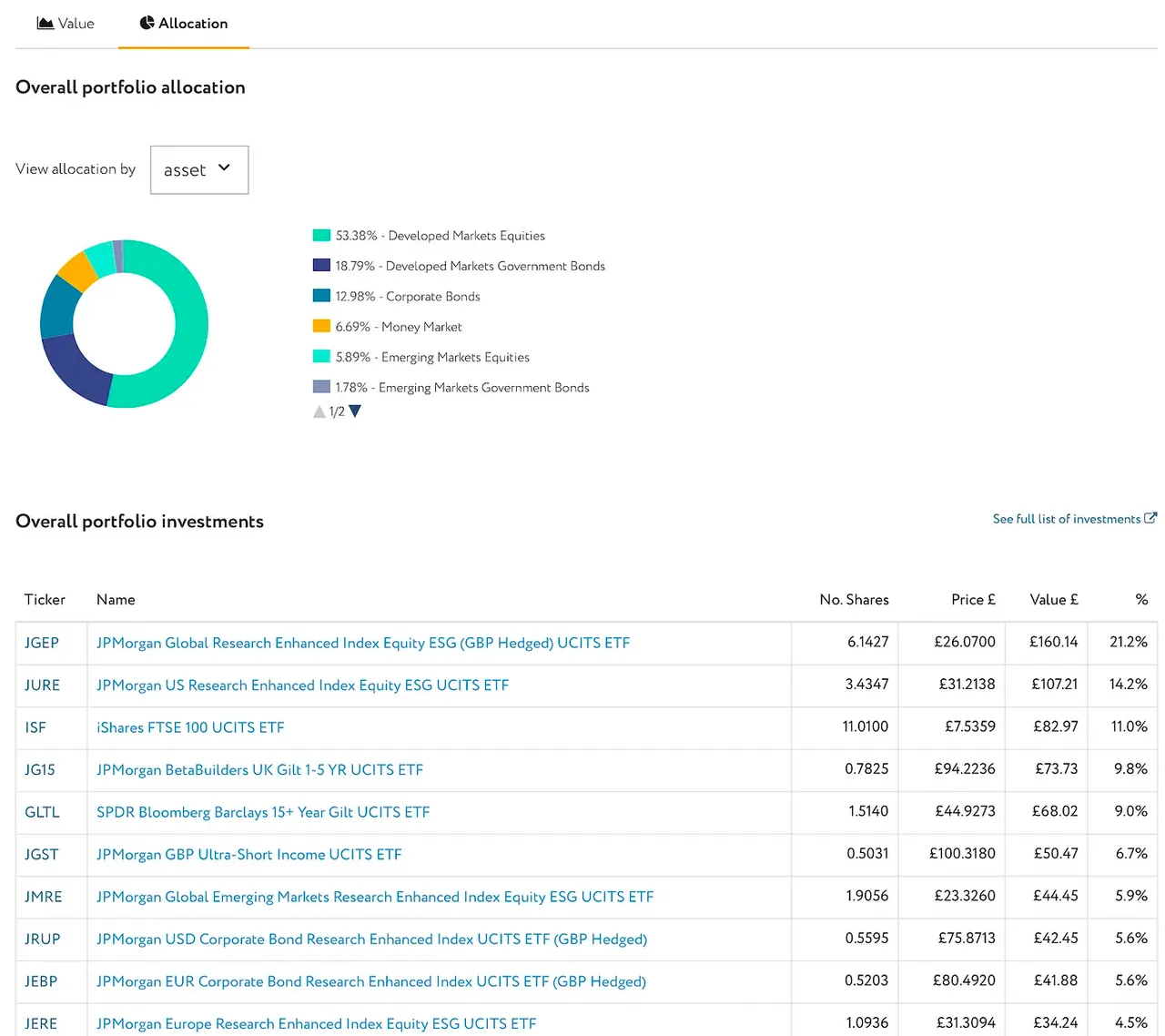

Their AI software trades and allocates all my cash, regulates everything to give the best returns.

Not only this but in the UK, the government contributes 25% extra into your pot.

So if you keep scrolling you will see that the AI has allocated my cash into various assets to spread the risk.

Below are the projected values in 5 years when I invest £334 a month.

You will also see just above the graph where it says “government bonus” this is the 25% the government will have contributed on top of my stock earnings.

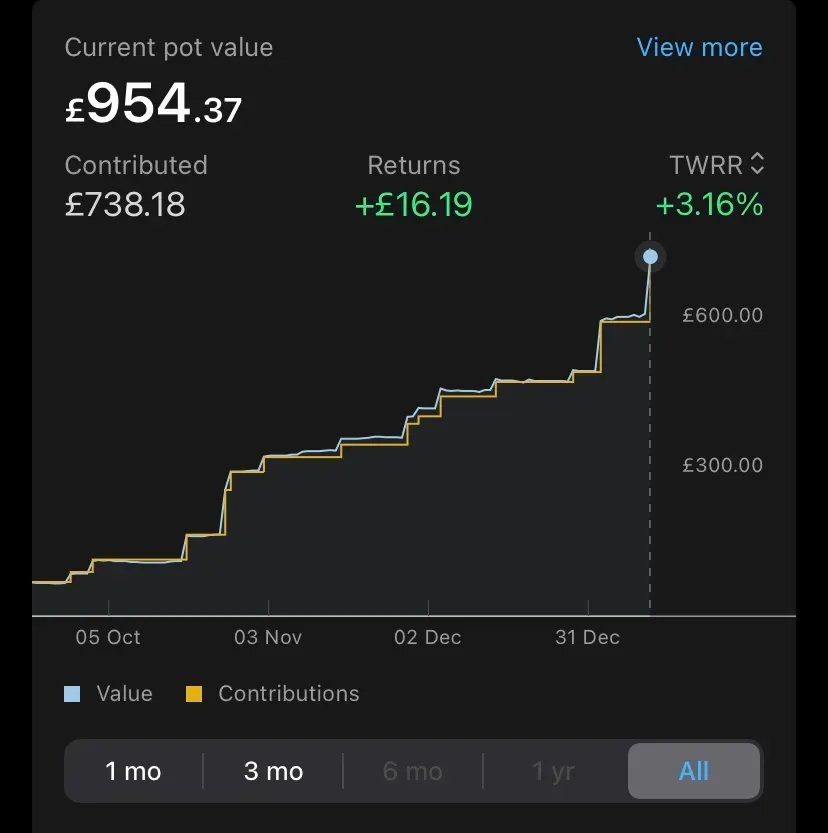

And here are my current stock market returns. As you can see, my returns exceed the average rate of inflation, even without the added 25%.

This is my backup. No matter what happens, if all my businesses fail and I make nothing of my life outside of investments. In 5 years I will have enough for a deposit on a reasonable house at 25 years old.

This will put me ahead of about 90% of all UK citizens my age and even about 65% of people aged 65+

Update: this article has been sitting in my drafts for a while, so my investments have made a few updates and I now have £5020. £4000 of my own money, £1000 from the UK government and £20 made from the AI trading my money on the stock market.

Total gain after 3 months: 25.5%

So if I continue as I am, I should be set to have £25,000 or more by 25. As a waiter. Doing nothing special, nothing that stops me from having fun. Just putting away some money and being smart with my funds.

Im literally going to Thailand for 1/2 months, on a waiters salary and will still be on track to save another £5000 next year. So if I can, you probably can too.

High Risk: Crypto

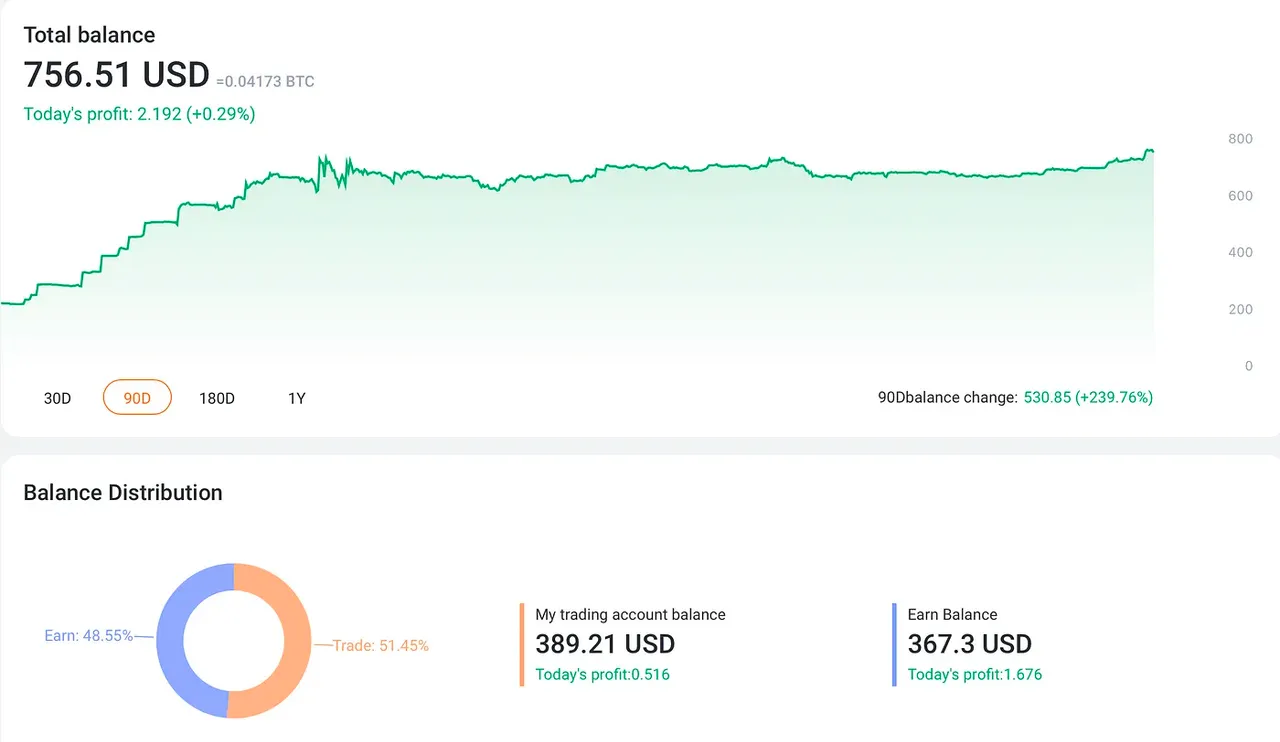

Crypto trading takes much more effort and learning. Rewards and losses can be huge, depending on how many risks you’re willing to take. I tried to stick to more stable currencies (Bitcoin and Ethereum) to make more stable returns.

You can make much higher yields when compared to the stock market. However, you risk making big losses if you get impatient. My account dipped by about $100 before making gains of about 5% after 2 Months.

Average stock market returns are about 10% yearly so 5% in 2 months is pretty good.

Make sure you look at the time of investment. When I put my money in, all cryptocurrencies took a huge hit. Therefore, I bought at bottom price and not at an all time high. Now that the markets are making a stable crawl back to stability, my profits are increasing.

For people in their twenties, a couple thousand is probably the majority of your networth. So it’s best not to keep all your money, at all times in crypto. My strategy is to wait for the lowest of lows, sell at the highest of heights and then completely remove myself from the crypto markets until the next dip. I then take those returns and invest in a much more stable LISA to maximise returns with the 25% government bonus.

If you want to start, heres my suggestion:

Get a coinbase account and do all the “Coinbase Earn” lessons. You get payed to learn about different crypto coins. Here you should try to understand why cryptocurrencies have value and why some coins might have more value than others.

Keep up to date with crypto news on sights like coinmarketcap.com and coingecko.com. Use these to familiarise yourself with the industry.

Finally, learn about crypto trading bots. Bots allow for larger profits as opposed to just buying and holding a coin. I used Pionex as its free and easy to use. It provides many different options for all skill and risk levels.

Update: As this article has been sitting in my drafts, so my crypto has been sitting in the trading software.

Here are the results…after 1 month and a bit I made…drum roll please…$20.

Nothing extraordinary, I reckon if I had more money or was able to leave it for a longer time, it would be worth it but just not right now.

So in my opinion, have a look at crypto if you have a nice chunk of money and time to invest, but not if its 20% of your salary like it was mine.

Credit Cards: Credit score

After speaking to some of my friends, I realised, lots of people are scared of debt. You have to understand debt is not a bad thing.

In fact, rich people do this all the time, they leveraged debt to their advantage. Sure, I could save £100,000 to buy a house after 10/20 years or get a mortgage after 5 and buy 2/3/6 houses in the time I’d only be able to save for 1 and use the rent to pay off the mortgage.

Sure you could save £3000 for that business Idea you have, or pay it off over 6 months with a loan and use the business returns to pay it off. High risk, High reward.

Wether you decide to do any of these or not, you need a good credit score. Most people my age don’t think of these things until they are desperately in need of it.

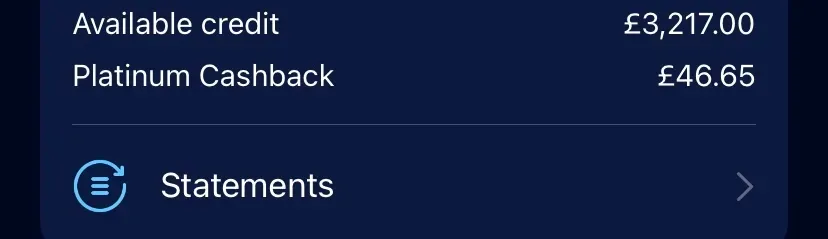

Credit cards also come with amazing benefits:

- I get cash back on most purchases

I get amazing offers, say I needed a laptop desperately for work or wanted to save money on that holiday I’ve been planning.

As well as thousands of £ of credit that I can use in case of an emergency. Car breaks down or boiler stops working, etc.

On top of these benefits I’m building a good credit score which I cant stress how important it will be in your later life.

As long as I know I can easily pay back what I spend on the credit card, theres more upsides than downsides.

Summary:

The one thing that will set you apart from the majority of the population is good financial health. I wasn’t joking when I stated you will supersede at least 50% of the world population.

Quick stats:

- 80% of individuals in the UK have less than £500 in savings

- 60% of Americans don’t have $500 in savings

- FICO says 16.4% of consumers had scores from 700 to 749 in 2021. (credit scores)

What does this mean for you?

These figures are only getting worse. Trends show younger generations are saving less and less, whilst inflation has hit an all time high since the 2007 great recession.

If anything, this should be a relief for you. It shows how easy its becoming to be above average. The waiter on $25,000 a year who saves 10% of that, will eventually surpass the salesman on $60,000 a year, with nothing to show for his higher earnings.

It’s all about being smart and investing in the right things.

So where to start?

With 10%

Put it away, learn how to invest and get a credit card so you can start to build a good relationship with money.

Disclaimer:

The information on this article is for general information only.

It should not be taken as constituting professional advice from the writer.

I am not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the website information relates to your unique circumstances.

I am not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.

Have a great day people :)