Money is the legal tender of human transaction, regardless of if it's for goods or services; money is usually the focal point of payment for a transaction in getting things done, and that's why it's quite essential. Unfortunately, not everyone can afford the amount needed at a point in time to settle all of their needs and wants, and that's why we see people delve into loans to help them sort out such immediates with the aim of settling the loan later on within a stipulated time. I've personally seen one of the benefits of taking loans for a good course, and today I'll be talking extensively about this subject matter.

One of the biggest fears of most people when it comes to loans is how they're going to pay back and what would happen if they couldn't, and in my own perspective, loans are very essential in our world today. If at all you want to get your needs at the right time and with a good price, abstaining from loans will not only delay your chances of acquiring your needs but also lead to you buying those needs at a higher value when you can finally afford them, and I can say this because one of my personal experiences is a testament to that.

I remember that by March last year, my community was suffering from poor power supply, and given my nature as someone who interacts with loads of electronic devices, I know I won't be able to cope without electricity, so I opted to seek an alternative to the government power supply, and in the end I was recommending to purchase solar for clean energy generated from the sun by a friend, which I found to be a good idea but couldn't afford the amount at the time.

After several back and front, I decided to take a loan to purchase the solar, which was at the time sold for two hundred and fifty thousand naira for an outright payment, although I could have easily gone for the installation payment that was 350 thousand then, but then I concluded within me that there's no point stretching the payment, and since I purchased the solar, it has served me generously, and I can't help but always be grateful for the decision I made to take that loan back then and purchase the solar system.

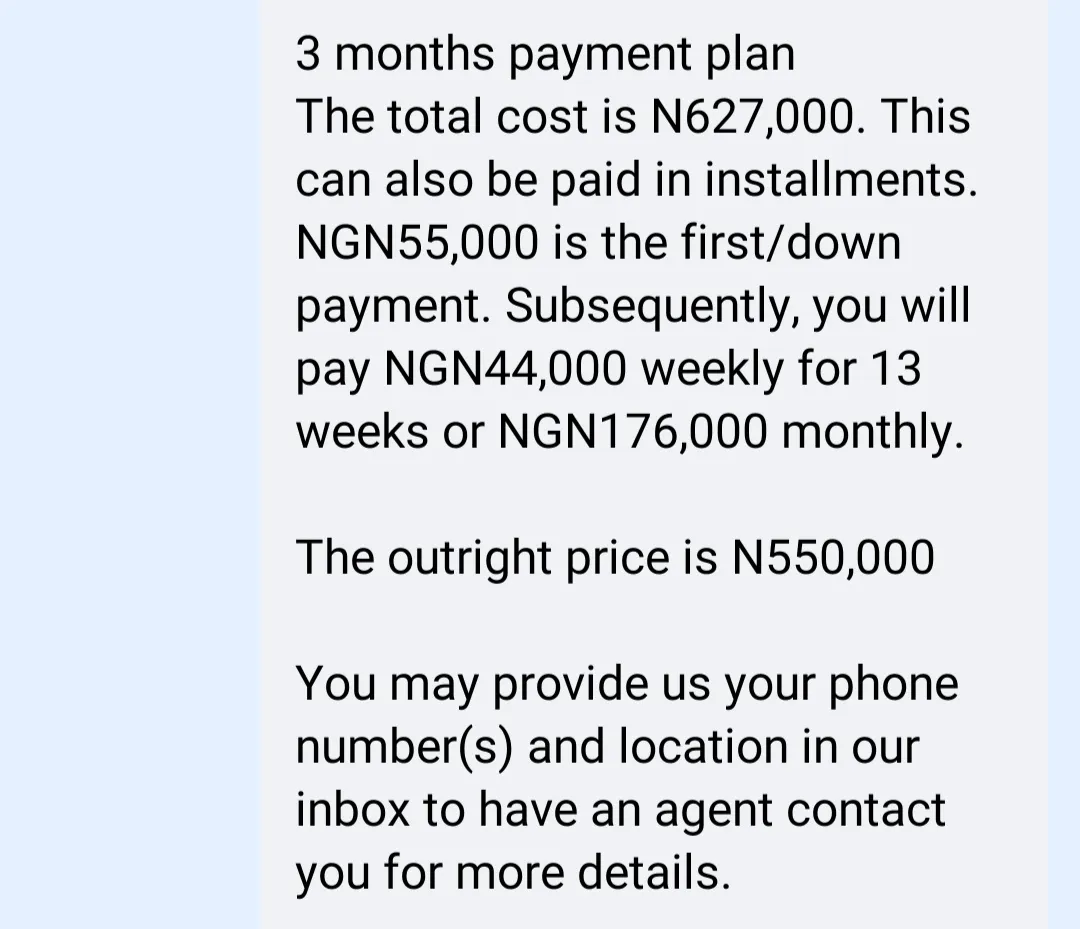

Fast forward to present day, and I decided to take a peek into how much the same package of solar I purchased last year cost presently, and I realize it's increased by over a hundred percent because the solar I purchased last year at two hundred and fifty thousand Naira is now being sold at five hundred and fifty thousand Naira for outright payment and installment within three months is now six hundred and twenty-seven thousand Naira.

The rate at which the value of everything is increasing is just jaw-dropping, and I can only imagine what if I didn't take that loan then. That means if I decided to be gathering the money to get that $250,000. Then, buy now when it's complete; I'll now need an extra $300,000. Before I can purchase it, and this personal experience of mine is just one of the notable reasons why a loan is good and necessary.

The loan I took for that to purchase the solar system and other stuff was 500 HBD, and I made an agreement to pay everything back in seven months, but I paid everything back within five months, all thanks to my HBD earned via author rewards on a daily basis. Then I was paying 100 HBD monthly until the final payment was made to clear my loan.

Just make sure you've got a well-prepared method of paying back the loan and have several alternatives to the first options you've got, so if one fails, you'll still have another to pay up your loan. With several lessons and experiences I've had with loans and the unstable economy of the world, it's worth noting that I'll never shy away from taking a loan but will always delve into it to meet my needs.

All photos are mine.