I am a long time XRP holder and believer. There are a lot of misconceptions about XRP and many detractors. This mainly stems from the centralization of XRP with the company 'Ripple' holding a significant portion of the supply. When it comes to crypto I believe you are either an advocate for the adoption of cryptocurrency due to financial reasons or for moral reasons, I suppose it's possible to want to profit while making taking a moral stance, however I would argue that most people are either one or the other. Personally I am more interested in profit, thus I care very little about the centralization of XRP, in fact I think it is a good thing.

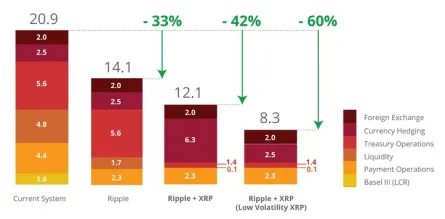

A number of commentators have questioned the utility of XRP given that customers of Ripple don't have to use XRP to use Ripple software. This is true but at the same time very basic analysis. Ripple's main product is X-current which is essentially a replacement for Swift, while the product does save a significant amount of time and money, X-rapid saves more. As you can see below:

The use of blockchain and especially cryptocurrency is a huge leap for financial institutions, as a result Ripple's strategy will be to get customers to accustomed to X-current before moving them on to the most cost-effective product X-rapid.

Ripple's X-rapid product sources liquidity for financial institutions by using XRP as an intermediary asset. In traditional banking, to facilitaite cross-boarder payments banks must have capital in the domestic markets they are sending money to. resulting in in-efficient capital deployment. There is an estimated 21 trillion of dormant capital lying dormant to facilitate cross-border payments

A simple example of how X-Rapid works: Imagine a US based X-rapid customer needs to pay supplier in China RMB 6,385 which is the equivalent of USD $1,000. X-rapid works as follows:

USD $1,000 convert to >>>> XRP convert to >>>>> RMB 6,385.

Essentially X-rapid uses XRP as intermediary currency to reach the final destination. This is done by converting the initial currency by buying xrp with the initial currency (USD)and then selling XRP for the final destination currency (RMB). This would be done by dealing with local exchanges in each country. It is not yet clear, but I believe Xrapid is able to handle the transactions on behalf of the customers rather than the customer needing to open bank accounts with a ton of exchanges.

While I believe the product is great in theory, there are three problems that need to be solved:

Fiat/XRP pairings- Simple put there is not enough liquidity in the form of international exchanges for X-rapid to work to its full capacity at the moment. There needs to be Fiat/XRP pairings for every single corridor that the X-rapid customer wants to send funds to, as ultimately the exchange will be providing the initial purchase of XRP and final fiat currency swap of the transaction.

Volume: Financial institutions deal with significantly large amounts of money, well into the billions for a single company. This means that there must be a significant increase in liquidity for all XRP pairings to ensure that X-rapid can source the necessary liquidity for large payments

Price: The price of XRP must be much higher. As mentioned the amounts being transacted can be well into the billions. Thus with XRP's current market cap of 27 billion, sending billions of dollars becomes inconvenient as sourcing the number of XRP required to make the transaction is extremely difficult.

In order for Xrapid to be a success these three critical aspects must be improved upon. Luckily for XRP, Ripple is a very successful company with significant financial resources it can use to enhance the XRP ecosystem. While these resources will no doubt increase the adoption of XRP, Ripple still needs a lot of exchanges operating across the world for X-rapid to reach its full potential.