My previous post for XAUUSD (Gold) can be found here.

https://coinanalyst.investments/2018/04/29/xauusd-gold-4hr-tf-elliott-wave-analysis/

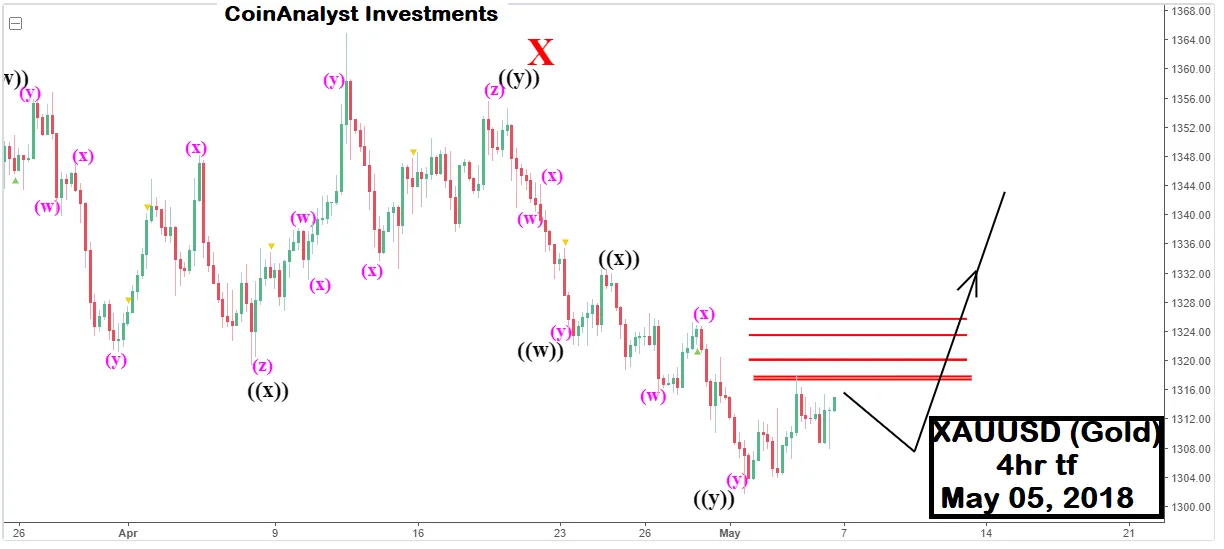

It was mentioned in the post that XAUUSD (Gold) was possibly going to resume an uptrend either as an impulse wave or correction (3 wave move). XAUUSD (Gold) finished last week with a net change of

~-0.65%. Even though XAUUSD (Gold) grazed above the point of invalidation (POI) of the analysis last week, the possible trajectory for XAUUSD (Gold) is still maintained as an upward movement in price either as a correction or resumption of an impulse (trend) wave.

A corrective move back up implies that XAUUSD (Gold) will continue its current downtrend, while the resumption of an impulse wave should see XAUUSD (Gold) capture the high of ~$1365.16 made on April 11, 2018.

Any price move upward is expected to find intraday resistance at the horizontal price levels marked on the chart. These are given below

- $1317.41 and $1317.39

-$1320.11 and $1320.14

-$1323.50 and $1325.72

Alternatively, a break below ~$1301.61 means the uptrend is done the price of XAUUSD should sell off and target support between ~$1251.84 and $1236.78