Wall Street Journal columinst James Mackintosh thinks we should thank the Fed for the fall in bond yields, and therefore for the rise in stock prices relative to corporate earnings. Thank the Fed for the Stock Market’s Run—and the Plodding Pace to Come - WSJ

To credit the Fed for higher stock prices, he shows a persuasive graph showing that the earnings yield (inverted P/E ratio) often moves up or down with the 10-year bond yield. So far, so good. Other things being equal, when bond yields fall the price/earnings ratio of stocks typically goes up (and the earnings yield goes down).

Where Mr. McKintosh goes wrong is that he claims the U.S. bond yield fell because the Fed lowered the federal funds rate on bank reserves to nearly zero.

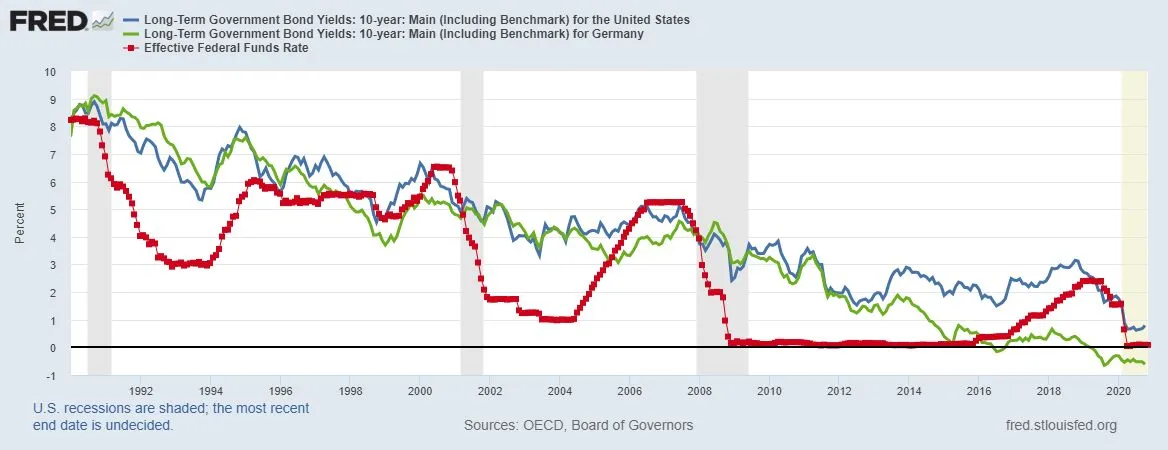

But bond yields are largely global, not national. My graph shows the 10-year yield on U.S. and German bonds track each other quite closely, though the U.S. yield has been a bit higher lately. They do not track the fed funds rate - more often it's the other way around.

The red line shows the U.S. federal funds rate, which typically rises before recessions (no coincidence) then falls until the Fed once again hungers for another recession.

The Fed cut the fed fund rate from 1.1% to .25% on March 6, then near zero on April 1. Those moves followed rather than led a drop in rates on bills and bonds. A recovery did not begin until states began to reopen, most or them in early May.

If the Fed can raise or lower long-term U.S. bond yields at will by fiddling with the fed funds rate, why are U.S. and German yields (among others) so tightly linked together? It is doubtful that Germans would readily believe their own national bond yields are determined by the U.S. Federal Reserve, so why should we believe U.S. bond yields depend on the fed funds rate?

Thank the unique global importance of the much-maligned Big Tech companies for most of this year's run in the stock market, including newcomers like Zoom and Moderna.

And thank most states for reopening their economies, except that seven of them (notably California) have once again closed most businesses.