What would you do if you knew?

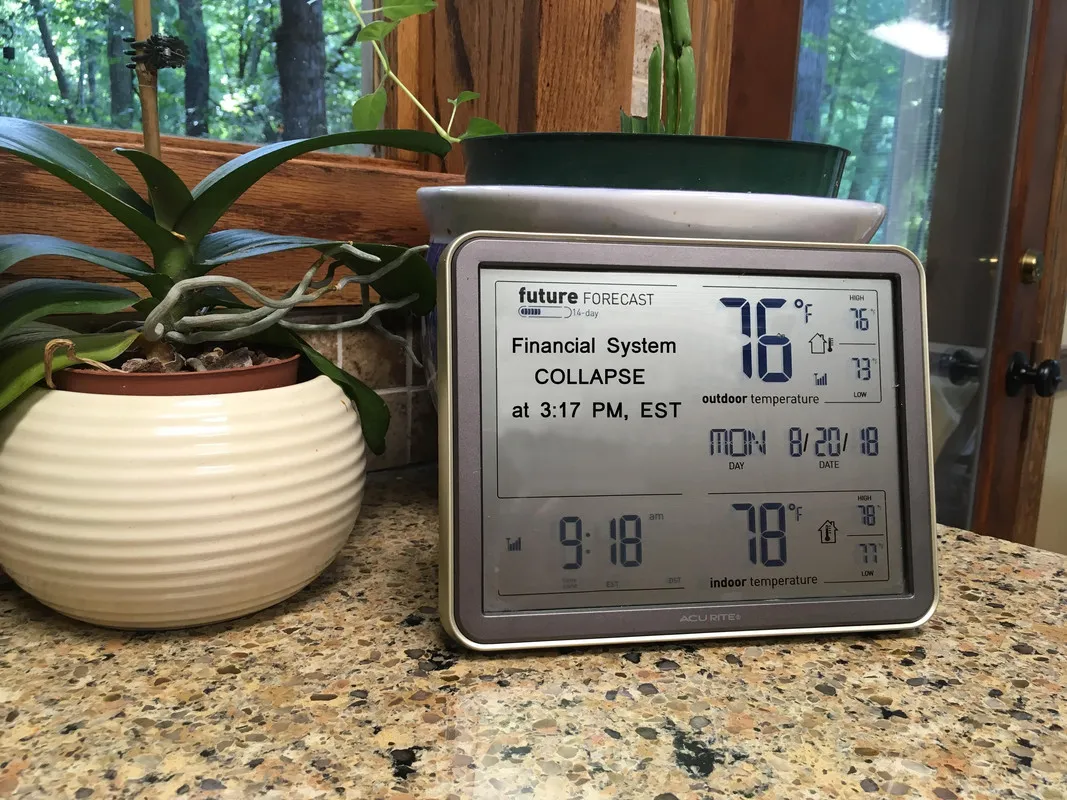

Without bothering with the technical details of how it came, suppose for a moment that suddenly and unexpectedly, you had a valid warning that the financial system was going to crash in a few hours.

What would you do once you had gone through the mental denial and acceptance phase of the initial panic?

Suppose that all of the following runs through your mind while you are deciding on your immediate actions: You had studied and researched the possibility, and you knew the facts and expectations. You knew the "how", and now you know the "when".

It does not matter how it happens; war, an Electromagnetic Pulse, or a natural event. Most likely, when the system does collapse, it will be caused by a bank defaulting on derivatives it holds as an obligation on its books; an obligation to cover another banks' risk that is suddenly impossible to meet and one that will cause a domino effect through the world banking system as it triggers payments of other derivatives held by other banks that cannot be met either.

Once it begins, what is to come will be all of the credit created by the world banking system destroying an equal amount of wealth in a matter-antimatter reaction that cannot be stopped. The real problem is that the banks have easily created far more credit than there was wealth and people began to confuse credit and money and think of them as being the same. The banks knew otherwise because credit made them very rich.

There are hundreds and hundreds of trillions of dollars worth of those bank-invented financial instruments of mass destruction, and the banks used them to enrich themselves by selling risk to other banks and thereby placing all bank customers at extreme risk. There are far more derivatives than there is money on earth to pay for them. One German bank alone has over fifty trillion dollars in derivatives; by comparison, there are only about 1.5 trillion in cash dollars in existence. That one bank has more than enough derivatives to bankrupt all other banks! Of course, nothing could ever go wrong with the bankers' concept of risk management.

Image by @willymac

The collapse would happen worldwide in a matter of a very few hours, if not minutes, depending upon where it began. One bank's computer announces a "We're bankrupt" warning to a stunned staff, and, at the same time, other banks' computers get the news and they reproduce the same chaos in the tallest, most expensive buildings in all the major cities on the planet. Each computer does quick sums and computes the obvious fact that more money is owed to other banks than they have access to, triggering default rules that spread through the linked systems at near the speed of light. Every bank on the planet just became worthless. Customers of those banks have lost every penny in checking and savings accounts through the banks' legal confiscation of all deposits to meet inter-bank obligations. That part of the complete system failure would be over before the first customers found out a failure was underway.

Customers have no money and the banks have no money. Everything was credit; there was virtually no real money involved and nothing to prevent as much credit being created as the banks could entice borrowers to use. The closest thing to money is the paper Dollar in your possession, even if they are I.O.U.s to the Federal Reserve Bank. Everything else is a computer entry in a bank's computer and you do not own that. At least you have the paper Dollar and it will be good for a few days.

In Des Moines, Iowa, a customer logs on to her online account to see if a check has cleared. Access is slow and a few seconds later, a small window announcing that the bank is sorry, but their computer is down for the remainder of the day but will be up before business hours tomorrow. Of course, all the bank's customers get the same message. Calling the bank gets a voice message that all lines are busy. No one tells you that the bank will never open again and that your money no longer exists.

Within the first two hours or so, the credit card companies will be officially notified that their bank cannot accept any transactions and that credit lines have been temporarily suspended. Panic and turmoil will spread through the credit card company's main offices as they decide their next course of action. They will have no option but to notify their branches and data centers to reject all credit cards because they know customers have no method of paying for their purchases. Without banks, customers cannot be direct billed nor can they write checks. Credit cards just became as worthless as all the blank checks.

Before they know anything has happened, customers in Memphis, Tennessee, Miami, Florida, and a hundred other cities routinely visit their bank to withdraw cash and find a small sign on the inside of the locked door announcing that the bank and its ATM machines are closed because of electrical problems but will open in the morning at regular time.

After hours, the sign will be replaced with one that simply says CLOSED, and just below it, another small sign with the name and telephone number of the Federal Deposit Insurance Corporation that itself will be closed within two weeks without having reimbursed a single customer of any bank. The Federal government will begin to close operations because the banking transfer system cannot function since there are no counter-parties for the valueless Dollar.

Since the failure was late in the business day where you live, the damage done is not apparent yet to most people. If you stop to fill your car or truck with gas you find that the credit cards don't work, but you happen to have the cash and you use it to pay for the purchase, noting that you will need to get more cash tomorrow. Others who stop and cannot use their cards and have no cash are the first to begin the sharp slide down the steepest decline in Western history.

Early that evening, in South Texas, on Interstate Highway 10, a long haul trucker running on fumes stopped at a Loves' station and pulled up alongside twenty other trucks for two hundred gallons of diesel fuel. The company credit card was refused by the pump. The driver called the dispatch office and asked about the problem with the card but they were having a hard time finding out anything. While he waited for instructions, another trucker at the adjacent pump had the same problem, but with a different credit card. Both were tired, anxious to get back on schedule, and getting frustrated. When they went inside and found the turmoil in process, they realized that they would not make more miles today, and that delivery times would be missed. It began to get rowdy as one of Love's staff turned out the lights in the big signs towering above the Interstate while another announced to the assembled customers that they had been told to not sell any more fuel or merchandise unless it could be paid for in cash. The trucker had $62 with him.

An older couple had stopped for gas on their way back home to Pensacola, Florida, and saw the sign's lights go out as they pulled up to the giant gas station. The fuel gauge was in the red and the driver was thankful they had made it safely. Little did he know that neither his nor most of the other vehicles would leave the parking lot again, and that his only choice for getting home was to walk. Without food, water, or lodging, it would be a very unsuccessful journey. People all over the country and major parts of the world were having similar problems

That scene was repeated hundreds and then thousands of times. Delivery trucks filled with goods stopped wherever they ran out of gas. By morning, there were very few vehicles moving on the normally-crowded highway.

Customers in stores shopping for clothes or food or anything else began finding out that all purchases must be for cash only, because there was some kind of problem with the credit cards. Without knowing how important cash had become, many paid for things that used up their precious cash. Others left, angered by the store's service.

By early morning, the news has spread, even telephone calls from friends and family in the early morning hours with the news that credit cards did not work and urging early trips to buy groceries as soon as they could. Before the day was over, even large stores were visibly drained of merchandise and people were drained of their cash reserves.

By the second day, stores were not getting any re-supply trucks. Many trucking companies had recalled their trucks if they had enough fuel to return; there was no reason to deliver goods that could not be paid for. Thousands of big trucks ran out of fuel along the Interstate highways and the drivers began thinking of beginning their long treks home.

Most people went to work the day the banks did not open; many knowing nothing about the financial problems because they never paid attention to financial news. The work actually done varied, depending on how closely related to the financial system they were. News spread within organizations and work groups as they contacted the outside business world and, by the end of the day, almost everyone knew there was a serious problem, and that their paychecks would be delayed. People left work early to get the groceries they could pay for with their remaining cash.

The stock market closed at noon the first day when a three-day suspension was imposed. That was for public morale only, because no one on Wall Street expected that the NYSE would open again. With no money and no banks, what was the use?

The telephone, cable TV, and utility companies began executive meetings to determine how to cut losses to stockholders, knowing that they were delivering services that would not be paid for. Delivering prepaid services and then suspending operations was the only answer. Cell phone and TV service would terminate for everyone in less than a month.

When people are worried about having enough food and are running out of gas for their cars, a lot of them will not go to work. The second day, even more will stay home with family when it becomes obvious that there is no way their pay can be direct deposited and no way they could be paid in cash since there is no cash. Why work when you cannot get paid? Even career employees began to realize that their retirement income and pensions had disappeared, and they left also. By the end of the fifth day, almost nothing would be functioning.

The second night, there were thousands of armed robberies by people trying to get cash.

By the third day, many places with anything left to sell were refusing to take Dollars because of reports - primarily from foreign news reports via satellites and short wave radio - that the dollar had lost all of its value, along with most other currencies. "What do you have to trade?" was the most often asked question.

Police forces quickly diminished in size as violence increased. With no police response, neighborhoods became armed camps against the armed groups of foragers. Foragers will steadily become more violent and more forceful and will become takers. That is human nature. Wolves are takers, and wolves eat sheep. That is nature.

Cities are not good places to be in those times. Nothing is working, the first responders are more stressed than anyone because they feel a duty to protect but they have families to protect, also. Hospitals quickly exceed their emergency room capabilities at the same time supplies become difficult to replace and as the staff thins out.

As will everyone else, the power companies will have staff shortages. Their limited supplies of fuel for vehicles will run out since deliveries have stopped. Outages will occur and they will not be repaired. Circuits will trip and cascade failures will occur because linemen are protecting their families. Failed circuits shift loads to other circuits and that results in overload failures. Another line of dominoes begins falling inexorably.

Medicine will not be available. Where would it come from if people are not working and trucks are not running because gas is not being delivered because there is no money to pay for anything? Without medicine, life will become a shortened nightmare for many, many people.

Grocery stores will be empty in three days. Within a month, there will be no cell phone, cable TV, or Internet and most electricity will be lost. There will only be hungry people looking for food...wherever they can find it.

NOW, what would you do to prepare in the remaining few hours?

And a better question would be: What should you have done sooner to prepare for this almost-certain event?

Things break. Systems break.

When no one gets paid, everything breaks. When people are hungry, things break even more easily. When there is no more food, there is only survival.

Everything is so intricately intertwined, small failures in complex systems trigger larger failures and that can become catastrophic. Once started, failures run themselves and they fail very rapidly. Things go from working to not working, literally overnight.

How did it happen?

The fractional banking system was the beginning.

Credit instead of money was the wrong fork in the road.

Unbacked fiat made failure inevitable.

The Just In Time delivery system ensured the rapidity of a societal collapse.

The lack of a financially educated population made easy work to lull it into passivity.

An unaccountable government with cozy banking ties signed the death warrant.

About Me:

My Writing:

- BONELAND

- Losing Shirley

- Jules, Freddie and the Monkey Man

- The Foot

- Beans

- Timeline

- The Time Tree

- The Little Lake Without a Name I

- The Little Lake Without a Name II

- Dog Friends – Inza

- Dog Friends – Sara

- Dog Friends – Millie

- Philonous, Where Are You?