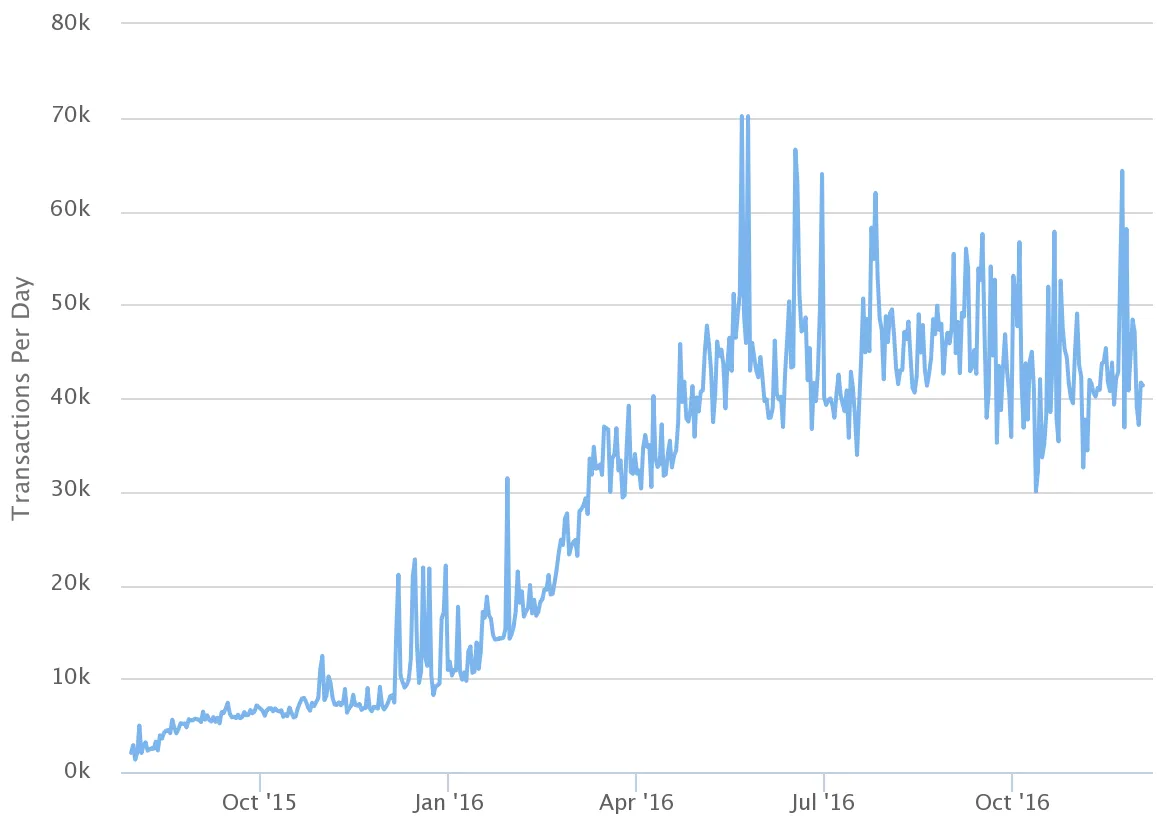

This is the statistics, you can see by own.

The digital currencies experience unprecedented gains in 2017.

Digital currencies in a digital world.

An electronic failure could be the biggest risk for the cryptocurrencies.

A commentary on traditional markets.

Will governments embrace or reject a trend that is significant?

I get myself into trouble with many readers when I mention the "B-word" when referring to the move in the cryptocurrencies in 2017. Those devotees of the new asset class that includes Bitcoin and Ethereum are happy to accept the term "bull market" when describing the price action in these assets. However, when I have used the word bubble, the hair stands up on the back of their necks, and I get lots of nasty and passionate comments. On the other side of the coin, those who reject the idea of the cryptocurrency world have been providing scores of reasons why the market in the digital currencies will disappear in a flash. However, this year that flash has been nothing short of a fire, a bullish and bubblicious inferno of buying and that is a lot of Bs that will likely bother and badger or even bug almost everyone who reads this piece.

The truth is that I was a doubter in the early days of Bitcoin and other cryptocurrencies, which I wrongly looked at as economic science fiction rather than financial fact. Meanwhile, I was 100% wrong and have admitted so much in many articles over the past two years. The price appreciation in Bitcoin and Ethereum have humbled me as the two markets are moving on what I learned early in my career is the most significant reason for price appreciation. The bottom line is that there are more buyers than sellers in these markets. In 2017, buying has amounted to nothing short of a stampede to an extent seen in few markets through history.

The digital currencies experience unprecedented gains in 2017

My training is as a commodities trader, so I am accustomed to volatility. I am used to the price of a raw material doubling, tripling or quadrupling and then halving or worse over short time frames. I watched as the price of sugar traded to 2.29 cents per pound in 1985 after it traded to over 45 cents in 1980 and over 60 cents in 1974. I watched as silver rallied from under $2 per ounce to $50 and then back to under $6. Most recently, the price of cotton rallied from under 60 cents per pound in 2009 to $2.27 in 2011.