Week 39 - Investment moves

- Current US market condition as of 11:56 am (EST)

- Sept 24 Investment moves

- Visa Iron Condor Explained

Current US market condition as of 11:56 am (EST)

The market was between red and green today. Let's see where it will end.

Sept 24 Investment moves

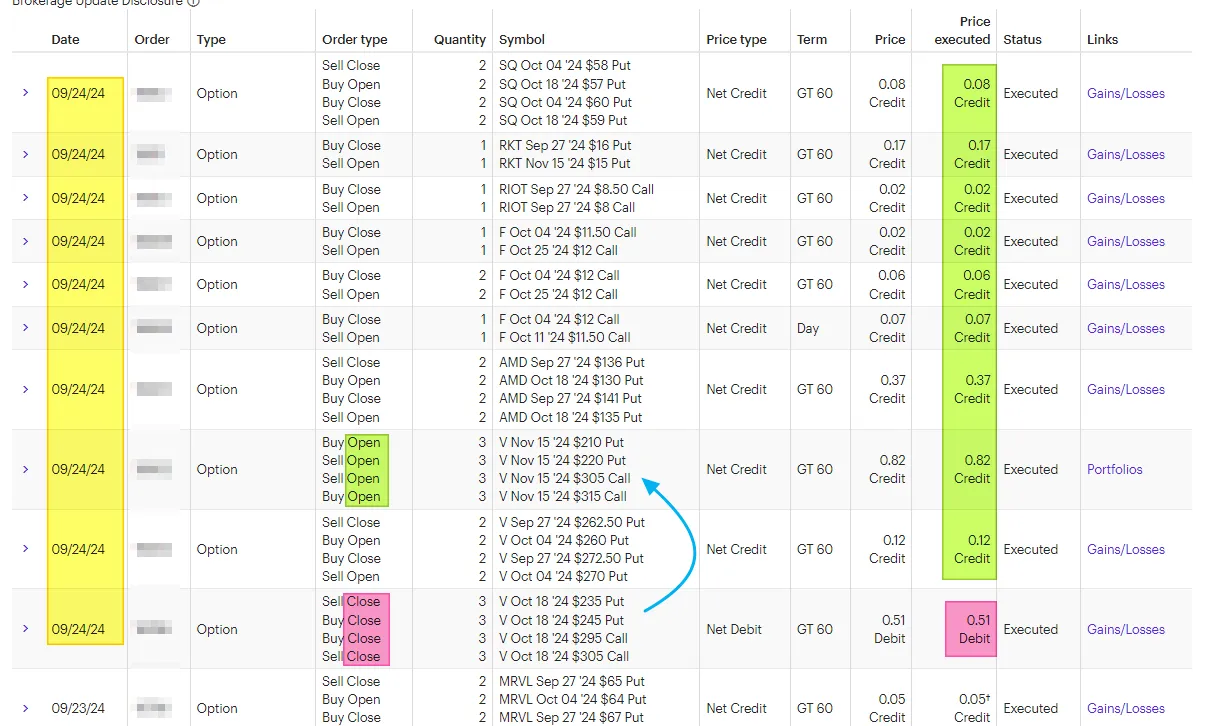

Here are the option trades for today:

Summary:

- Closed Visa Iron Condor (Oct 18)

- Open Visa Iron Condor (Nov 15)

- Adjusted Visa Put credit spread.

- Rolled SQ put credit spread.

- Adjusted RKT CashSecuredPut $1 lower.

- Adjusted RIOT covered calls $0.50 lower.

- Rolled F covered call up.

- Rolled F covered call out 3 weeks.

- Adjusted AMD out several weeks and lowered strike price $6.

I adjust the option to either add risk when needed or remove risk by adding more TIME and moving the STRIKE price away from the market price. This constant adjustment should add some extra profit over a long period.

Have

Visa Iron Condor Explained

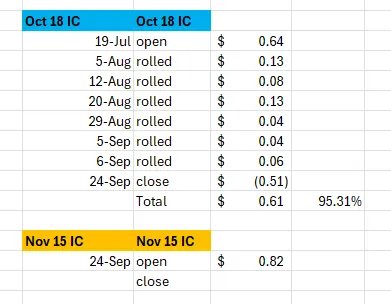

To understand how I made money on Visa, you need to see when I opened it and follow it to the position's closing. This will include all the rolling/adjustment of my position.

To see what I made, it is easier to see what I collected and what it cost to CLOSE the position:

I made $61 per contract out of the initial $64 opened. My profit was 95% of the initial value I collected from the Option on July 19. I could have continued this trade into next week and continued to make money (over the .64 max profit if I did nothing with the original trade).

Have a profitable day!