Advancing Europe with the steem blockchain

Background

The European Capital Market is in many respects still fragmented. Improving transparency and access to information has been shown to stimulate financial investment across Europe, something the continent needs.

The EU (Commission+Council+European Parliament) has therefore issued a Transparency Directive (2013/50/EU) which requires companies listed on regulated markets in the EU ("issuers") to publish a regular flow of periodic information (e.g. annual financial reports) and ongoing information (e.g. change in shareholding) to the market (similar to what US companies provide, and investors in the US can access, through the SEC's EDGAR system).

Unlike the US, which only has one SEC, the EU Member States have created national databases, operated by "Officially Appointed Mechanisms" (OAMs; please stay with me!) and "National Competent Authorities" (NCAs; I know how it feels, don't let me down, keep reading!).

Problem statement

Since the implementation of the Transparency Directive, several problems related to the accessibility of information to investors were identified.

- the Member States "OAMs" are not connected to each other nor to a central database (that could be the EU equivalent of EDGAR). This leads to difficulties for investors to search and compare information or make cross-checks among several Member States.

- the format of information provided by listed companies is not standardised yet. Some reports are only available as scans of paper files.

To the above, one should add the sensitive topic of data ownership. For reasons of liability related to the accuracy of the information provided to the public, creating a common EU database where the OAMs would upload their respective content is a non-starter. The ownership and responsibility for the data should remain with the national OAMs. No "EUDGAR" can easily be imagined.

Thus unrestricted access to regulated information provided by issuers from across Europe, and the ability to search and compare data across national boundaries forms the fundamental definition of the problem EFTG is trying to solve.

Existing "Proof of Concept"

A few months ago, the DG FISMA of the European Commission has done a Proof of Concept in order to investigate the applicability of the Distributed Ledger Technology (DLT, aka "blockchain") to the above problem. That PoC was done using a minimal private Ethereum blockchain and, lo' and behold, it's even been introduced on Steemit in a short post !

That PoC was successful but would hit against the inherent technical limitations of the Ethereum blockchain in an attempt to scale. To point to just one aspect, only meta-data linking to the actual reports were stored in Ethereum "tokens" while the reports themselves remained in the OAMs databases.

A new start

Moving to "Pilot phase" (which means using real data and involving real OAMs, even if not all 28 of them from the get-go), DIGIT's "Blockchain Competence Centre" has been asked to propose another blockchain solution that would solve the problem stated above. After careful analysis and pondering a number of aspects which are summarised in this slide

we have come to the conclusion that the technology which scores higher overall on these points is ... the steem blockchain!

As the EU has an strong commitment to actively support open source software development, we are thereby proposing to the steem and Utopian community a collaboration, to advance together the European project by joining the efforts toward a more transparent "Capital Markets Union". Thus stimulating investment, growth and jobs in Europe.

The User Stories

These user stories were contributed by Michal Piechocki, CEO of BR-AG who contributed to the PoC (and who should help us with better detailing the "business requirements" for the current "Pilot" phase)

Anne is an investor who is looking for opportunities on pan-European capital market.

Peter is an M&A manager who is looking for possible synergy opportunities among the European capital market participants.

Maria is an auditor who is searching for peers necessary in transfer prices analysis.

Since there is no central platform for analysts and investors to obtain that information conveniently, reliably and promptly, and also because financial reporting data is available in different languages, and often in various file formats, and is accessed using different methods, making informed decisions for Anne, Maria and Peter is much harder, or in some cases impossible

European regulators have undertaken several initiatives to help Anne, Peter and Maria tackle these challenges.

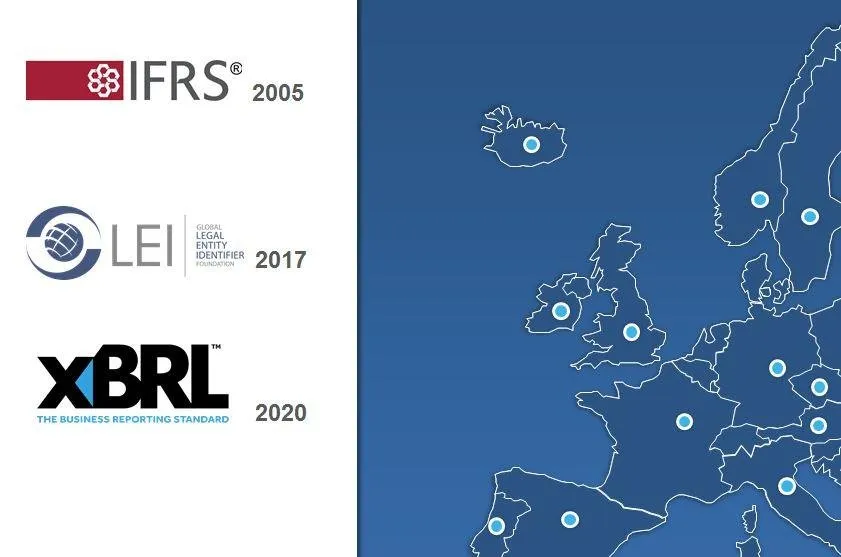

In 2005 the European Union has introduced unified accounting and reporting standards called the International Financial Reporting Standards (IFRS).

From 2017 the EU requires capital market participants to start using the Legal Entity Identifier (LEI) as a unique company identification mechanism.

From 2020 all EU listed companies will be required to apply a common European Single Electronic Format which adopts the Inline XBRL standard for digital representation of financial reports.

Building on these standards, the EFTG attempts to build a blockchain-based commonly accessible registry that synchronises national regulatory information automatically.

Here are some questions our three characters, Anne, Peter and Maria would like to find an answer to:

Anne: "I would like to invest in European companies that have sustained an average ROE of 12% over the past 5 years"

Peter: "I am looking for a steel producer in east Europe with less than 30% debt-to-equity ratio to merge with a shipbuilding company "

Maria: "I am looking for industry peers with more than 500 million EUR assets and more than 80 million EUR revenue and more than 5 million EUR profit"

The Rationale

The EFTG Pilot project is earmarked by the European Parliament as a "blockchain project" but both the budget and the deadlines are very challenging, especially in an institutional setting. Our plan is to start from the steemd codebase and use mostly the internal team to adapt it into an "eftgd".

The "eftgd" packages would then be distributed with detailed instructions to the limited set of OAMs participating to the pilot. After performing an independent code audit (if they see fit), these OAMs would deploy our eftgd "witnesses" on their infrastructure under their complete control and take care of coding the "adaptors" which will read data from their own existing databases, transform it into the common format and send transactions to an eftgd node of our EFTG network.

We plan to call on the open source community to help us with the UI/UX : the dedicated "condenser" and the user on-boarding and wallet management interfaces allowing Anne, Peter and Maria to answer their questions.