Investing in stocks can be a great way to build wealth over time, but finding undervalued stocks can be challenging. However, with some research and analysis, it's possible to identify stocks that are trading at a discount to their intrinsic value... Here are some points on why I think Unity Software stock is a buy in current price range.

Data source from macrotrends.net

Balance

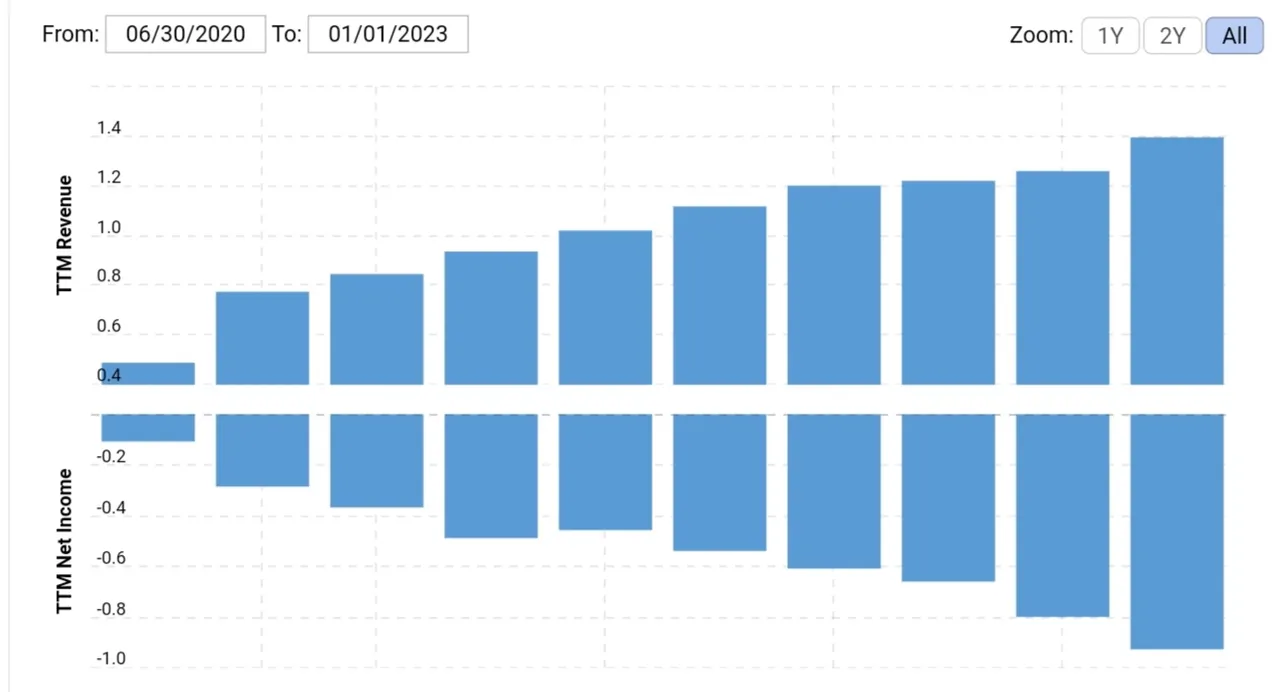

Their CAGR on gross revenue is very high (Compound annual growth rate), but also their burn ratio and increasing negative net profit. However, looks near to have a turnaround and stop the burn and keep the cash flow... They are making 1.4 bn /year of gross revenue and still burning 900 Mi as a net result.

See, you don't want to buy a stock after it already upvalued a lot due to their financial statements be already good and price trending in hype, you want to buy it cheap while they seen to have an issue and balance looks unresolved, we are looking for a future projection and perspective... Its true that to make discount cash flow valuation we would need to see the current net result, and multiples indicators like price/earnings can also look distorted, overall is a tough case to analyze with a common sense, even though its a buy when the stock price hasn't reflected the expected growth.

Fundamentals

Unity is heavily investing in AI and metaverse for sometime, its already possible to program a game without knowing how to code, only by describing what you want to extensions linked like chatgpt itself. This can provide a growth in demand for production of games on future, besides all the web 3.0 disruption into the game industry that we are seeing. Only by investment of private capital into production of games is expected that nft games turn from around 5Bn market range into over 70Bn by 2027.

If a company is trading around -12 on price/earnings (P/E) ratio, like is Unity case (due to their negative net margin as told before), It is due a variety of factors such as high expenses for heavy investments in growth initiatives. In this case, the negative P/E ratio would not necessarily be an indicator of the company's health or growth potential, but rather a reflection of its current financial situation.

If the company grows its gross revenue over the years, this could be a positive sign for its future profitability and growth potential.

Besides, when talking about fundamentals, we want to watch moat (competitive advantages) for a margin of safety. Current there are few good game engines on the market, its main competitor is the Unreal engine, that doesn't has open capital, Unity is the second most used and is great for 2d fun games, but can make great 3d games like Apex Legends and Escape From Tarkov, I see an inelastic demand that won't go away easily.

T.A.

Unity is trading at a 11Bn Market Cap and at a $30 usd price at this post's time. Insiders sold some of their shares on the bull run some time after the IPO, the stock went down due to their high burn ratio in a over-inflated market and followed by hikes on rates (that is precified in their costs, revenues and net results expectations), after all the distribution on price we see a consolidation range from $20 to $40, which can be a good accumulation zone. Now we see inflation lowering on CPI's releases and almost a positive real interests rates (nominal rates discounted inflation), so is expected that Fed stop hikings, keep it for some time to avoid stagflation, and depending of following results it can shift to quantitative easing again (low interests), which would precify positively tech stocks valuations. We are seeing Ark Investments Fund buying Unity stocks, they have a better team of analysts focused on growth stocks than the only one person writing this blog, so you should dyor others sources to base your decisions. Good luck on the markets!!

I just want to edit to disclose that unity is still having net deficits on EPS (earning per shares) even at 2024 release that tracks 2023 YTD. Thats it. We still need to wait for a turn around to positive cash flow to result in the stock price.