So the news is out. President Donald Trump lowered corporate and pass-through tax rates from 35% to 15%. News outlets everywhere announced this as a triumph for small business owners. However, the people who benefit from this tax cut the most are not the owners of your neighborhood’s corner store or family diner. According to Politico, those who benefit the most are owners of companies that are eligible for pass-through taxes.

First of all, what is pass-through taxation?

Cornell Law School’s website defines it as: “…how individual owners of a business pay taxes on income derived from that business on their personal income tax returns. Pass through taxation applies to sole proprietorships, partnerships, and S-Corporations. This is opposed to traditional, or C-Corporations, where the company itself pays corporate taxes on income the corporation derives.”

Whoa, that was a mouthful. What it essentially means is that for companies to be deemed small enough to qualify, they can only have 100 shareholders. Think about it, how many businesses do you know come close to having that number of shareholders? Certainly not your small-town mom-and-pop stores.

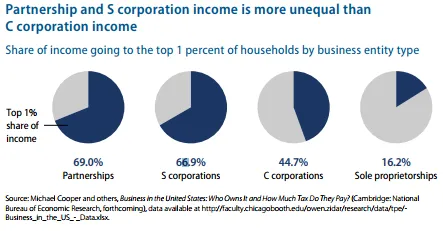

Naturally the next question is then, who qualifies for pass-through taxation? This report estimates that more than 50% of American companies do, which includes approximately 100,000 big businesses which are structured as partnerships or S corporations by exploiting loopholes in the American business taxation system. To give you some perspective, 70% of partnership and S corporation income goes to the top 1% of U.S. households by income, and 70% of partnership incomes come from the financial industry and holding companies that belong to the super-rich (top 0.01% of Americans).

Source: http://www.politico.com/agenda/story/2017/04/26/trump-small-business-tax-cut-rich-000430

If you are a small business owner, or know people who own small businesses, you will realize that they are already paying taxes of around 15% or lower. The ones who are going to benefit the most are firms that pay marginal tax rates above 30%, which make up only 2.4% of pass-throughs. However, they earn more than 50% of pass-through incomes. Those who stand to benefit the most are the super-wealthy of America, who make capital gains through stocks and bonds, as opposed to everyday Americans who make labor income from wages, bonuses and other compensation. (These are people who have systematically benefited from our modern economic system since the Reagan administration.)

By masking as a small business (i.e. less than 100 shareholders), the super-rich avoid paying taxes that can be used to improve the education system, reduce the national debt, or improve business infrastructure that will benefit actual small business owners.

Congratulations to those who work for or have shares in a C-corporation, your taxes are officially lowered. You now pay less taxes which frees up more funds to reinvest in your company. For the rest who do not benefit as much from the change in tax rates, the government has other schemes in place to help you out. For example, the Protecting Americans from Tax Hikes Act of 2015’s Section 179 allows firms allows firms to expense, or deduct up to $500,000 of cost equipment, which includes off-the-shelf computer software. You will no longer have to keep track of depreciation of new investments.

Disclaimer: Please check with your tax advisors if you qualify for tax reductions and expensing benefits from Section 179.

The global economic landscape is ever-changing, and artificial intelligence has gone from novelty playthings to useful office tools that can save your company and employees precious time and money. Juniper researcher Lauren Foye mentioned that “providers using bots can expect average time savings of just over four minutes per enquiry, equating to average cost savings in the range of $0.50-$0.70 per interaction.”

Automated chat customer support services such as Botdesk allows you to easily create a FAQ chatbot that can be easily launched on your website in 5 minutes. Customer service robots are becoming increasingly popular with millenials and are incredibly affordable these days, and as the technology improves, one can expect the price to dip further.

As mentioned above, chatbots have the ability to engage multiple users at a time, providing faster response times. Happier customers are more likely to return, which generates more revenue for you!

Automation is an unstoppable force; taking the first industrial revolution as an example, automation of labor created jobs in maintenance and creation of machines. Likewise, you can encourage your employees to go back to school or take up courses to future-proof their skills and in turn, your company.

Hence the title of the post: you may not benefit much from tax cuts as a small business, but you can sure benefit from technology for visible improvements to your business and life.

More on pass-thru taxation

http://www.politico.com/agenda/story/2017/04/26/trump-small-business-tax-cut-rich-000430