Disclaimer: I do not have a lengthy track record as a successful trader. This is a personal challenge and meant for entertainment purposes only. If you do decide to actively trade in cryptocurrency then never use more than 1/10 of your overall stack. You will make mistakes and you will get hurt. However, if you can learn a profitable strategy before getting completely rekt then the initial investment will be irrelevant.

The price of Bitcoin has been rather stagnant over the past couple days and that could not be further from the case with the traditional markets. The S&P 500 has been breaking down through support and is threatening to create a new local low below $2,700.

Silver is breaking down through it’s major area of support. It has held above $15.60 for over two years and is currently threatening that level. Gold is making a similar move after breaking down the trend line that has held up the price since December of 2015 and US Oil (WTI) has mooned over 20% in the past week.

I have been positioning myself for the next crash since December of 2017 and am starting to sense the first tremors which lead me to believe that the tides are a turning. You might be wondering why Gold and Silver are pulling back at the same time as the S&P 500. It is an irrational response by emotional traders.

Let’s take a look at what happened in 2008.

Gold pulled back from $1,028 to $684 before taking off to to $1,922. The pullback started on 3-7-2008 and continued to 10-20-2008. As the stock market was crashing panic started to take over. People were afraid of having any exposure to the market and/or they needed cash right away to cover living expenses. Therefor they sold gold when it was clearly a time to buy.

In my last Gold Bubble Weekly Update post I made an important update after turning bearish. That is simply my short term outlook. I am viewing a ~ 6 month sell off in Gold occurring simultaneously with the S&P as the necessary final step before going to the moon.

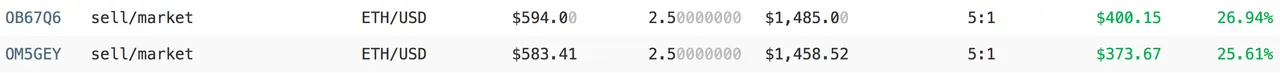

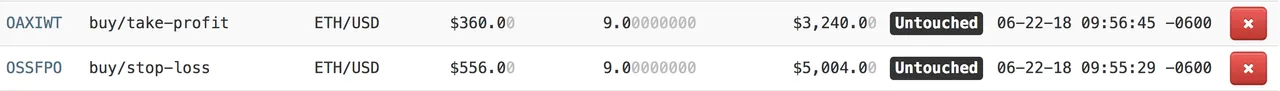

Open Positions

To read more about this position refer to day 100 of the 4 hour chart DAILY UPDATE.

Watchtower

These are trade ideas and/or open positions that I am keeping my eye on. They may or may not pan out the way I see. These are just ideas, I am not recommending them to anyone else.

(1) BTC:USD | Resistance Clusters

(2) ETH:BTC | Rekt

(3) LTC:BTC | High probability short at trend line

(4) S&P 500 | Support turning into resistance at $2,740 | Bearish cross on 12 and 26 period EMA’s on daily chart.

(5) Gold | Didn't bounce off $1,260 support. Next stop should be $1,236 | Not chasing short entry until we bounce.

(6) Silver | Breaking down long term support | Not chasing short entry until we bounce

Lifestyle

I feel like I have been finding a better balance in my life with each passing day. I am getting more efficient and confident in my daily tasks. I have been spending less and less time to make higher and higher quality posts. This has given me extra time at the end of the day which I have been using for social activities.

I played disc golf then went to a rooftop bar on Monday. Softball and then PBR’s and pizza followed yesterday. Tonight we have 6 tee times at the country club and will be gambling, drinking beer, smoking weed and listening to music.

Tomorrow I am taking the afternoon off to play more golf. Friday is still up in the air and then I am playing in a golf tournament on Saturday. As I spend more time living life and away from the charts I will have to be very careful that I don’t fall out of balance in the other direction.

I am fully positioned in my BTC and ETH shorts and now it is time to wait. Being glued to the computer while watching the 15 minute chart is not the best way to wait! Instead I prefer to set my stop losses, get out of the house and remind myself that this trade will not affect my lifestyle.

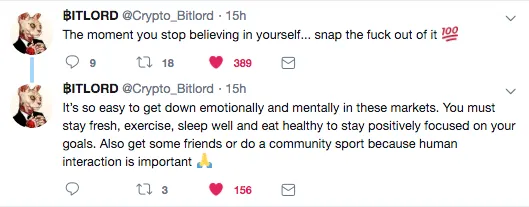

Tweet of the Day

Homework

Unfortunately the post about options and hedging has been delayed. I was in the process of posting it and ran into an issue. I will be doing my best to get this completed asap!

Thank you for your time! Have something to say? Leave a comment! Click follow so that you don't miss out on future updates. Remember that smashing the like and resteem are good karma!

After content like that, you know you want more!

Yesterday's Post - Day 108

4 Hour Chart DAILY UPDATE - Day 122

Weekly Gold Update - Week 15

School - Intermediate Trading Strategy | Gold Weekly Update (week 13) | White Paper Cliff Notes: AION | Intro to Indicators: Stochastic | Bitcoin Market Cycle

Need a break? Read some Poetry! - I believe | Aliens | The Universe is a Hologram | Sunset