Disclaimer: I do not have a lengthy track record as a successful trader. This is a personal challenge and meant for entertainment purposes only. If you do decide to actively trade in cryptocurrency then never use more than 1/10 of your overall stack. You will make mistakes and you will get hurt. However, if you can learn a profitable strategy before getting completely rekt then the initial investment will be irrelevant.

Yesterday I watched a presentation from Tyler Jenks which covered the ins and outs moving averages and consensio. I would highly recommend watching it! Here is the link for convenience.

He made a comment that really hit home with me. It went something along the lines of:

“It can be very dangerous to research Bitcoin and come to a strong conclusion one way or the other. When you do that you miss massive opportunities to profit from both sides of the market”

I am sure that he worded it more elegantly but that sums up the point being made. I know that I have fallen victim to this myself, otherwise I would have been much more profitable in this bear market.

Over the past couple months I have been trying my best to be as objective as possible. It doesn’t matter if the chart says SPX, XAU or BTC at the top, it needs to be analyzed objectively.

I am excited to see how much better I have gotten at this. I am a super bull on gold over the next 10 years and have been doing weekly updates which have been predicting the upcoming bubble. I turned bearish last week and have not wasted anytime in looking for a short sale entry (listed below under ‘Watchtower’).

Trading is about finding profitable bets and having the courage to execute. It shouldn't matter if that bet is a bullish position or a bearish one. If it does matter then that is a good indication of being too emotional.

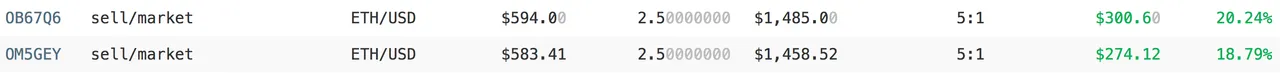

Open Positions

To read more about this position refer to day 100 of the 4 hour chart DAILY UPDATE.

Watchtower

These are trade ideas and/or open positions that I am keeping my eye on. They may or may not pan out the way I see. These are just ideas, I am not recommending them to anyone else.

(1) BTC:USD | New yearly low below $5,975

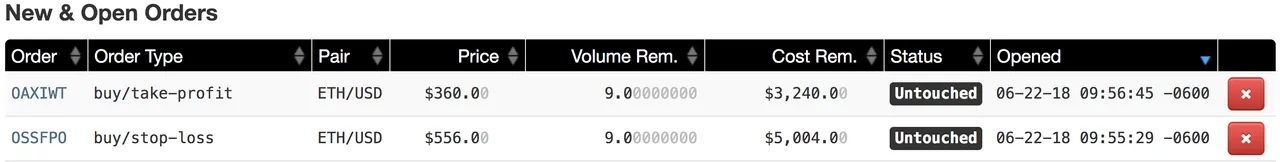

(2) LTC:USD | Yearly low breeched, approaching major levels of support ($49.50 - $66.75)

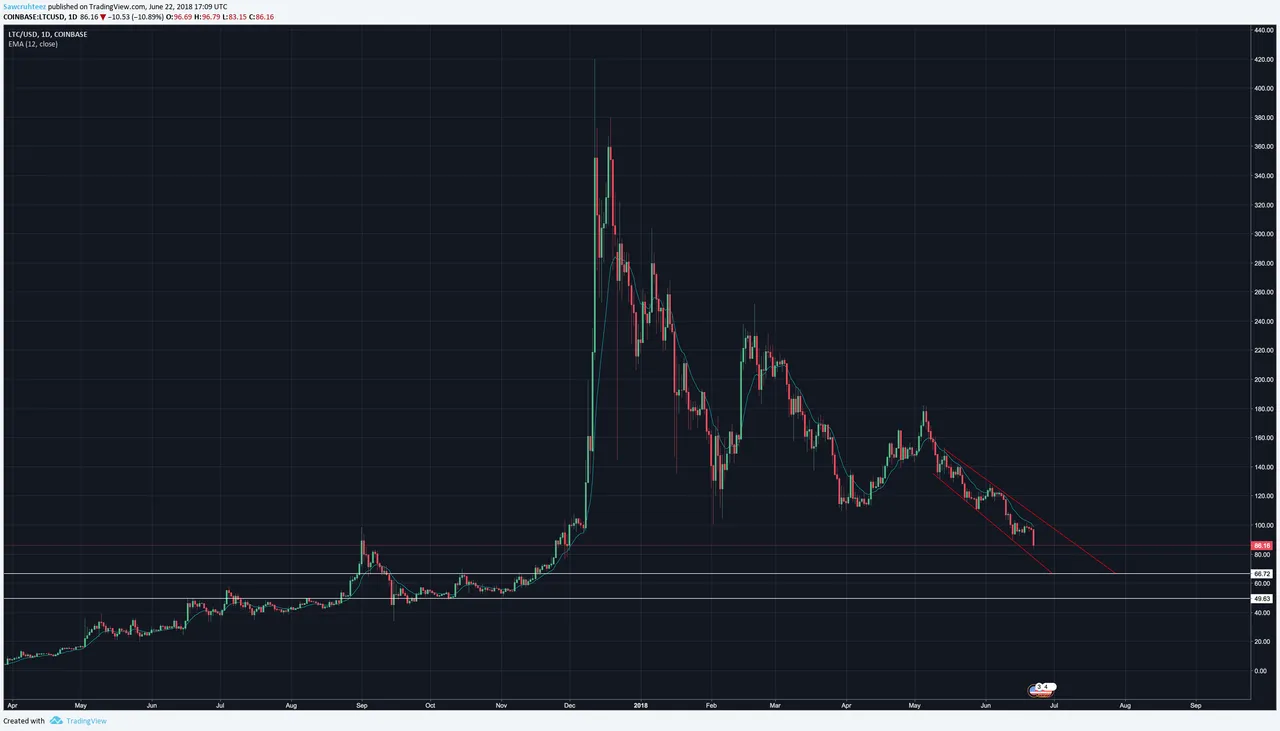

(3) ETH:USD | Inverted cup and handle | expect a second bounce off $350 support before confirming.

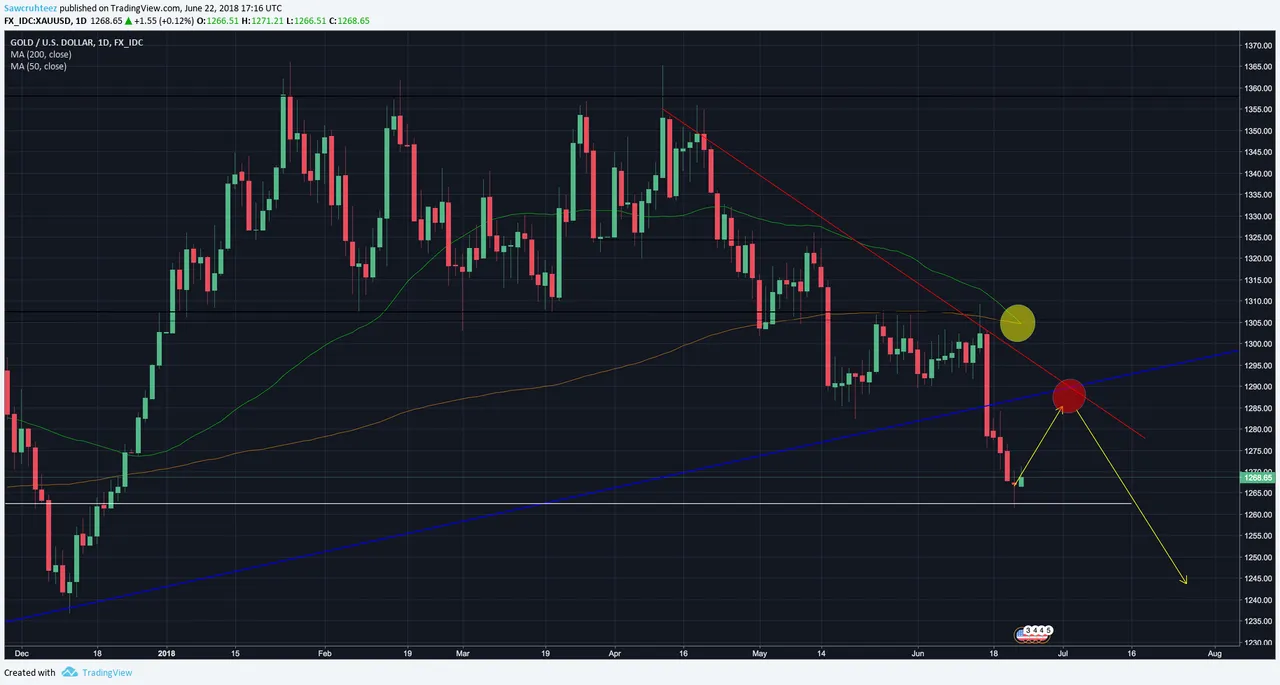

(4) XAU:USD | Short if price bounces into death cross and resistance cluster

(5) SPX:USD | Weekly 9 on TD Sequential | C Clamp on Daily

Lifestyle

I spoke with my best friend from high school on the phone yesterday and it really gave me some perspective about how much my life has changed in the past 6 months. There is always a voice telling me that I could be doing more and a chance to gain perspective is extremely valuable.

Changes in my lifestyle include:

Consistent exercise

Eating healthy, and cooking for myself

Quit nicotine (was smoking > 1 pack per day)

Quit Adderall (was taking > 10 mg per day)

Drinking much less

Smoking much less (marijuana)

Socializing regularly

The struggles with changing my habits have been well documented in this blog and it gives me tremendous pride to know that I have sustained all of the changes that I once dreamed of making. It is one thing to act differently for a day or a week. It is completely different to do it for 6+ months without letting the ups and downs of life cause a total relapse.

Tweet of the Day

@CryptoCore is one of my top 3 favorite traders. Highly recommend following him on Twitter and Trading View!

Homework

I am very excited about the upcoming article which will cover Options, Futures and Hedging! Imagine buying an insurance policy which would pay out when your crypto portfolio loses USD value...If you have a significant portion of your net worth invested in crypto then why wouldn’t you buy that policy? That is a put option and the premiums can be very reasonable!

Thank you for your time! Have a question? Leave a comment! Click follow so that you don't miss out on future updates. Remember that smashing the like and resteem are good karma!

After content like that, you know you want more!

Yesterday's Post - Day 103

4 Hour Chart DAILY UPDATE - Day 117

Weekly Gold Update - Week 15

School - Intermediate Trading Strategy | Gold Weekly Update (week 13) | White Paper Cliff Notes: AION | Intro to Indicators: Stochastic | Bitcoin Market Cycle

Need a break? Read some Poetry! - I believe | Aliens | The Universe is a Hologram | Sunset