INTRODUCTION

With the sudden rise in Bitcoin price today, it seems that Quickfinger Luc traders were overwhelmed with the many alerts that went off on different altcoin price drops. With relatively slow base trading in the past couple of weeks, this makes for a very busy day. A trader can be overwhelmed with the amount of choices of altcoins to trade and may even exhaust all their bitcoins buying up altcoins. Here I have outlined some trading tips during a BTC price rise.

1. Consider selling BTCs to your country’s currency and not take any trades

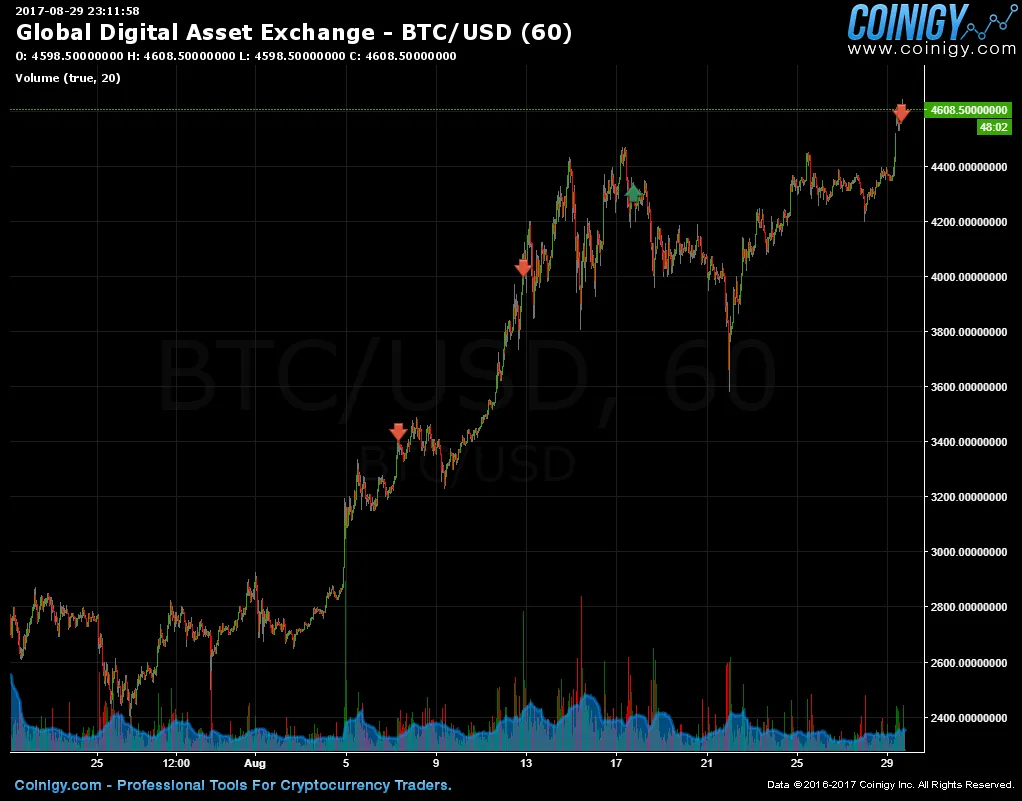

BTC/USD CHART IN REVERSE

If there was a USD/BTC chart, it would look like the one up top which is just the reverse of BTC/USD. The point is selling off your BTCs is like buying up USD, and a trader can use the same base trading method Luc teaches by simply reversing the BTC/USD chart.

In addition, traders can take the opportunity to go ahead and cash in any BTC profits earned from prior trades as BTC buyers are giving sellers a very good deal.

Pros to trading in cash: No volatility, good time to cash out to pay expenses, liquid (could be used to buy ETH for example).

Cons: Limited returns, boring (c’mon we are QuickFinger’s Luc traders)

2. Choose buying altcoins with big drops

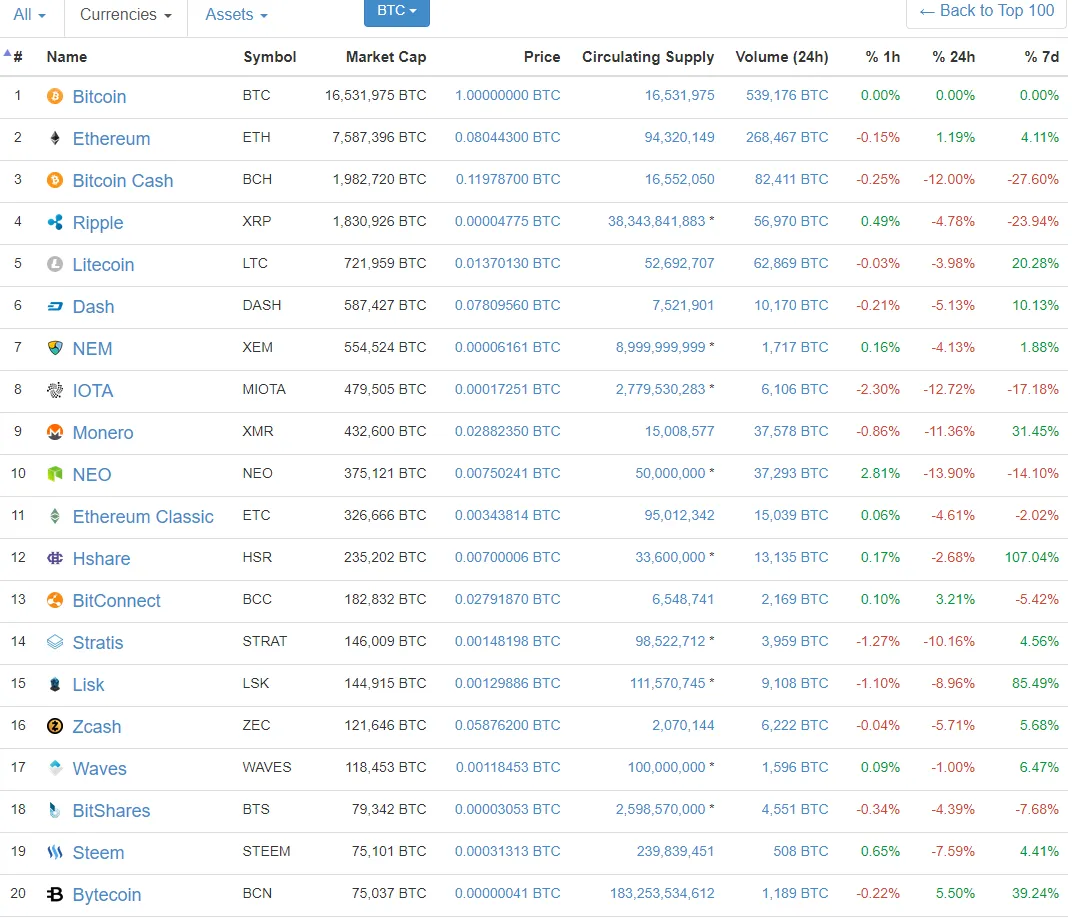

CRYPTOMARKET SCREEN

By choosing to buy altcoins with big drops, the returns will likely be bigger. Here from examining chart above courtesy of coinmarketcap.com, NEO and Monero(10+% drop) would be good coins to consider buying up while avoid Ripple and ZCash(5% or less). My typical aim is to get returns of at least 10% and buying when coins take a significant drop will present the greatest chance.

3. Choose altcoins with good history charts

ETH/BTC CHART

BURST/BTC CHART

This is a fundamental of Luc's trading method. Coins with good history charts will show constant quick returns back to base like Ethereum while an inconsistent return to base will keep you stuck holding the coin for a long time or maybe even lose money like BURST.

NOTE: *The above charts in this section are just examples and does not reflect if this coin should or should not be bought now during this BTC price hike.

4. Choose altcoins you’ve traded successfully in the past

Buy coins you have had success with in the past. You have a better understanding of the coin and it’s trading behavior. Also taking a position with a coin you’ve had success would make you feel comfortable. Make sure to get that coin at a cheap price.

Trades I Took

NEO/BTC

Reason: Safe trade to base with good return, dropped 14% (BTC value) in past day

NEOS/BTC

Reason: High success to return to base, familiar with coin, dropped 11% (BTC value) in past day

EDIT: I want to emphasize this is a "nibble" trade about half of my regular buy as the drop is only 3-4% from regular base. I wanted to get a little action as coin tends to spike 20%+ in next few days. If you are only familiar with Luc's base trading strategy, a new trader, or are not familiar with trading this coin, I would recommend buying 10% below base minimum.

ADT/ETH

Reason: Familiar with trading this coin.

*NOTE: Although this is ethereum chart, the coin is offering me a good deal.

EDIT: I don't use Luc's base trading strategy on this coin because of the low volume activity

BTC/USD

Reason: Pay bills

DISCLAIMER AND CREDIT

Nothing here is meant as financial advice. This is just a strategy that I'm using as a cryptocurrency day trader. Please seek a duly licensed professional for any financial advice. Never forget, cryptocurrency trading is extremely risky and never invest more than you can afford to lose!

I'd like to give a special thanks to Luc for his selfless contribution in teaching cryptocurrency trading. Please visit his blog at: https://steemit.com/@quickfingersluc

Thanks for visiting my blog and happy trading everyone. Let me know if there are any other tips you'd like to share from your experience, or some other thoughts.