The following is a timeline of actions on a trade I took and how I minimized loss upon finding bad news. The days of this event happened July 27th to July 28th 2017.

This isn’t advice on how to trade nor am I a certified trading professional. Please understand the risks associated when trading cryptocurrency.

10:14 PM: Alert triggered QRL coin has dropped more than 10%

Crypto Market Scanner shows sharp drop of 10% for QRL coin. Analyzing chart shows coin has hovered around 17500 to 19000 for the day. The drop was very sharp, so you have to act fast to get in around this range since this is a low volume coin. A buy order at 14100 was placed.

10:38 PM: Buy order fulfilled at 14100

Intending to sell between 16500 to 17500 for around 20% profit.

11:10 PM: QRL kept dropping past 10000, bounced up, and I bought more at 12000

The second drop was fast for a low volume coin and because the price drop was fast no buy orders of 10s and 11s were placed. However, a bounce happened back to 13, so at this point there was time to research any bad news on QRL coin, but I didn’t find anything in major news articles that threw any red flags. I proceeded to place a buy order around 12000 which order fulfilled shortly.

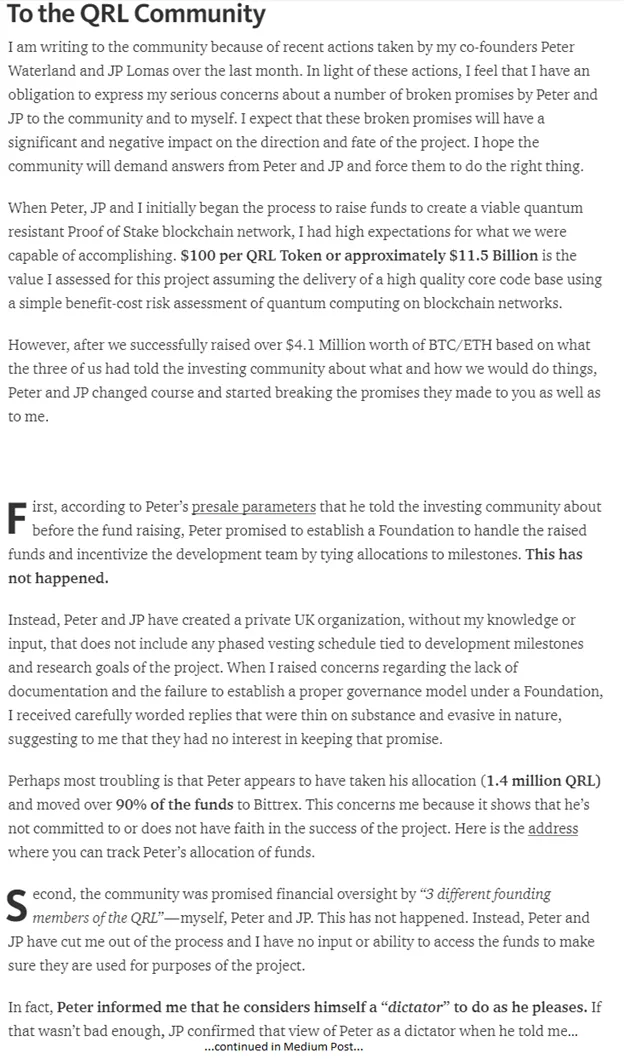

11:30: Price dropped below 7000 which is now more than a 60% drop within 1 hour. Reddit post explains drop

At this point, there is something wrong when price has dropped more than 60% in one hour. I decided not to buy anymore and figure out what’s going on before my next action. After researching a little deeper through social media platforms, I found a reddit post (shown below) was responsible for driving the price down.

https://www.reddit.com/r/QRL/comments/6q0oo0/a_message_to_the_qrl_community_from_jomari/

The same message can be found in twitter and bitcoin forums, but this information wasn't in any major news article.

Midnight 07/28: Decision time

After finding out about this bad news, I made the decision to get out of this trade FAST, but I wanted to minimize loss instead of making a fast sell. Back when I worked in the telecom field as an engineer, during unexpected circumstances such as server issues or major overloads we had to work throughout the night sometimes as much as 24 hours. As a professional, this would be very similar to the situation where you have to work overtime to put out a fire. I could have placed some sell orders and went straight to bed, but it was best to work through these trades at level 2 trading in order to minimize the loss. So I felt it was prudent to try to get these sells out on every bounce which needed to be monitored in real time to get out at the right time.

Midnight to 12 PM: Sell order completed, 100% out of the position, Minimized loss to 3.2%

All orders completed on each bounce. I couldn’t get a full order out on one bounce so I had to settle for partials throughout the night. I was hoping to sell at around 14000 to possibly break even, but reviewing the orders on Bittrex it seemed really ambitious to reach that high. My main priority was to SELL ON EVERY BOUNCE. After the final sell, I took a total loss of 3.2%. If instead I sold all my position at 11000 where most of the trading activity happened, I would have taken a big 15% loss.

Also, I did get sleep between 4 AM and 10 AM 😊

I would like to give a special thanks to Luc for teaching crypto trading. He explains how to minimize losses in his blogs and videos at https://steemit.com/@quickfingersluc.

Scanner tool is provided by nervisrek. He can be followed at https://steemit.com/@nervisrek. Thank you for such a valuable tool.

Let me know what you think and if there was anything I could do better, or maybe I acted to hastily saying this is a bad trade. All feedback is welcome as I’m still learning lots trading in cryptoland!

Thanks for visiting my blog and HAPPY TRADING.

Rob