Trader’s Dictionary — ELI5, Part 2

It’s time for another Trader’s Dictionary, written for you ELI5 style — or as close as I can get. We are talking about trading financial instruments here. I would be blown away by a five year old who could truly comprehend this stuff. Luckily, you’re not actually five, so you’ve got this.

For this post we will be focusing on five true basics that any trader needs to understand in order to even know what to do with their hands while on an exchange. These terms are — Order, Order Book, Market Order, Limit Order, Stop-loss Order.

1. Order

An order is an action taken by a trader to purchase or sell an asset from an exchange.

When executing a trade, the trader has two options. To buy or to sell. These two options are often alternatively referred to as placing bids or placing asks (or offers,) and entering a long or entering a short.

While in position, the trader can close their trade by placing a long order to close a short, or placing a short order to close a long.

On spot, this simply means buying and selling. You have some Ether, you want to buy some LEV. You place your bid for X amount of LEV at Y price of Ether. To sell that LEV back into Ether, you simply place your ask to sell X amount of LEV for Y amount of Ether.

In futures trading, such as an ETH/USD inverse futures contract, buying the contract would mean longing the contract as selling the contract would mean shorting. You would place a long order if you believe the price of Ethereum is going to go up against USD, or you would place a short order if you believe the price of Ethereum is going to go down against USD.

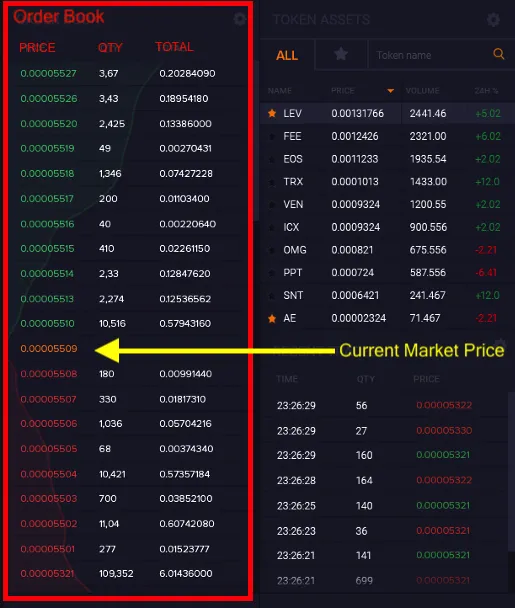

2. Order Book

An order book is a real-time list of buy and sell orders for a specific financial instrument, organized by price level. The order book lists the number of assets being bid or offered at each price point.

The order book is comprised of limit orders.

3. Limit order

A limit order is an action taken by a trader to execute a trade at a particular price that is preferable to the current market price.

Placing a limit order means that you have a price in mind of where you would like to buy or sell an asset. Say you are looking at the order book for ETH/USD at the top of a break-out. The price here is $800. You know you want to buy some ETH, but you don’t want to buy it yet as you know you will get a better price once the price has dipped a bit. So you set a limit buy for $760. This order will appear on the order book, but it will not get filled until the market price hits $760. This means that if you change your mind before the order is filled, you can cancel the order and retain your USD as you have not yet actually purchased any ETH.

The same can be done with a limit sell. You see the price of ETH at $800 and rising and you know it’s going to peak and correct soon. You have some ETH that you would like to take fiat profit on. But you want to make as much profit as you can, so you place your limit sell at $835. Once the market price reaches your order, you’re back in fiat.

Keep in mind these orders are also used for closing or exiting a position. You can place a limit order to buy at a price you believe your short will hit. When the order is hit, your position can be closed (entirely, if your buy order was for the full amount of your position — or partially, if you only want to close some of your position.) This works both ways, a long can be closed with a sell order.

4. Market order

A market order is the action of executing a trade immediately at the best available price, directly into the bids or offers of the order book.

This is the most simple way to buy or sell an asset. With a market order, there is no need to decide on a price target. You would simply enter in the amount of whatever asset it is that you want to buy or sell, then hit market order. When you market buy, you’re buying what is already sitting at the top of the order book (or the orders in the position closest to the current market price.) Your order is immediately filled. By market buying, you are buying into the existing offers on the book. Market selling executes right into the existing bids on the book.

5. Stop-loss order

Stop-loss orders are orders that execute the close of an open position when it reaches a particular level. These can be limit or market orders.

Say you’ve placed an order on an ETH/USD inverse futures contract that has opened you into a long position at $790. To minimize your risk exposure, you may want to start by placing a stop-loss order at $780, so if the price moves against you, you will be stopped out only $10 below your entry. This way, if the price continues to fall, your losses are minimized. Now, if the price rises to $810 and your trade moves into profit, you might want to start moving your stop-loss order up, starting with $800. At $840, you might want to keep moving that stop up, say to $830. Moving your stop-loss order up above your entry price as the market continues to rise ensures that if the trade reverses, you will be stopped out in profit.

There are several different types of stop orders, and they can be used not just to close a position, but to open one as well. We can look into these other order types in the next Trader’s Dictionary post.

Follow for further Trader’s Dictionary — ELI5 posts

Missed the last one? No worries — check it out here: Trader’s Dictionary — ELI5, Part 1

Want to learn more?

Check out the website

Read our white paper

Study our protocol

Follow us on Twitter

Join our Telegram group