"Alpha" is the difference between how your portfolio grows or shrinks with respect to overall market. If you have positive and big alpha that means, however the market moves you should be on the plus side.

For example if you "know" that blockchain will be big, and some projects will certainly do better than the others, you can buy the better ones and sell the bad ones. The difference will be your gain. To learn more about hedging Khan's Academy has good videos about hedge funds. I recommend them.

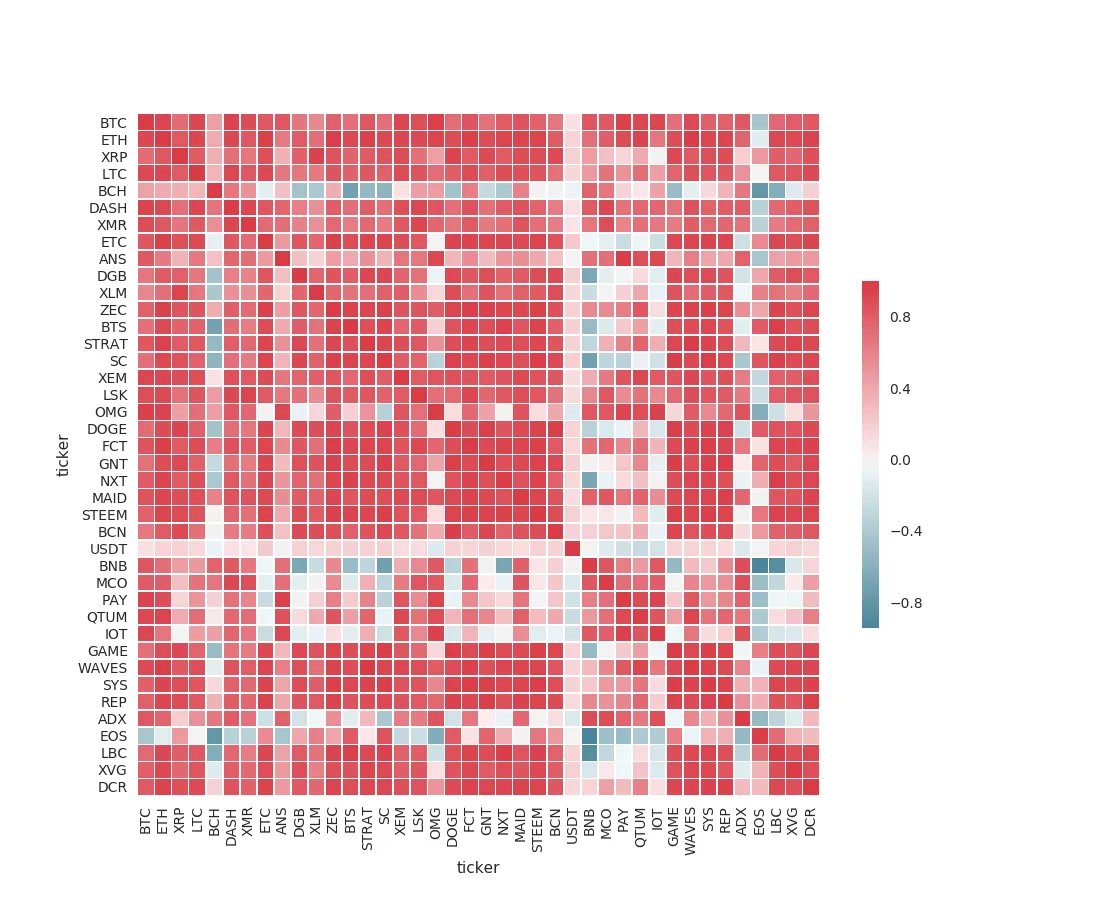

I collected prices in 5 minute intervals for 300 coins, and got the history in between Jan 1st and Aug 31st, 2017. So this doesn't include the Chinese FUD. When a price is not available the tool (in Python) disregarded and didn't count that price in calculations. The correlation type is Pearson.

After calculating the correlations, for the sake of simplicity I selected and showed here 40 coins with most volume traded on exchanges.

Link to better resolution: http://imgur.com/a/aYraw

White belt (USDT) has almost no relation to others. Mixed red-green belts are "independent" coins.

Mean correlations:

Disregarding USDT which is uncorrelated by design, we have BCH, EOS and BNB on top.

Coin, Mean correlation to overall market

BCH 0.102151

EOS 0.107354

USDT 0.112928

BNB 0.234794

IOT 0.322519

ADX 0.358795

MCO 0.407021

PAY 0.420214

OMG 0.496051

ANS 0.520597

QTUM 0.537294

XLM 0.565048

DGB 0.580644

LBC 0.601964

SC 0.604193

BTS 0.635785

NXT 0.640968

XVG 0.642369

DOGE 0.650372

ETC 0.660522

GAME 0.660655

BCN 0.667741

XMR 0.691249

XRP 0.692115

GNT 0.692524

STEEM 0.698942

STRAT 0.718324

LSK 0.737653

LTC 0.739248

DCR 0.742341

DASH 0.749734

SYS 0.760158

BTC 0.763944

XEM 0.764458

REP 0.777097

WAVES 0.788526

ZEC 0.792942

FCT 0.805125

MAID 0.810819

ETH 0.828468

We can say the coins on top have their own way of moving in the markets. Or if sometimes they move in the opposite direction to others, the correlation value gets lower and lower. If the coin is moving as everybody else, the value gets higher. Interestingly ETH moves very similar to whole market. Possibly because all the tokens are related to it.

We know that BCH is THE alternative to bitcoin, so no surprise there. Since BTC has high correlation, alternative of it must have low correlation.

Interestingly EOS came second. Why do you think is this the case? STEEM and BTS are not even close. My opinion is a lot of tokens are in ETH and EOS is the alternative of ETH, hence it has one of the lowest correlations.