It is always hilarious (or nerve-wracking if you are an options trader) watching the price action on a quadruple witching day. In commodities like gold, which also have their futures contract rollover on the same day, it can lead to some impressive movement. Often you see a main strike price act like a magnet that pulls price right to that level.

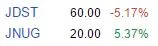

Today, we saw the triple leveraged junior mining ETFs end on exactly the ten dollar mark (to the cent!) meaning that call options (betting the price would go higher than a certain amount) as well as put options (betting the price would go lower than a certain amount) both expire worthless. It is always worth noting the open interest in both calls and puts and around what strike price the revolve near the expiration so that you can be aware of what direction the price will likely move towards by the end of the day.

Happy trading everyone, and good luck!

*Note: Options trades are significantly higher risk and prices can fluctuate with much volatility, especially in the triple leveraged junior gold mining stock ETFs I mentioned. I do NOT recommend trading such volatile options, especially if you are inexperienced in trading.