Do you want to become a cryptocurrency investor? There are many ways to get involved with the cryptosphere, but becoming an investor in this space is as easy as contributing to the first project by buying its altcoin.

How to decide which altcoin fits your investment needs, how can you actually buy and store the tokens, and prepare yourself with a strong investment strategy? Here’s your detailed guide with necessary tools and instruments referenced

There’re many ways for you to decide if an altcoin is a good investment or not, but there’s only one way you can conduct thorough research without spending a lifetime trying to analyze them all. Did you know that there are over 1,000 altcoins available right now? You better get started!

What is the secret formula for finding the winners in this sea of opportunity?

There is none.

If you’re willing to put in the work to place your investment in the best position for victory, you better do it in the most efficient way possible. First, in order to understand come key principles that you should follow, you need to understand why you want to invest in cryptocurrencies in the first place.

In order to provide you with the most accurate information, we invited an expert in cryptocurrency trading to answer your question:

Rebecca Mora, Cryptocurrency Trader, is an autodidactic student of Macroeconomics, Austrian Economics, and Cryptocurrency Trading. She has a deep passion in Bitcoin and alternative cryptocurrencies.

Do you want to expand your knowledge and evolve from an inexperienced trader to a full-time cryptocurrency trader? Rebecca Mora guides you with her Cryptocurrency Trading course on how to understand the fundamentals, avoid getting scammed, and how to grow in trading confidence by watching live examples!

Cryptocurrency Trading: Complete Guide To Trading Altcoins

How do you start making money?

Do you know what kind of money you want to make?

“Over the summer, the whole market was down in general, but I was actually able to make good money in the first month where the entire market went from $40 billion to $100 billion. I was able to make 5 times the profit.” Rebecca Mora

Why cryptocurrencies?

First of all, have you made your decision to invest in cryptocurrencies? If not, here are 3 reasons that will convince you to take this step right away:

Hedging your net-worth against the probability of the dollar to fall (many people assume that sometimes it’ll inevitably happen).

Supporting the cryptocurrencies’ vision of freeing the world from banking systems controlled by governments.

Believing in a better future for technology (Who doesn’t, right?).

With these reasons fueling your motivation, you’re already on the path to success. You should never get involved with cryptocurrencies because of FOMO (Fear Of Missing Out), trying to make a quick buck, or investing in things that you don’t understand. But I guess this doesn’t apply to you if you’re already here, reading and learning.

What’s your strategy?

There are two things you have in your control: how much money are you willing to invest and for how long you want to keep them in. Based on your capital you want invested in cryptocurrencies, you have different options available for you:

A small investment ($100 – $5000)

An average investment ($5000 – $100,000)

A large investment ($100,000 – $1,000,000)

With anything more than $1,000,000, you are already an accredited investor, and your strategy should be treated in a more diversified manner inside the crypto-space.

How does your starting capital influence your investing options?

Risk increases exponentially with value, but also with profits. From 5 times on a small investment to 10 times for a big one. No one who has a few months in cryptocurrency trading under their belt will speak about a less than 100% increase in their portfolio. That is just to give you a taste of how profitable trading is in the cryptosphere.

This leads to the following question: When do you want to cash in your 2x, 5x, 10x profits?

Short-term (hours to days)

Mid-term (weeks to months)

Long-term (6 months to years)

How the amount invested is increasing your profits, the duration is doing the same thing. If you’re willing to invest for a longer period of time, you’re decreasing your risk and increasing your profits because you’ll be able to choose safer options with slow, but steady growth, like the following examples showing their percentage increase from 2017: Ethereum (2,000%), Ripple (1800%), and Litecoin (1400%).

What’s the real risk?

Chasing big profits in a short period of time can lead you to losing all of your money in just a few transactions. These schemes are called PnDs (Pump and Dump), and they work as follows:

You see sudden increase in price due to someone driving prices up (that’s the pump).

It then goes down no more than 50% of how much it pumped (there’s the dump).

If you are not that “someone” who invested prior to this movement and sold at the first peak, you’re losing money (2x, 5x, 10x). It would be illegal in a trading market but cryptomarkets are free markets, yet to be regulated.

Does this scares you? Here’s the decision maker: pump’n’dumpers need to target coins with a low market cap and reduced trading volume in order to be able to manipulate the market with fairly small amounts of money.

How can you choose the right altcoin for your investment needs?

That’s the question you should ask yourself. You shouldn’t be chasing the most popular altcoin, the cheapest one, or even the newest one. The popularity is relevant only if you have bought way earlier and you’re now enjoying the rise generated by newcomers (don’t be that newcomer yourself).

What are tools you should be using?

Don’t forget about the best feature of blockchains: It’s verifiable. Everything is open for anyone to easily audit and verify it. And because you may or may not be technical enough to check every blockchain directly (plus, doing the math can be a real time-consuming chore), there are websites and online tools that provide the data in real time.

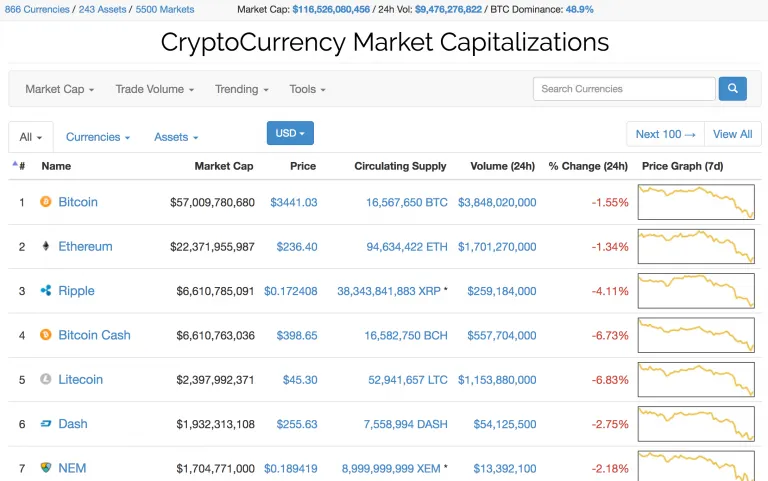

CoinMarketCap for related resources.

Digrate for rating markets.

TradingView for technical analysis.

Coingecko for price tracking.

Cryptocompare for portfolio tracking.

Why is the market priced in Bitcoin?

Simply because Bitcoin is considered the blue-chip of the cryptomarket (a stock that has a market cap in the billions, is the market leader in its sector and a household name).

Being able to accurately speculate Bitcoin’s price can help you successfully trade altcoins in relation to it. But remember, this is only ONE factor influencing their fluctuations.

Take Ethereum for example. When it reached its all time high this year, everyone was speculating that it will take over the market (take Bitcoin’s price). So when Bitcoin was going down, investors were moving their investments to Ethereum. This made its price always act in opposition to Bitcoin. Months in, Bitcoin maintained its supremacy, stole the spotlight because of all the SegWit drama, and as a result Ethereum’s price moves up and down in correlation with Bitcoin’s.

What market indexes should you follow?

People who are interested in cryptocurrency actively use stats on coinmarketcap and other resources to calculate the gross market value without an inclusion of dead or scam currencies. There are cryptocurrency indices as well, like DRI Index, Bit20, Composition, CRyptoIndeX, and CAMCrypto30.

The DRI Index, formed by Digital Assets Rating Agency DigRate, calculates not only the arithmetical capitalization value and market dynamics accordingly, but it also successfully excludes dead wallets and scam coins. In this way, the data provided on coins who have the liquidity to the users follow a clear set of rules:

Are traded on the top 10 exchanges.

Have a turnover of no less than $30 million.

Have a daily turnover of no less than $50 thousand.

Besides that, it is very convenient to examine the dynamics of market capitalization in different dimensions. There are more than a thousand coins on the market. Monitoring a coin’s position in the DigRate Index will protect investors from swindlers and adventurers.

You can stay in touch with the DRI Index on Digrate right now.

How is the news affecting the price?

This leads to another factor: the news! Prices are highly influenced by the news. Keep in mind that the news itself doesn’t really need to always be related to altcoin or even in cryptocurrency in general. Analyzing the recent news of China banning ICOs, coins related to projects based in China, like Neo, were affected by the news cycle. One good example is PAY, the token used by TenX project, which is based in Singapore. Somehow, the FUD (Fear, Uncertainty, and Doubt) affected its price heavily. The development process of their projects wasn’t affected in any way by the new Chinese laws, but if you bend the logic in some way, you can interpret people’s reaction based on Singapore’s geographical proximity to China and the lack of knowledge in some parts of the world about the relationship between Singapore and China.

“I think you should be very careful in a very volatile market. When China was banning the ICOs, everything was in red. So it’s just a matter of knowing that if you are an investor it’s going to be great, but if you are a trader like me you should always be aware of the immediate dangers that are involved within the market.” Rebecca Mora

The news isn’t always as straightforward as you want it to be, but you definitely can’t ignore that factor because your investment is directly influenced by it.

Reliable news sources:

CoinDesk: an independent publication covering the news and market analysis.

Cointelegraph: an independent publication offering the latest news, prices, and breakthroughs.

Bitcoinist: blockchain industry news, reviews, and education.

CryptoInsider: a dedicated cryptocurrency development and consultancy group.

CryptocoinsNews: provides breaking cryptocurrency news, blockchain technology, and smart contracts.

And the news isn’t always coming from related resources or even true facts (Remember fake news?). Being part of such an early market with such a small community, the news can grow rapidly on social networks and forums with just a few shares. Ethereum’s price was driven down by almost $100 when someone posted on 4chan that Vitalik Buterin (Ethereum’s founder) died in a car accident. How crazy is that?

The market is always changing. You need to assure your success by staying in touch with the relevant information, and by making the right interpretation. The signals will be there long before the market will make its move.

At what price should you buy?

Besides its market relationship and the current news cycle, you can interpret the price in other ways. How does it relate to its past price? It can be at an all-time high value. This is the biggest risk you can assume when buying. From here, the price can go in two ways:

It can continue going up until it finds its value (this happens when the product is launched, an important milestone is reached, or an unexpected partnership is announced).

OR the buying volume is exhausted and it’ll go back down to a correction (the price was pushed up by hype and momentum higher than its real value). Usually, traders look for this target price to cash in their profits because they may or may not care about the project’s development and once a few big sales happen, the price faces a larger pullback.

You can avoid this uncertainty by trying to figure out the real price yourself. It takes some imagination and a few calculations, but if you can get a good prediction, it can save you some serious money.

How do you calculate its future price?

You can do this by interpreting the market cap in relation with other coins on the market. In order for Ethereum to reach $500, the market cap needs to be $47bn. How likely is it that this will happen? Bitcoin’s current market cap is $70bn. Ethereum is in direct competition with Bitcoin, so it is not unlikely that it could reach $70bn.

Possible Price * Circulating Supply = Market Cap (Is this Market Cap plausible?)

how to analyze an altcoin

In order to be able to make an accurate analysis, you need to understand the project you are about to invest in by buying its tokens. How you can do that in the most efficient way is shown just by answering the questions below. Use it as a template, a step-by-step guide, or simply as a checklist that you need to go through when you want to determine the value of a specific token. Each question comes with guidance tips and suggested places. By having this information at your disposal, you are already steps ahead of most investors who blindly follow rumors and outdated news.

“Good technology (technology that’s not a complete rip off of another coin).

A community which is easy to interact with.

A development team which frequently answers questions.

What do you need to understand?

- What problems are they solving?

Where’s the need for this product or service? Why does this exist? If these questions have a simple answer, it has a good reason to be here.

Where to look: analyze what got you here and why anyone should be interested.

- What’s the proposed solution?

Explain it to yourself in one sentence. You can even try the template: “Do X and get Y without [the problem found above].” Is this the most straightforward method to solve it?

Where to look: the website, the whitepaper.

- Who’s the target market?

If you’re interested in the project, you may be in the target market. You should define the people like you that would become customers for the proposed product or service. Is the market large enough for this product to exist?

Where to look: look in the whitepaper if it is defined. If not, you should try to define who needs this product yourself.

- What’s the competition?

Who will try (or is currently trying) to get a share of that market? It doesn’t necessarily mean that product needs to use the blockchain. Any product or service that is solving the problem for potential customers is competition.

Where to look: look in the whitepaper who they are considering competition, then search for similar services and try to find a solution.

- Who’s on the team?

You need to find out if they can really bring the idea to life, right? Research each team member for past experience, recommendations, and rumors. You never know what you could find, but always be sure to go deep enough to get the whole picture.

Where to look: website or whitepaper, their Linkedin profiles, or do an internet search to see if they appeared in any publications or interviews.

- How are they running the business?

This one is harder to find out, but it is well worth the time. You need to understand where their focus is. Are the developers trying to build or launch their first product? Have they hired PR managers and bought billboard ads? Or are they entrepreneurs hustling their way into cryptospace? Figure out what their strategy is from their actions.

Where to look: try to get the bigger picture by looking at the whitepaper, roadmap, and interaction with the community.

- Would you use the product?

It’s a simple question. Even if you don’t have the problem. Would you use the product? Try to go deeper and think about why. Why would you use this product? What convinced you that this is a better product than that of their competition?

Where to look: find out what you liked about the product (it can be the interface, the novelty, the ease of use).

- Will the product remain relevant in 3 years?

You can’t know for sure, but you can guess. How obsolete is the technology or the methods they’re using? Even if they’re using a blockchain and you are SURE that this is the way of doing it in the future, ask yourself: Will people still want to do this in 3 years? The field may become obsolete by then.

Where to look: find out what experts believe the future might hold.

- Is it related to something you do or something you like?

This is a tricky question aimed to identify if you are betting on this project because you are emotionally invested, or if you’re analyzing it from a rational perspective. If you are indeed biased, it doesn’t necessarily mean it’s a bad thing, but you should realize that and try to eliminate your emotional biases during the research process.

Where to look: examine the things you’re doing every day, the things you like, and the things that kept you busy. Are any of them related to this project?

- Does something appear to be sketchy, or off?

Does anything appear abnormal or “sketchy?” Try to think of how it will affect a potential buyer’s decision. You did your research, and you found that it has a simple explanation. But every newcomer on the edge of deciding to buy or not won’t have that information, and most of them won’t even attempt to get it. They will just leave because of their first impressions.

Where to look: what raised a question mark for you when you first got into this project?

Here are the 10 questions whose answers will cover for you the main information you need to make a proper analysis of any project.

Should you invest or not?

If you’re still not sure about your decision, you can ask yourself these questions that will certainly bring together any doubt your prior research didn’t reveal already.

Let’s wrap this all together:

Does it fit your strategy?

Is its current price around what you’re willing to pay?

Can it answer all 10 questions?

Not sure about it? Maybe you should look at other projects first before making your final decision.

Do you have your confident YES? Let’s find out what your investment options are and how to buy the tokens, keep them safe, and how to cash out your profits (how to spend them will be your toughest choice!).

How to invest in altcoin

Like in the stock market, you need to use a public exchange to buy tokens from available sellers. But these are not just normal exchanges, where you send your money in and start trading. These are cryptoexchanges. You need to have cryptocurrency in order to get started.

Let’s say you want to invest in the NewEconomyMovement project (a Smart Asset blockchain). Their tokens are called XEM on the exchanges.

According to coinmarketcap, it is available on Bittrex. That means that you can use that as the exchange (or any other exchange that it may be listed on).

On Bittrex, you find that you can trade BTC (Bitcoin), or ETH (Ethereum), for XEM. The flow is:

Buy BTC or ETH.

Send them via Bittrex.

Trade your BTC/ETH for XEM.

Take your XEM from Bittrex.

Done! But how can you do all of these?

I’m willing to walk you through all of the formal steps that you need to follow in order to choose the most reliable services, to be sure that you won’t lose your money, and to get you the lowest fees (In order to make more many you need to spend less, right?).

Where to buy Bitcoin or Ethereum

Which one should you choose? XEM is a great example because it can be traded with both of them. But most of the available altcoins are paired only with BTC, but some can be traded with ETH too. There are also small number of cryptocurrencies can be bought directly with fiat currency (regular old money).

Coinbase is an online platform for buying, selling, transferring, and storing digital currency.

Cex.io buys and sells Bitcoin for USD or Euros with payment cards or bank transfers.

Coinmama buys digital currency with your credit card or cash.

LocalBitcoins facilitates over-the-counter trading of local currency for bitcoins.

How to make your first cryptocurrency transaction

The transaction process is rather easy. You need to validate your identity like any other services that offer monetary services.

You can do this by providing:

The required personal information.

A photo or scan of your ID/Passport/Legal documentation.

And proof of residency(a recent utility bill or a bank statement in your name).

I should warn you that the validation process can take anywhere from days to weeks, depending on their customer volume.

Once you’re validated (you’ll be notified through email), you are ready to buy your first cryptocurrency: Bitcoin.

How to join a cryptocurrency exchange

Follow the same process for choosing and getting an account on a cryptoexchange that listed the altcoin. You can find the list of exchanges on coinmarketcap. Look for any geographical restrictions and fees, and start the validation process right away (this could take a few days).

Bittrex is one of the largest crypto-to-crypto exchanges, offering a large number of trading pairs into bitcoin.

Poloniex is a digital asset exchange offering maximum security and advanced trading features.

GDAX is a digital asset exchange offering an easy way to deposit funds with a Coinbase wallet, bank transfer, wire transfer, or digital currency.