Toys "R" Us recently became the latest victim of the "death of retail." The once-iconic toy store filed for bankruptcy after years of falling sales. As the Wall Street Journal reported this morning...

WALL STREET JOURNAL excerpt below:

Toys 'R' Us Inc., the rainbow-colored toy emporium that for decades was the go-to spot for birthday and holiday gifts, filed for chapter 11 bankruptcy protection late Monday night, undone by a hefty debt load and the rapid shift to online shopping...

The filing in U.S. Bankruptcy Court for the Eastern District of Virginia was triggered by vendors and suppliers tightening terms with the company ahead of the key holiday selling season, which accounted for 40% of its $11.5 billion in revenue last year. For the past several years, the company has lost money in each quarter except its holiday quarter.

"None of the suppliers want this company to disappear, but they have a fiduciary responsibility to their own shareholders," said a person familiar with the situation.

End of WSJ excerpt

Toys "R" Us is a 68-year-old, privately held toy-store chain. If you don't have young children, you probably haven't been in one lately... But Toys "R" Us' problem is that even if you do have young children, you probably haven't been in one lately, either.

Many observers think that the entire concept of a "toys-only" retailer is going away. The investment community considers the company to be in "terminal decline" – which is a fancy way of saying its business model is doomed. Revenues are down 15% since 2011. Margins have slipped significantly. Stores are closing at a rapid pace.

The death knell for toy stores probably sounded back in 1998 – the first year Wal-Mart sold more toys than Toys "R" Us. The Internet only compounded the problem by introducing yet another low-cost channel of competitors.

Most kids born in 2016 will never shop in a toy store. Toys "R" Us management knows this and is bolstering the company's online presence. But the company still generates most of its income from 1,600 sprawling retail stores and the legions of employees who staff them.

But Toys 'R' Us isn't just a troubled retailer...

It was also one of the most heavily indebted companies in the U.S. The company had more than $1.5 billion in debt set to mature this year and next... just in front of a virtual tsunami of additional junk-rated debt maturing over the next five years. More from that WSJ issue...

WSJ Except Below:

Management and investors know the company is in trouble. And so, Toys "R" Us is wisely not waiting until its $1.6 billion in outstanding bonds mature in 2017 and 2018. It's trying to refinance that debt now...

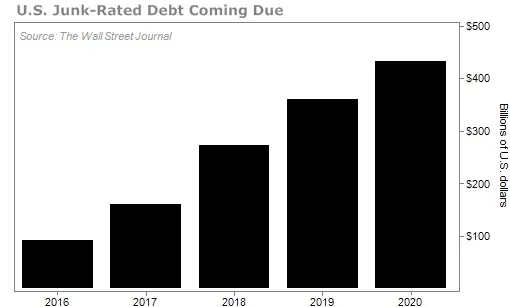

Be wary of companies and bonds – especially junk bonds – trying to roll over debt from 2018 to 2020... The market may be frozen by then. This chart, based on one the Wall Street Journal published with data from Standard & Poor's ratings agency, tells the story.

( )

)

Between now and 2020, $1.32 trillion of junk debt is expected to come due. Most of that matures toward the end of the five-year period. So Toys "R" Us wants to cut to the front of that line.

That's why we called Toys "R" Us – with its "junk" rating and its obsolete business model – the most important company in the U.S. economy.

...

The entire bond market – which dwarfs the stock market – is watching Toys "R" Us. Wilbur Ross, the billionaire Wall Street icon, recently told cable network CNBC:

Refinancing is the real issue because you have a wall of maturities starting 2018, building up through 2021 to 2022... but [this wall of maturities] really reflects in the market a year or so earlier... so it's really a 2017 issue.

Ross is right. The real action will come in 2017. But Toys "R" Us can't afford to wait. It is the first brick in Ross' "wall of maturities." Will it be able to refinance? How onerous will the terms be? Do investors have an appetite for high-yielding bonds of dubious companies? We're about to find out. The answers will provide insight into just how bad the next credit crunch is going to be.

End of WSJ excerpt

In other words, they believed Toys "R" Us was something of a "canary in the coalmine" for the broad credit markets.

You see, on the surface at least, the current credit environment is far more positive than it was when they wrote those words.

Yet despite a massive rebound in corporate bonds over the past 18 months – with junk-bond yields returning to near-record lows – Toys "R" Us was still unable to refinance this debt.

This is bad omen for the broad credit markets... and a terrible sign for other junk-rated companies that need to refinance more than $1 trillion of debt over the next five years.