HyperQuant is a professional platform for automated crypto trading, asset management and dApps creation that is based on the forefront AI, Risk Management, Blockchain innovations and Fast Order Delivery protocol. It is made by professional quant traders who know capital management industry back to front. All market participants from minor crypto financial specialists to professional capital managers, VCs and hedge-funds will have access to a broad variety of smart arrangements covering all aspects of crypto venture and crypto trading forms.

Hyper Fast

We have built up the Fast Order Delivery protocol for the platform. It works several times faster than similar arrangements and gives the upper hand on the market. We are building relations with the exchanges, which allows us to get server colocation. That helps algorithms in our framework to trade considerably faster.

Hyper Smart

All the parts of the platform are managed by an AI that self-teaches with the accumulated data. We are also joining the exchanges into the Electronic Communication Network (ECN), inside which the AI will have the capacity to automatically convey the trade deals.

Hyper Secure

The automated hazard management framework limits the dangers. Trade hashes are built into the blockchain for the transparency.

Utilize CASES

B2B Use Cases

Market Making: the administration allowing to increase token liquidity.

Hedge-fund Software : the software allowing to start your own crypto-cash hedge-fund in a matter of minutes.

Quantitative framework and SDKOur library of Algorithms and strategies allows you to create absolutely any imaginable strategy.

B2C Use Cases

Robo advisor based on smart trading botsGet top-performing crypto trading bots created by the most effective quant traders in the market

Shrewd telegram bot

Join utilizing your personal telegram account.

Top off the study to characterize your hazard profile

Get trade signals based on your hazard profile

Trading-Mining software

Start the easy to use application

Connnect to "trans-charge mining" exchange

Start the program! It makes purchase/offer orders in this way getting tokens in exchange of commission.

HyperQuant Platform Architecture

Application Layer

Suppliers advanced services that enhance the functionality of the platform.

AI Layer

Analyzes all components of the platform and completely automates Data Interchange.

Center Layer

Incorporates all functionality for creating and conveying decentralized automated speculation arrangements.

Ethereum Blockchain

Gives the smart contract mechanism.

How Do HyperQuant Work?

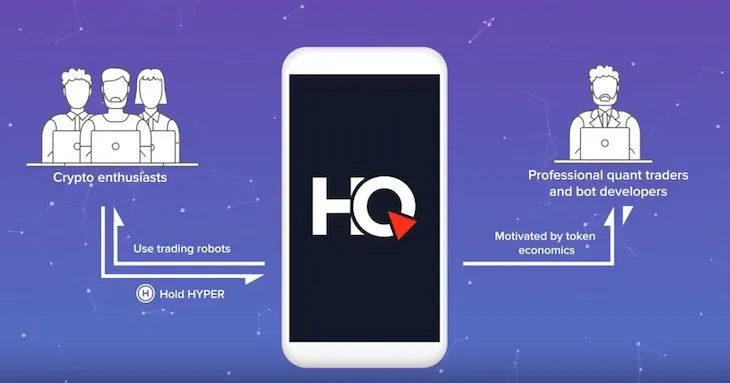

HyperQuant's plan of action is based on an innovative approach that figures out what's important and necessary for clients. The idea of this plan of action depends on recognizing high benefit zones, deciding techniques for gaining market share and guaranteeing its security from rivals. HyperQuant biological community creates an architecture that makes it conceivable to transform pioneer innovation into actual monetary value. Services created in the HyperQuant biological system have great potential for growth.HyperQuant utilizes trading robots to finish trading operations on financial markets with an arrangement of algorithms. Trading with the assistance of an algorithmic framework has several advantages: to make choices at maximum speed and to finish trade tasks at speeds that are not available to humans, automatically handling market data and generating trade signals, and trading signal preparing accuracy allows to avoid mistakes by demand settings market.

Trading robots work entirely as per established algorithms and finish trading operations without feeling and can manage several thousand securities simultaneously. Cryptocurrency traders and token holders are vulnerable to feelings that lead to irrational choices. Trade strategies apply in any market, with any assets and at any time. Algorithms are carefully written and have no danger of making the wrong choice because of uncertainty, anger, fear, and dissatisfaction. The basis of the algorithm is in the class division of strategy.

Trading strategies and models have several classifications :

Pattern Following Strategy:

The main goal of this strategy is to discover favorable rates for finishing trading operations with the aim of maintaining a profitable position in the longest timeframe. Strategies take after the pattern of attempting to capture the gigantic fluctuations of financial instruments. A pattern based strategy based on technical indicators is the most popular strategy. Technical indicators are capacities based on the values of indicators of statistical exchange, for example, costs of traded instruments. The tenets of opening and shutting positions in this strategy are shaped by the derivation of indicators and comparative values calculated between themselves as well as the market value.

The Counter-Trend Strategy:

is a strategy based on the expectations of significant value developments and resulting positions opening the other way. The assumption is that the cost will come back to its average value. The counter-slant strategy is regularly attractive for trading because the goal is to purchase at the most reduced cost and offer at the most elevated cost.

Pattern Recognition Strategy:

The motivation behind this strategy is to classify questions in various categories. Image acknowledgment tasks in conveying new, recognizable items to particular classes. Such strategies utilize neural systems as the basis for education and are generally utilized for the acknowledgment of candlestick patterns. The candlestick pattern is a particular combination of candlesticks. There are many candlestick models and assumptions about constant or invert value developments happening based on the appearance of candlestick models. These assumptions are a strategy based on the presentation of technical analysis.

Arbitrage Strategy:

There are diverse kinds of Arbitrage strategies: Cross-Market Arbitrage and Statistical Arbitrage.

Strategy based on machine learning:

The basis of machine learning is the demonstrating of historical data and the utilization of models to estimate future costs. One kind of machine learning is classification.

Token Sale Details

Private sale: May – June, 2018

Public pre-sale: July, 2018

Ticker: HQT

Token type: ERC20

TGE Token Price: 1 HQT = 0.00028 ETH 1 ETH = 3500 HQT

Fundraising Goal: 20 000 ETH

Total token supply: 200 000 000 HQT

Available for token sale: 35%

HQT Token Distribution

Token Sale: 35%

Reserve fund: 39%

Team: 15%

Advisors & Partners: 9%

Bounty: 2%

Token Economy

Hold Tokens

To use crypto trading bots

To use market making and hedging software

Earn Tokens

By developing and placing dApps on the marketplace

By providing valuable data to the marketplace

Spend Tokens

To create smart contract that store data about your investment portfolio and your personal configuration of trading bots

To build your own trading dApps or hedge fund software on top of the platform

Visit the links below for more information:

WEBSITE: https://hyperquant.net/en

WHITEPAPER: https://hyperquant.net/en/whitepaper/

TWITTER: https://twitter.com/HyperQuant_net

FACEBOOK: https://www.facebook.com/hyperquant.net/

TELEGRAM: https://t.me/hyperquant

YOUTUBE: https://www.youtube.com/channel/UCOgRfmQR-GKJlbnF1tRQPgw

ANN THREAD: https://bitcointalk.org/index.php?topic=2104362.0

Authored by Lelvin

Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1275173