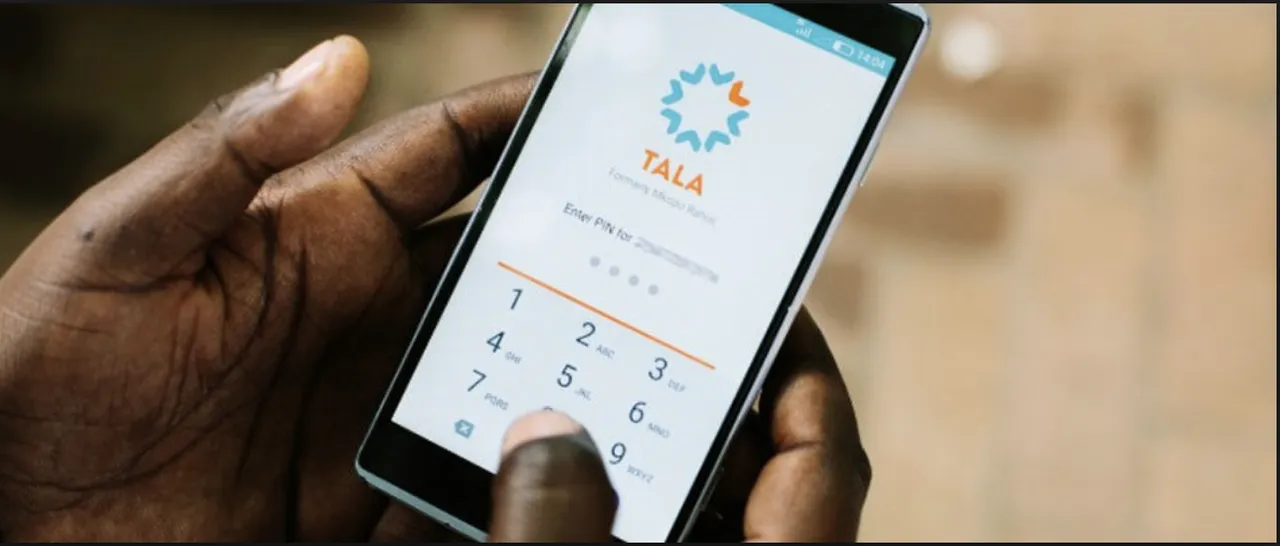

Photocredit: Financial Tribune:

The Current Global Issue

Currently there are over 2 Billion individuals who are currently underserved in the realm of raising capital through borrowing funds. Lets face it, when you want to get a loan for your new house, a small business, or even maybe your wedding - there are plenty of options between banks and private money lenders because at the end of the day, you have a well defined credit score by one of the big 3 Credit Bureaus (Equifax, Experian, or TransUnion). However, in emerging markets - these bureaus aren't available for an indviduals in emerging nations to provide a credit score. Local Banks offer outrageous interest rates that citizens can't afford because there was no reliable method to where they could determine the borrower's credit. Tala provides reliable credit scores and deliver micro-loans within minutes to these developing nations, who in turn are seeing incredible growth in the lower and middle class through this new access of capital.

What is Tala?

In recent years, Econometrist Shivani Siroya has found a way to not only provide a reliable credit score to those who aren't provided with one, but also deliver a micro-loan within minutes of running the app on their mobile devices. By downloading the Tala App on their smartphone, a borrower will be tested on over 700 different signals within 20 seconds, and upon the completion of the assessment - Tala will provide a reliable, accurate credit score and a mobile loan on the spot.

Through the access of user privacy data, Tala is able to have users opt in & use their pesonal information that includes location data, financial information, and even app usage to get a holistic view of the potential borrowers day-in-a-life. In turn, they are able to aggregate this data to provide a more accurate credit score than a traditional assessment provided by the big 3 credit bureaus to that generally don't have traditional income documentation.

Why is this Important?

Through the access of micro loans, users can use funds to attend personal events, purchase homes, fund their businesses, and overall increase their quality of life by having access to capital used to grow out of their current station. For a farmer, this could mean purchasing additional seeds to grow more crops for the next season. For an herder who raises goats, this is a medium to purchase additional goats to expand their business and use the additional cashflow as repayment.

Through scenarios like the above, we are seeing incredible growth in the emerging market middle class in which Tala has a footprint in, because accessible capital helps increase consumer spending and the flow of transactions - which in turn helps the government grow through the use of taxes.

An Astonishing Repayment Rate

Per Shivani Siroya, CEO of Tala, the repayment rates are over 90% on loans that are virtually unprotected. When benchmarking the numbers against the traditional credit bureus, they far outperform the traditional U.S. micro-loan market as the credit scores provided by Tala seem to be far more accurate - all due to the personal nature of the data collected. By developing complex data models, Tala is able to provide these loans to both Andriod and iPhone users, which enables them to capture the whole market in the areas they have a presence in (currently East Africa and Southeast Asia).

Using a quantifiable grading system - they are able to grade borrowers and continue to provide them micro-loans, even upgrading their credit score in real time to give users more access to capital should they need it, and decreasing it should they not submit payments on time. This futuristic method of credit scoring is disrupting a very traditional market and can be applicable to virtually any nation, including the U.S.

What's Next?

Tala is quickly expanding its reach to markets that have significant numbers of underserved individuals - including the Mexico, India, and South East Asia. Recently, they've also brought on board [Ex-Uber Data Chief Kevin Novak(https://techcrunch.com/2017/12/08/ex-uber-data-chief-kevin-novak-joins-la-based-startup-tala-in-big-win-for-la-ecosystem/) to expand their data models to become more accurate by also account for the cultural differences of each market and introducing new opportunities through the power of big data. Tala has originated and delivered over 4 million loans raised $30 million in financing at the beginning of 2017, and expanded to the Phillippines and Tanzania.

Tala is solving an immense, world-wide problem through the use of data and cultural influence. In the next decade we can very well see a shift in how borrowers obtain credit through non-traditional means, and Tala is in the forefront of this innovation. They have proved the concept, applied it in multiple emerging markets, and have an incredible trajectory of grwoth with no plans of stopping. It's just a matter of time before we see this bleed into larger markets.

Sources: