I know it seems like all bad news when you get suckered. But unlike that time my fiancee rented an apartment in NYC that didn't exist from a scammer with a fake key, you can actually recover a portion of your losses legally, and without bribing the NYPD out of your slush fund.

Here are (some of) the concerns you must address on your tax return, if you have a loss from one of the "lending coin ponzis", such as Bitconnect, USI-Tech, RegalCoin, HextraCoin, EthConnect, etc.

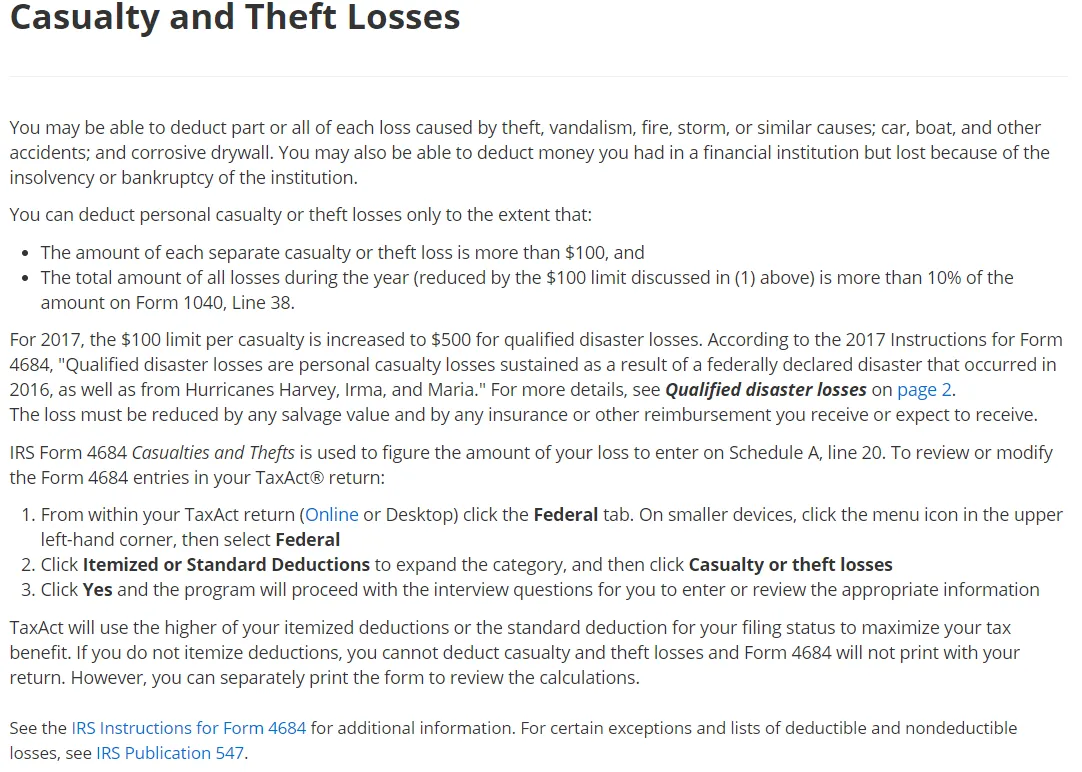

#1. You may deduct your losses on pyramid schemes entered into for-profit as a casualty/theft loss using IRS Form 4684 Casualties and Thefts.

Odd coincidence there, by the way - a Turbo Tax "pro" citing a Steemit article!

#2. You must file your losses in the year "they were discovered by the taxpayer" per TurboTax, or in some cases "when substantially realized and no form of recovery is likely". This may require....careful explanation of the facts to determine when you, personally, felt you would not receive your principal back. You'll hope that this is Fiscal Year 2017.

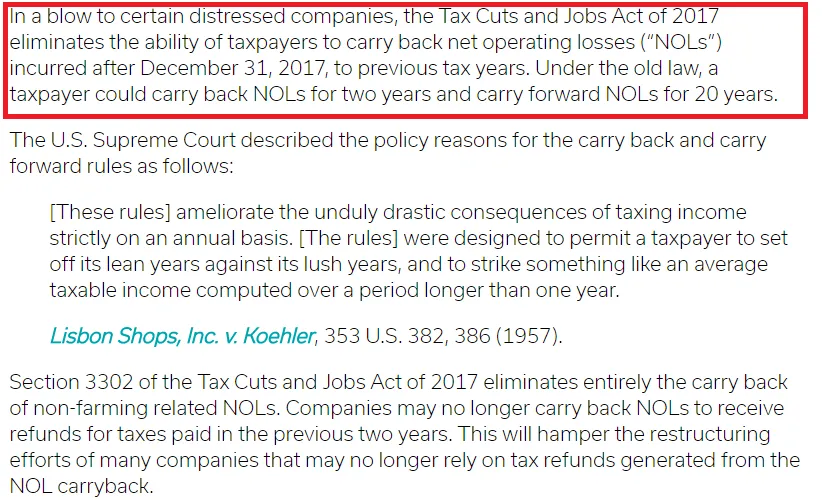

#3. If you do not file in Fiscal Year 2017, you're going to get hit with a nasty tax law change. Starting in 2018, you can no longer carry-back a net operating loss to previous years, recovering your previously paid taxes. You may only carry it forward indefinitely, which means you will not receive tax relief immediately and such relief will be dependent on your future earnings. One should be careful to file legally and in a timely fashion, but you definitely want to realize losses in 2017 if possible.

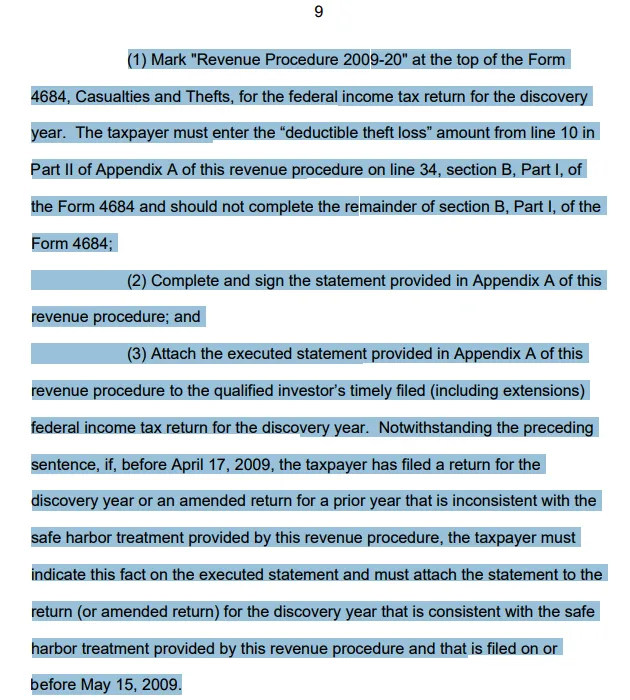

#4. Safe Harbor law. Use it. In exchange for giving up 5% of your claimed losses (and only claiming 95% of your loss as a deduction), the IRS essentially agrees to use the "kid gloves" on you. Safe harbor filings are excluded from many requirements of proof that could result in you being audited later for the mistakes you should have paid a crypto-accountant (which doesn't really exist, catch-22 IRS?) to not make in the first place.

Both the IRS and the courts will also look upon your case more favorably if filed under Safe Harbor, just in case you are audited (a not unlikely scenario when carrying back large losses.)

#5. File an extension if you need one; they are free and easy to get.

"OK Lexiconical, that's a lot of talking and such, but how about some step by step instructions?"

Sure. Right from the IRS, post Bernie-Madoff:

Have fun reopening those old wounds. At least you'll be paid (back) for it!

Disclosure: I am not a currently practicing accountant.

We also have a Radio Station! (click me)

...and a 10,000+ active user Discord Chat Server! (click me)

Sources: Google, @cryptotax, https://steemit.com/money/@cryptotax/was-your-bitcoin-stolen-potential-tax-benefits-for-your-loss, TaxAct, TurboTax, IRS.gov, Investopedia, Bloomberg, Steemit, ThompsonCoburn

Copyright: SmartSteem, PALNet, SPL, Tax Act, TurboTax, IRS, ThompsonCoburn