Summary

- In August, gold prices reached their highest level in six years. Low interest rates should continue to support gold.

- China's appetite for gold-backed ETFs reached extreme highs too.

- Here are three technical reasons why gold prices should keep advancing in the near future.

- This idea was discussed in more depth with members of my private investing community, The Lead-Lag Report. Get started today »

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.

- Alan Greenspan

Gold is back in fashion this year. Economic and geopolitical uncertainty, coupled with low interest rates, continues to fuel demand.

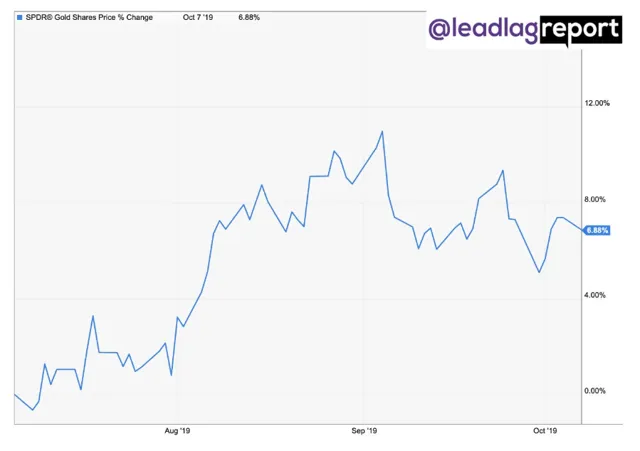

A recent Lead-Lag Report mentioned that gold ETFs have seen their most significant quarterly inflows since 2016. In August, gold price reached its highest level in six years.

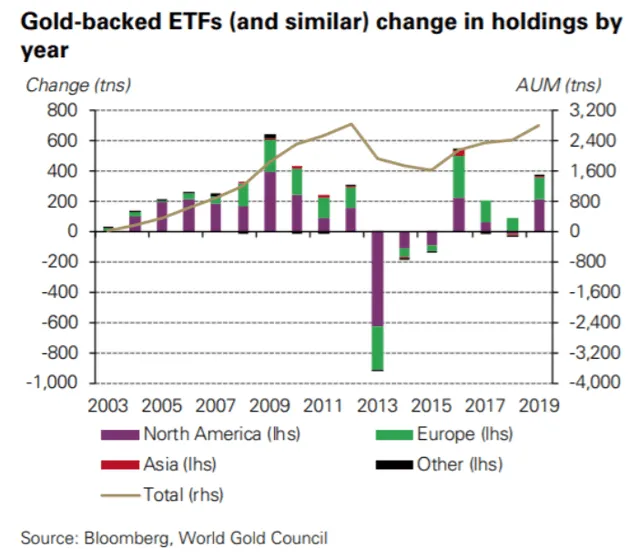

To be precise, the amount of gold held by gold-backed ETFs surged to record highs in September. The World Gold Council (WGC) estimates that about 2.8k metric tons of gold were held in gold ETFs in September, the strongest increase month to month since 2016.

And it’s not only an American story. Funds listed in Europe and elsewhere joined the party as well.

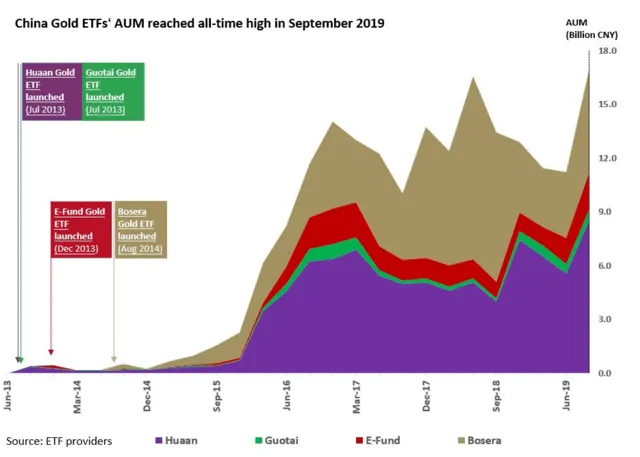

Moreover, China's appetite for gold-backed ETFs reached extreme highs too. The AUM of Chinese gold ETFs sits at all-time-highs around 17 billion yuan, roughly $2.2 billion.

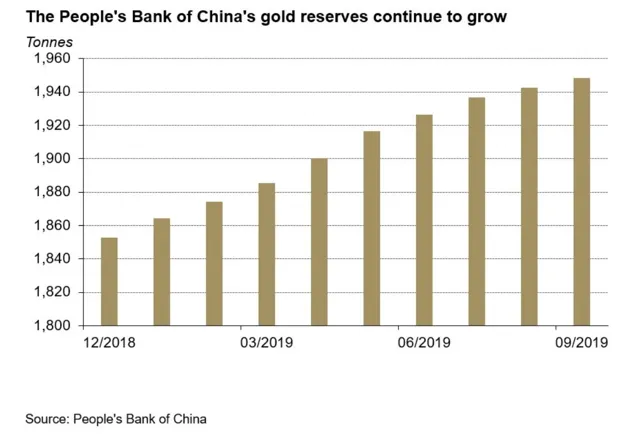

To continue on the same lines, the official Chinese demand for gold didn't stop in the last month. China's gold reserves continued to grow, adding another 95.8 tons to its reserves in 2019.

It appears that there's a strong demand for both paper and physical gold. Here are three technical reasons why gold prices should keep advancing in the near future.

First, let’s have a look at the bigger picture. This is a twenty-year weekly chart beautifully showing the parabolic advance before and after the 2008 financial crisis. What followed is a correction, badly needed from a technical point of view.

But the 2013-2019 consolidation looks like a classic rounding bottom pattern, a bullish reversal pattern known for the fact that it is time-consuming. Well, six years did the job.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.