Every decently-made object, from a house to a lamp post to a bridge, spoon or egg cup, is not just a piece of ‘stuff’ but a physical embodiment of human energy, testimony to the magical ability of our species to take raw materials and turn them into things of use, value and beauty. (Kevin McCloud, designer)

Over half the total cost of the packaging item depends from the major raw material used. This happens because, in most parts of the world, the export of commodities is risky, expensive and often exclusive, as only major actors are able to move in the intricate system of agreements, permissions and cross-border fees international trade implies.

Consequently, any fluctuations in the raw material prices are bound to have a huge impact on any business, and in particular, on the packaging, that entirely depends on them. Population and wealth around the world continue to grow putting a strain on the demand side of the fundamental equation for finite commodities: more people, with more wealth, translates to more demand for raw materials. In 1960, there were fewer than three billion people on the earth. At the end of 2017, the number of inhabitants stood at 7.445 billion. More people, with more wealth, translates to more demand for raw materials. And, when economic conditions are growing, demand for staples increases exponentially.

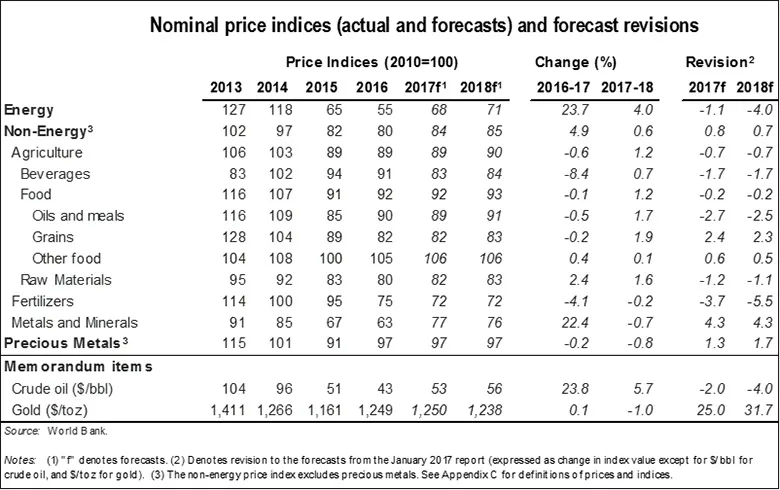

Many industrial commodities that are the building blocks of infrastructure around the world outperformed the major equity indices in 2017. The price of palladium, and industrial and precious metal appreciated by over 56% on the year. The price of lumber moved 36% higher, aluminum and copper posted better than 30% gains. Zinc, nickel, and lead were all up more than 20% on the year. Crude oil, gold, and heating oil all moved more than 10% to the upside.

Yes, industrial commodities had definitely a great 2017 and many signs for 2018 confirm a continuation of the trend!

The main reason is, evidently, the inverse historical relationship between the U.S. dollar and raw materials prices: the U.S. dollar index moved over 10% lower last year and closed the year close to recent lows and a critical support level.

Secondarily, there is the issue of the oil price, that raised to $73 a barrel as far, as a result of growing demand, agreed production cuts among oil exporters and stabilizing U.S. shale oil production. But the price of the other main raw materials is no exception: gold prices reached higher U.S. interest rates; agriculture prices increased due to reduced supplies; prices for energy commodities — natural gas and coal — climbed 4%, metals index is stabilized now, but just after a 22% jump in 2017.

Finally, there is the Third World Economy — and first of all China — factor: their development plays a fundamental role in the price trajectory for raw materials.

To sum up, it’s a big mess!

As commodity raw material prices depend on the global energy prices and supply capacity, which in turn depend on world economy fluctuations, regional weather conditions, wars and hundreds of other complex and almost unpredictable geopolitical factors, there comes the challenge: how to maintain a balance between the security of supply and low pricing volatility?

Once again Blockchain technology comes to the aid!

As it already happened for gold trades, it can offer a secure means of exchange of raw materials, open up channels of trade among buyers and sellers and provide more transparency and trust inside such an unstable and unpredictable market.

No matter cryptocurrencies oscillations, the blockchain technology is likely to remain and could change commodity trading for the better:

• It allows to bring together all market participants — miners, refiners, wholesale traders, financial institutions, investors and traders and the retail sector;

• It provides clients the ability to trade raw materials in cryptocurrencies;

• It has the advantage of storing data in digitally distributed ledgers, which are safer and always updated, can’t be modified or deleted and exist on multiple computers and networks in different locations.

As we know, indeed, when a change come about in the chain, it will immediately and simultaneously be reflected in every copy: this guarantees a high degree of visibility of every transaction, ensures consensus as everyone in the chain is a manager of equal stature and eliminates any disputes over the sequence of events.

Blockchain could help commodity traders overcome conventional market barriers in dozens of ways! It not only ensures timely settlement, expedites capital allocation and provides proof of collateral, but also helps to avoid much of the increasing regulatory scrutiny of financial markets. Raw materials transaction is not just from mine to purchaser: it involves many different means of transport, warehouses and factories, but also documents and international regulations compliance. Raw materials trade is a delicate issue and regulatory bodies require a great transparency of the provenance and traceability of shipments.

Digitizing the global trade of commodities means having buyers, sellers and third parties, such as banks, shipping companies, governmental bodies, inspection companies, banks, etc., on the same distributed ledger, which can be viewed and updated by all parties simultaneously; it means being able to share data on the status of documents, deliveries, payments and documents; it means having the possibility to reach potential buyers/importers and sellers/ exporters worldwide with the guarantee of price fairness in unregulated and illiquid markets and dozens of other benefits that we are still not able neither to image.